Certificate Of Trust Form Withheld

Description

Form popularity

FAQ

You must report Form 1042-S on your tax return if you receive one, as it details income subject to withholding. This form is particularly relevant for foreign persons receiving income from U.S. sources. Incorporating your Certificate of trust form withheld in this context can help clarify your tax position and ensure compliance with IRS regulations.

Yes, withholding can be distributed on a trust, depending on the trust's income and the distribution strategy adopted. If the trust generates taxable income, it is important to manage distributions carefully to avoid any potential tax liabilities. Your Certificate of trust form withheld can play a crucial role in planning these distributions efficiently.

An exemption from withholding can include various circumstances, such as certain types of income or specific types of beneficiaries. Understanding the implications of your Certificate of trust form withheld is vital, as it can impact your withholding obligations. Learning more about your specific situation can help you make informed decisions regarding these exemptions.

Yes, you still need to file a final Form 1041 even if there is no income for the trust. This form serves as a formal closure to the trust's financial activities. Including your Certificate of trust form withheld is important, as it documents the trust's status and validates your claim on the return.

To submit Form 56 to the IRS, first ensure you fill it out completely and accurately. Then, you can send it by mail to the designated address listed on the form instructions. It's crucial to include any pertinent documents alongside your Certificate of trust form withheld when submitting this form, as it can define the trust's legal standing.

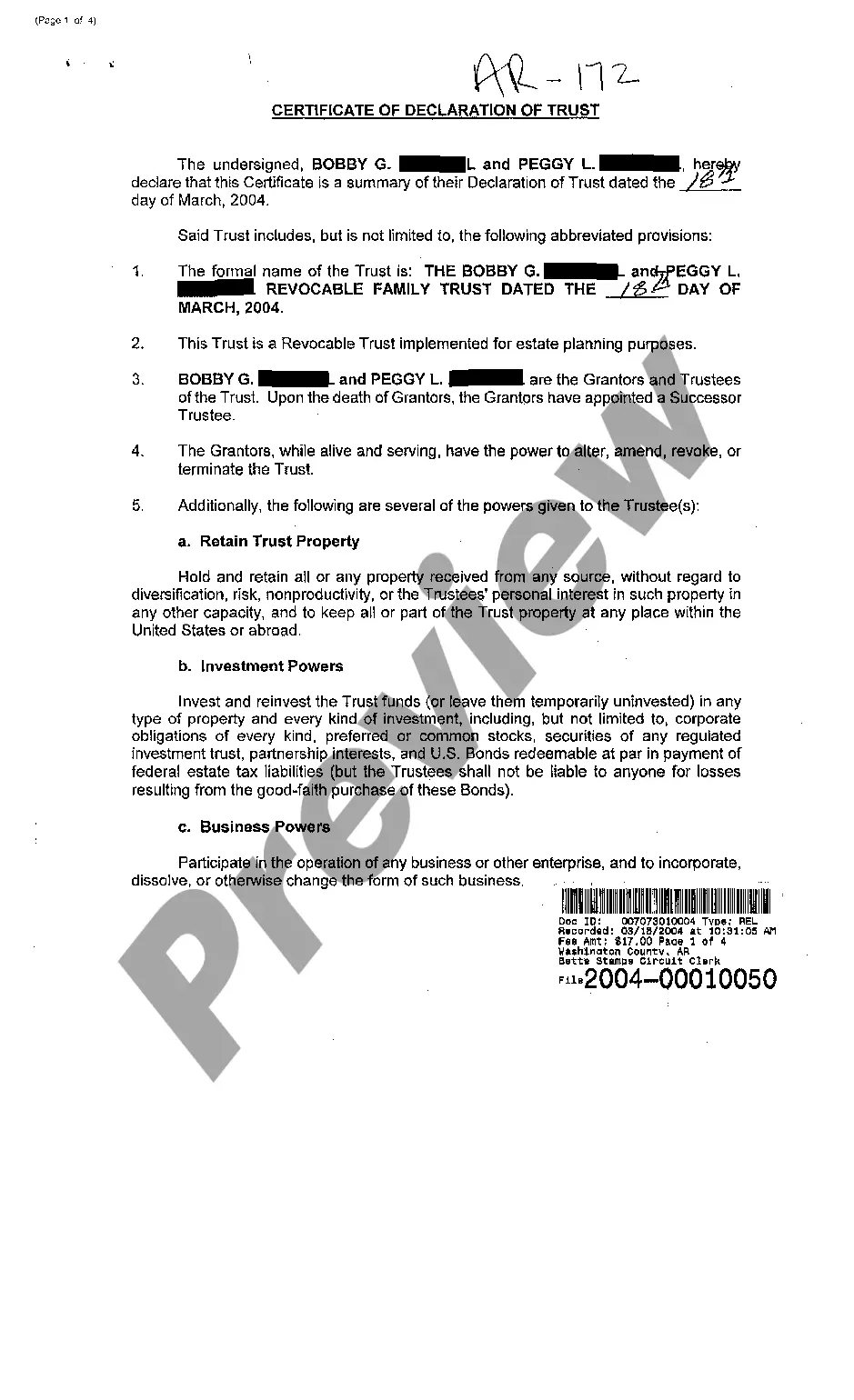

To obtain a trust certificate, the trustee must prepare and file necessary documents that validate the trust's existence and outline its structure. This often involves providing information about the trust's assets, beneficiaries, and governing terms. For a streamlined experience, visit US Legal Forms to find templates for a certificate of trust form withheld that can simplify the process.

A withhold certificate is a document issued by the IRS that authorizes the withholding agent to withhold a reduced amount or no tax at all from certain transactions. This certificate facilitates the withholding process while ensuring accurate compliance with tax obligations. When creating or managing a trust, understanding how this relates to your certificate of trust form withheld may be essential for tax efficiency.

To reclaim FIRPTA withholding, you must file a U.S. tax return for the year of the transaction. Include the appropriate forms and documentation to demonstrate that the withheld amount exceeds your actual tax liability. If you need guidance, consider consulting US Legal Forms to access resources related to certificates of trust form withheld and tax procedures.

To obtain a certificate of trust, you generally need to work with the trustee or the individual who established the trust. They can initiate the process by preparing necessary documentation and filing it with the appropriate authorities. If you need assistance, platforms like US Legal Forms offer reliable templates to streamline obtaining a certificate of trust form withheld.

A certificate of trust is typically created by the trustee of a trust. The trustee prepares this document to affirm the trust's existence and provide information to third parties, such as banks or real estate professionals. By using a certificate of trust form withheld, the trustee can ensure that the trust continues to operate smoothly while protecting the privacy of the trust's terms.