Sociedad Llc With Irs

Description

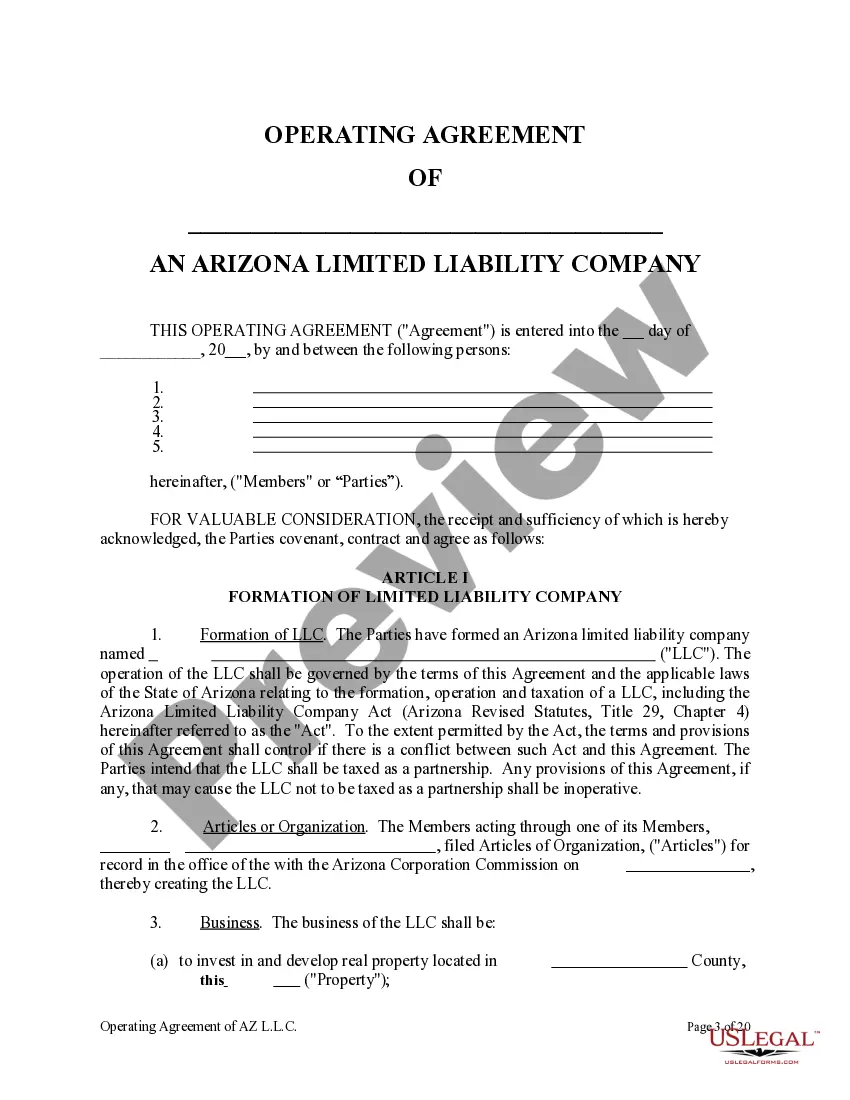

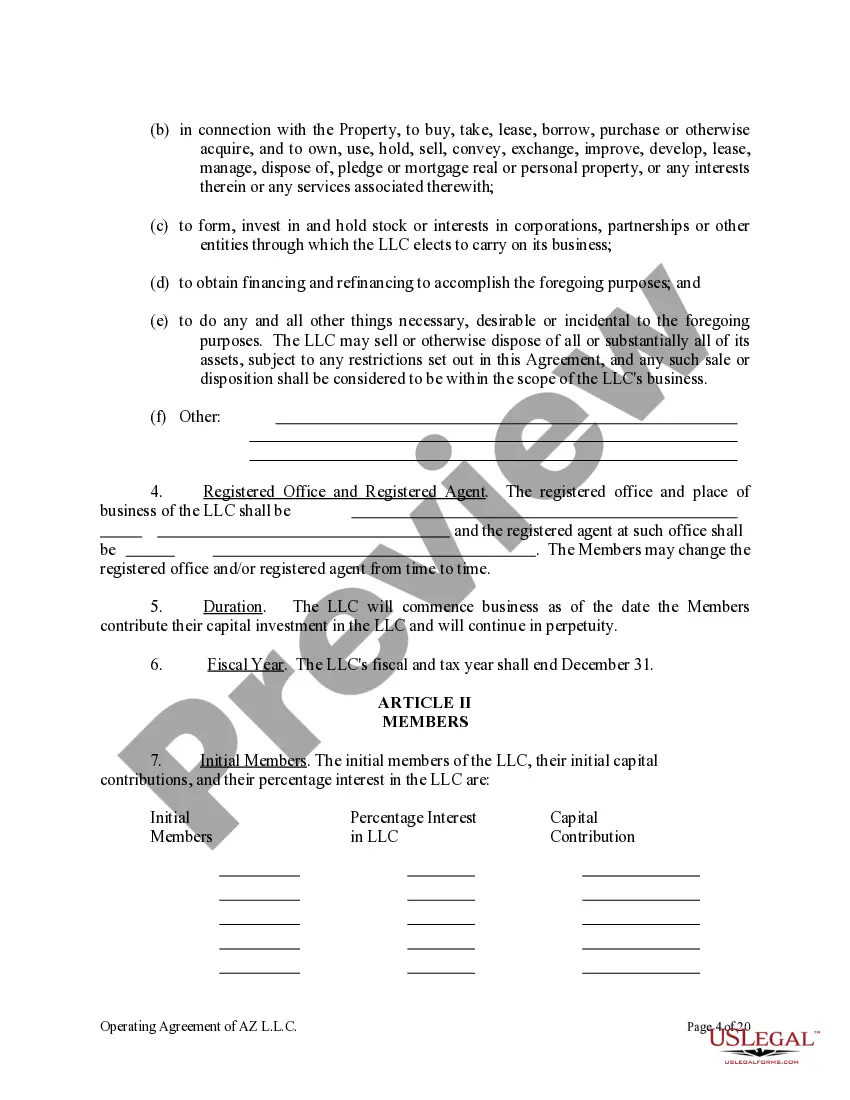

