Sociedad Llc With No Assets

Description

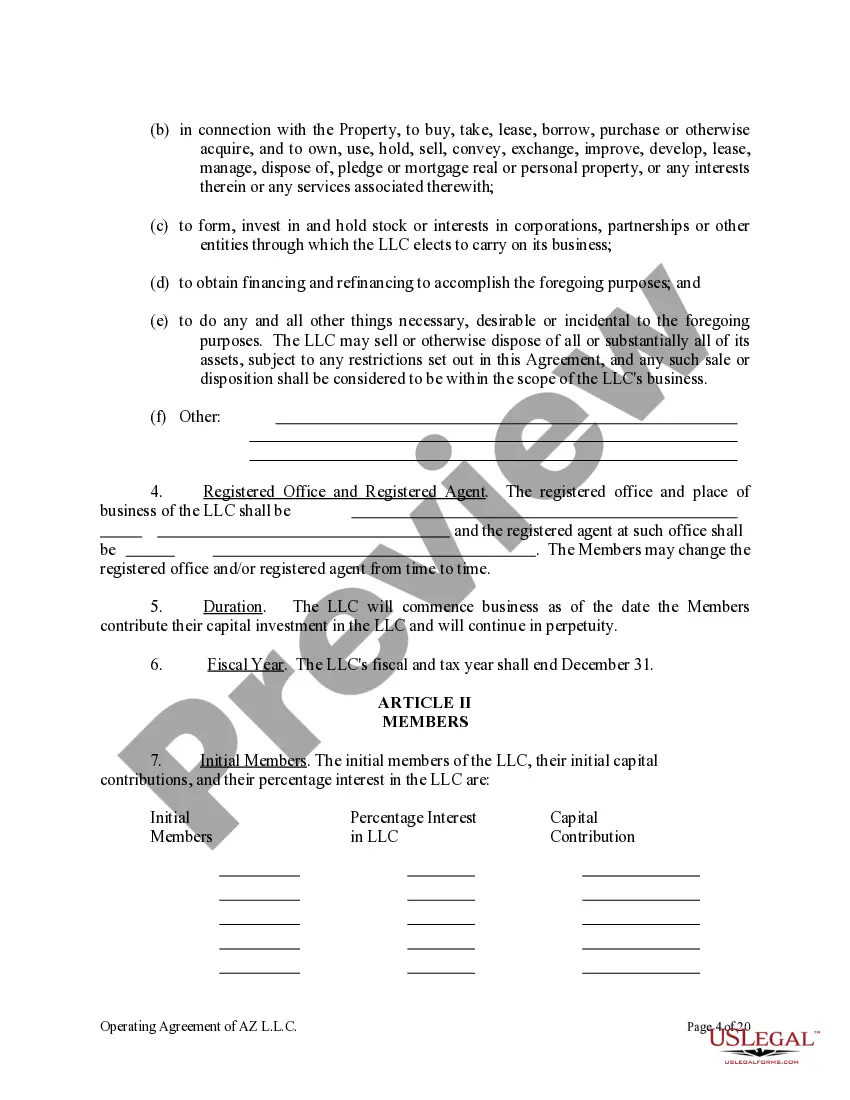

How to fill out Arizona Limited Liability Company LLC Operating Agreement?

Managing legal documents can be perplexing, even for seasoned experts.

When you seek a Sociedad Llc With No Assets and lack the time to spend searching for the correct and current version, the process can become overwhelming.

Utilize cutting-edge tools to complete and manage your Sociedad Llc With No Assets.

Access a collection of articles, guides, and materials pertinent to your circumstances and needs.

Ensure that the template is acknowledged in your state or county, select Buy Now when you are ready, choose a monthly subscription plan, and download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online library, backed by 25 years of experience and reliability. Streamline your document management process easily and efficiently today.

- Save time and energy searching for the necessary documents, and utilize US Legal Forms’ sophisticated search and Review feature to locate Sociedad Llc With No Assets quickly.

- If you hold a membership, Log In to your US Legal Forms account, locate the form, and download it.

- Visit the My documents tab to review the documents you've previously stored and manage your files as needed.

- If this is your first experience with US Legal Forms, create a free account for unlimited access to all the platform's benefits.

- After obtaining the form you require, make sure to confirm that it is the correct document by previewing it and reviewing its details.

- A robust online form repository could significantly change the game for anyone aiming to handle these situations effectively.

- US Legal Forms stands as a market frontrunner in online legal forms, offering over 85,000 state-specific legal documents available to you at any moment.

- With US Legal Forms, you can easily fulfill any requirements you may have, from personal to commercial paperwork, all consolidated in one location.

Form popularity

FAQ

You can sue a Sociedad LLC with no assets, but successfully collecting on any judgment may be difficult. Courts typically allow lawsuits against LLCs regardless of their asset status. However, if the LLC lacks assets, recovering any financial judgment could prove challenging. It's important to explore all options and possibly consult with a legal professional to understand the full implications of suing a Sociedad LLC with no assets.

If a Sociedad LLC with no assets also reports no income, it may still be required to file annual tax returns, depending on state regulations. This is vital to maintain compliance and avoid potential penalties. Additionally, having no income might limit the LLC's ability to grow or cover future expenses. It's wise to consult experts at US Legal Forms to ensure you handle such situations correctly and strategically.

In a Sociedad LLC with no assets, it is indeed possible for an LLC member to have 0 ownership. This situation can occur if the member has sold or transferred their ownership interest. However, it's important to review the operating agreement and state laws, as they may specify certain requirements for ownership. The flexibility of a Sociedad LLC allows for various ownership structures, making it suitable for different business needs.

Even if your Sociedad LLC has not conducted any business activities, it is generally still necessary to file an annual tax return. This filing maintains your entity’s good standing and keeps government agencies informed. If you want to simplify this process, consider using platforms like US Legal Forms, which offer resources to ensure you meet all necessary compliance requirements.

Yes, you can have a Sociedad LLC with no assets that does nothing; however, maintain your filings and necessary paperwork. Even if your LLC is inactive, you should still comply with state regulations and respond to annual tax requirements. Keeping everything updated mitigates risks and ensures you can reactivate your business whenever you choose.

To file taxes for a Sociedad LLC with no assets and no income, you'll want to adhere to IRS guidelines for your specific entity type. A single-member LLC often files a Schedule C with your personal tax return, while a multi-member LLC files Form 1065. Each method allows you to report on the status of your business, even if it has not generated revenue.

Filing taxes for a Sociedad LLC with no assets but also no income is a straightforward process. Even without income, you still need to file your annual tax return. You typically use Form 1065 for reporting if your LLC is a partnership or Schedule C if it is a single-member LLC. This keeps your business compliant with tax regulations.

Yes, you can write off LLC expenses even if your Sociedad LLC with no assets has not generated income. Expenses directly related to operating your business, such as formation costs or maintenance fees, can often be deducted. However, it’s important to keep thorough records to support your deductions. Always consult with a tax professional to ensure compliance with tax laws.

When forming a Sociedad LLC with no assets, it’s essential to consider what you may need in the future. Generally, you can place tangible assets like real estate, equipment, and inventory into your LLC. You can also consider intellectual property or other investments that may grow your business. Planning ahead ensures that your LLC is ready for expansion as opportunities arise.

When you sue a Sociedad LLC with no assets, the chances of collecting any awarded damages decrease significantly. The court may rule in your favor, but without assets, enforcement is nearly impossible. You may need to explore other avenues, such as negotiating settlements. Using platforms like uslegalforms can assist you in understanding your options and preparing necessary documents efficiently.