Emancipated Minor In Massachusetts

Description

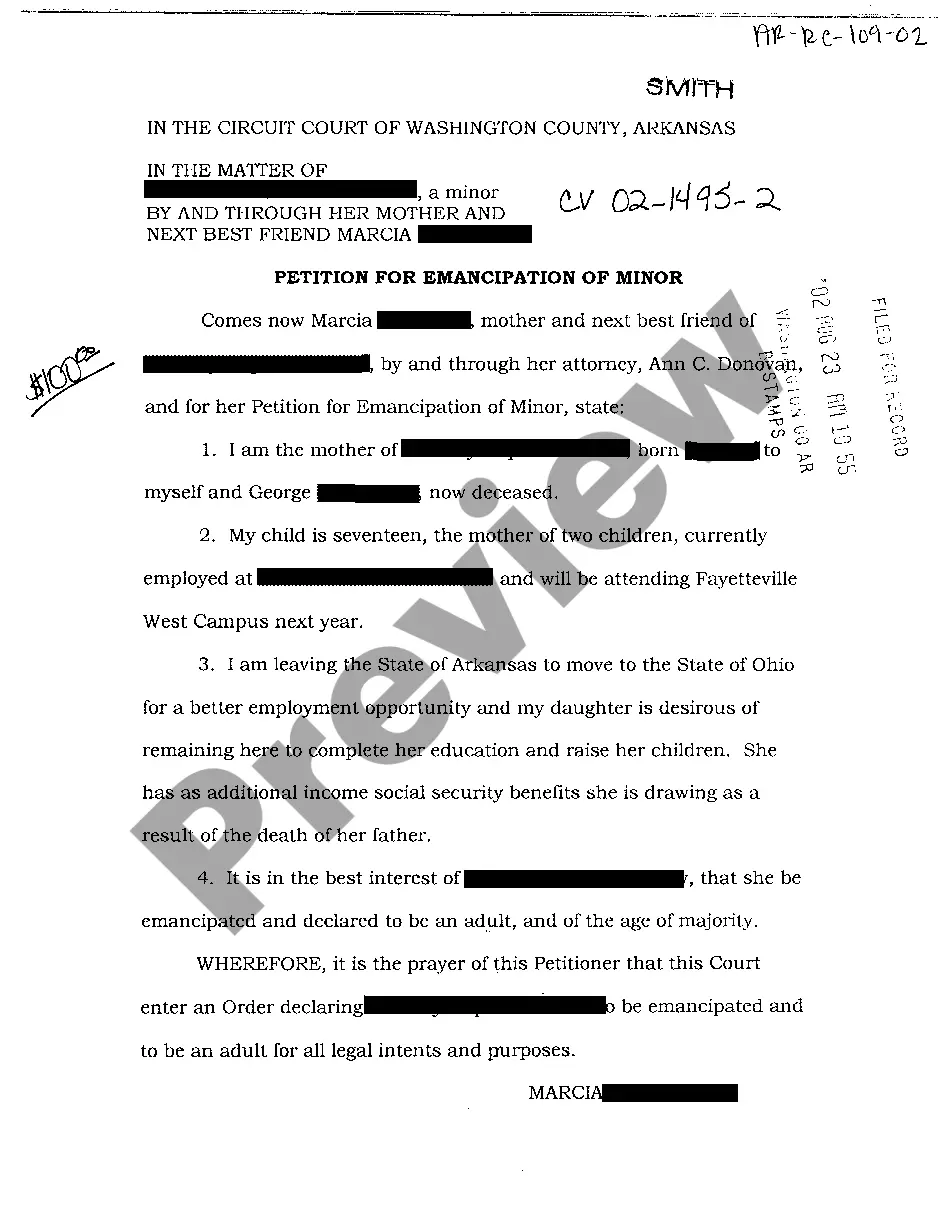

How to fill out Arkansas Petition For Emancipation Of Minor?

Whether for professional aims or for personal issues, everyone eventually encounters legal circumstances in their lifetime.

Completing legal documents requires meticulous care, starting with choosing the correct form template.

Once downloaded, you can fill out the form using editing software or print it and complete it by hand. With a vast catalog from US Legal Forms at your disposal, you need not waste time searching for the right document online. Use the library’s user-friendly navigation to find the suitable template for any circumstance.

- For example, if you select an incorrect version of the Emancipated Minor In Massachusetts, it will be rejected upon submission.

- Thus, it is essential to have a reliable provider of legal forms like US Legal Forms.

- If you wish to obtain a Emancipated Minor In Massachusetts template, follow these simple procedures.

- Locate the template you require by using the search bar or browsing the catalog.

- Review the description of the form to confirm it aligns with your situation, state, and area.

- Select the form’s preview to view it.

- If it is not the correct document, return to the search feature to find the appropriate Emancipated Minor In Massachusetts template.

- Obtain the file if it fits your needs.

- If you possess a US Legal Forms account, simply click Log in to access documents you have saved in My documents.

- If you have yet to create an account, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: either use a credit card or a PayPal account.

- Select the desired file format and download the Emancipated Minor In Massachusetts.

Form popularity

FAQ

Ohio LLC Formation Filing Fee: $99 The price to start an Ohio LLC is $99. Forming your LLC in Ohio starts with filing Articles of Organization with Ohio's Secretary of State. Regular filings (mail, in person, and online) take about 3-7 days to be processed.

Please note: A limited liability company's operating agreement and other internal documents are not required to be filed with the Ohio Secretary of State. The Articles must be signed by at least one person. The filing fee for the Articles is $99.00. The Articles must include a business name.

But while it's not legally required in Ohio to conduct business, we strongly recommend having an Operating Agreement for your LLC. Additionally, financial institutions (like banks) and other organizations may need to see a copy of this paperwork in order for you to do business with them.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

5. Operating Agreement. The LLC operating agreement is an internal document used to establish operating procedures and policies for the company. Drafting an operating agreement is not mandatory; however, it is recommended as it provides proof of the rules and responsibilities agreed upon during formation.

Below is a breakdown of the process of forming an LLC in Ohio. Find a Business Idea. Create a Business Plan. Choose a Name for Your Ohio LLC. Appoint a Statutory Agent. File Articles of Organization. Receive Your LLC Certificate. Draft an LLC Operating Agreement. Obtain an EIN.

Yes, an Ohio Registered Agent is necessary. State law requires someone to be available to accept Service of Process for your LLC. You must list a Registered Agent on your LLC paperwork. And then you must continuously maintain (keep) one on file with the state as long as your LLC exists.