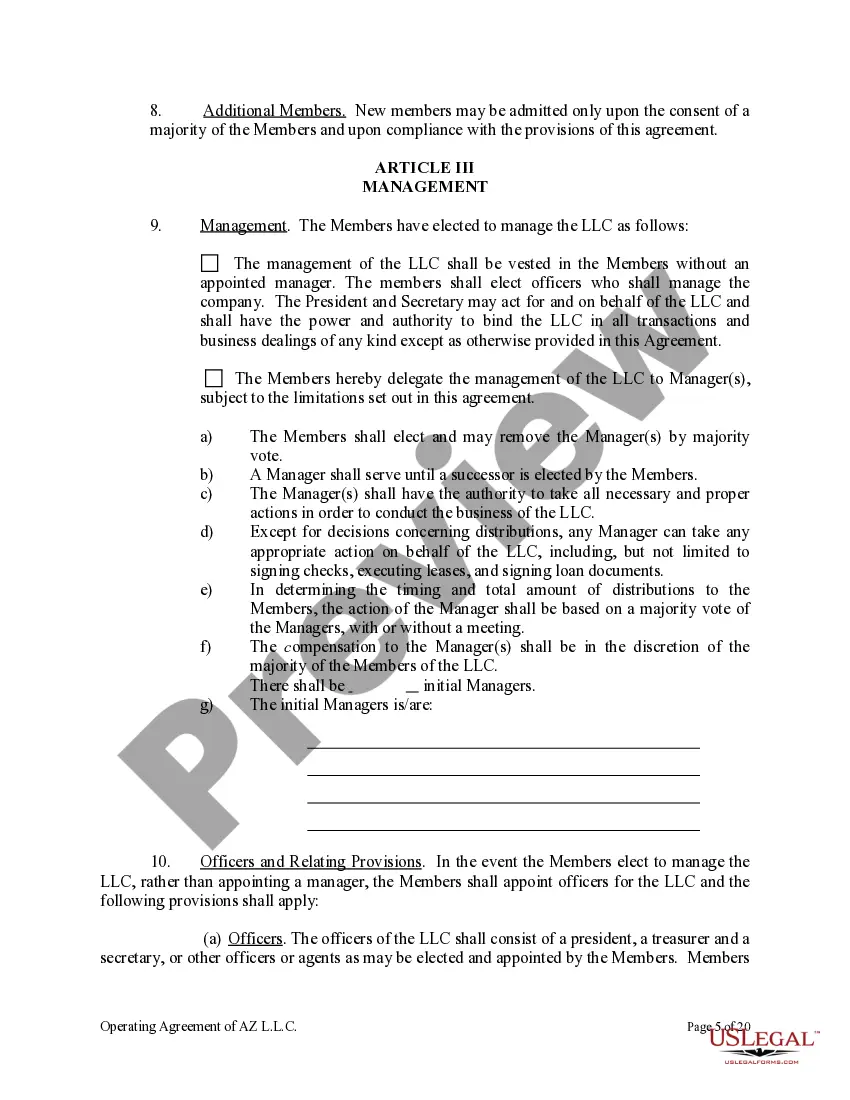

How to fill out Arizona Limited Liability Company LLC Operating Agreement?

Regardless of whether for commercial objectives or personal matters, everyone must manage legal issues at some stage in their life.

Filling out legal papers necessitates meticulous focus, starting from selecting the correct form template.

Once it is saved, you can fill out the form using editing software or print it for manual completion. With an extensive US Legal Forms library available, you don't have to waste time searching for the correct template across the web. Utilize the library's straightforward navigation to discover the suitable template for any event.

- Locate the template you require by using the search bar or catalog browsing.

- Examine the description of the form to confirm it aligns with your situation, state, and locality.

- Click on the preview of the form to inspect it.

- If it is not the correct document, return to the search tool to find the sample of the Sociedad Llc With Irs that you need.

- Download the template when it fulfills your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you may acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you prefer and download the Sociedad Llc With Irs.

Form popularity

FAQ

A Sociedad LLC with IRS need to file specific forms based on its structure and tax classification. Main forms include Form 1065 for partnerships, Form 1120 for corporations, and potentially Form 8832 to elect tax treatment. To manage these filings effectively, consider using platforms like US Legal Forms to ensure compliance and simplify the process.

The form your Sociedad LLC with IRS must file for federal taxes depends on its tax structure. Single-member LLCs are treated as sole proprietorships and file Schedule C with their personal tax return. Multi-member LLCs usually file Form 1065 and issue K-1s to members, providing each member with their share of income and deductions.

When you form a Sociedad LLC with IRS guidelines, you may need to choose between filing Form 1065 or Form 1120S, depending on how your LLC elects to be taxed. If your LLC has multiple members and has not chosen to be taxed as a corporation, it will typically file Form 1065. Alternatively, if you elect S corporation status, your Sociedad LLC with IRS will file Form 1120S, which offers potential tax benefits.

The IRS tracks LLC income primarily through the tax returns filed by the members of the LLC, as well as through any reports submitted by banks and other financial institutions. If your Sociedad LLC with IRS elects to be treated as a pass-through entity, the income will be reported on your personal tax return. It is crucial to maintain accurate records and file returns on time to ensure compliance and avoid potential penalties. For assistance with tax filings and organized documentation, uslegalforms offers essential tools and templates tailored for LLC owners.

To obtain an IRS letter for your LLC, you can request a copy of your Employer Identification Number (EIN) confirmation letter that the IRS previously sent you upon forming your Sociedad LLC with IRS. This letter serves as proof of your LLC's tax identification. If you have lost your original letter, you can call the IRS directly or utilize online services to access the necessary documentation. For added convenience, uslegalforms can guide you through this process and help you find the forms needed to request your letter.

Yes, a single member LLC must file Form 8832 to elect to be classified as an S Corporation before it can file Form 2553 with the IRS. This election provides several tax benefits, including the potential to reduce self-employment taxes. By strategically choosing to classify your Sociedad LLC with IRS guidance, you can optimize your tax situation effectively. To get started, consider using resources from uslegalforms, which can assist you in completing these forms accurately.

Before 2025, LLCs must file their annual tax returns and maintain compliance with state-specific regulations. Your Sociedad LLC with IRS also needs to ensure that they have filed any required schedules or forms specific to their business classification. Staying ahead of these filing requirements is crucial for smooth operations.

The new law affecting LLC holders involves increased transparency and disclosure requirements, impacting how businesses operate. Specifically, this law requires certain information to be reported to the IRS, which your Sociedad LLC with IRS will need to adhere to. Understanding these requirements ensures you remain compliant and avoid penalties.

LLCs are generally taxed as pass-through entities by the IRS, meaning the profits and losses pass through to the owners’ personal tax returns. This taxation structure simplifies the process for a Sociedad LLC with IRS, avoiding double taxation. However, you can also elect to be taxed as a corporation if that suits your business needs.

Yes, an LLC is recognized by the IRS as a legitimate business structure. When you establish a Sociedad LLC with IRS recognition, it allows for certain tax benefits and flexibility in how you choose to be taxed. Understanding these acknowledgments is crucial for maintaining your business’s compliance.