Waiver Of Accounting Form For Covid 19

Description

Form popularity

FAQ

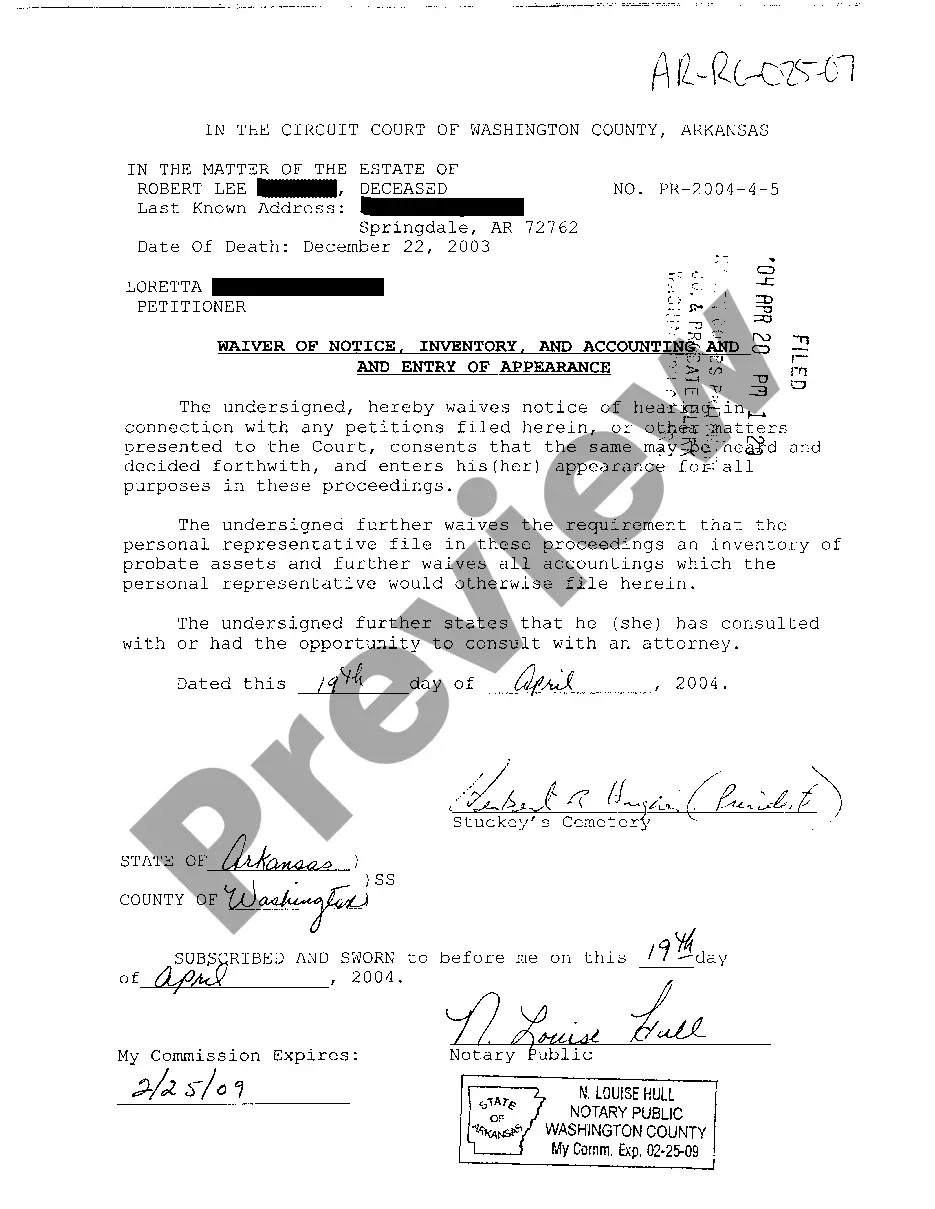

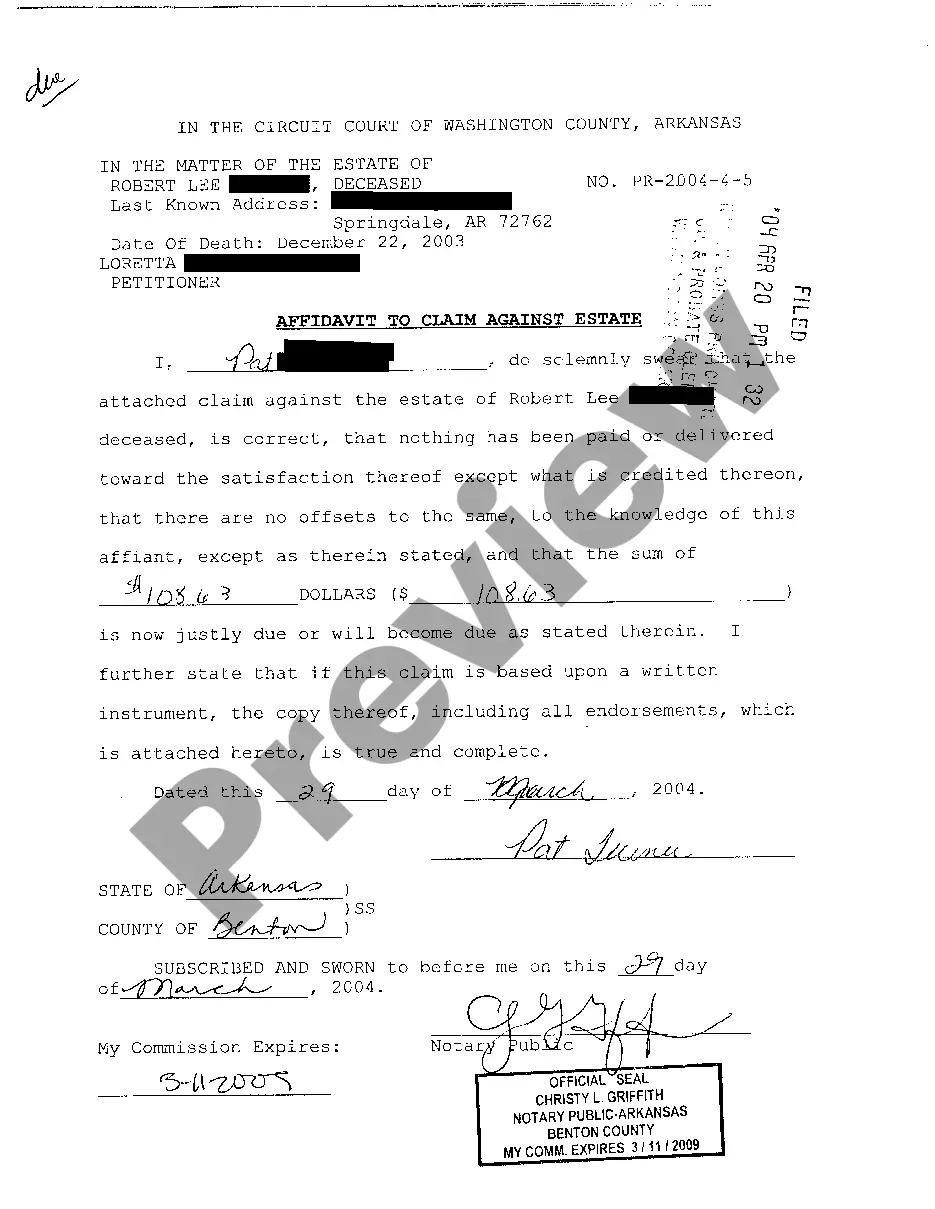

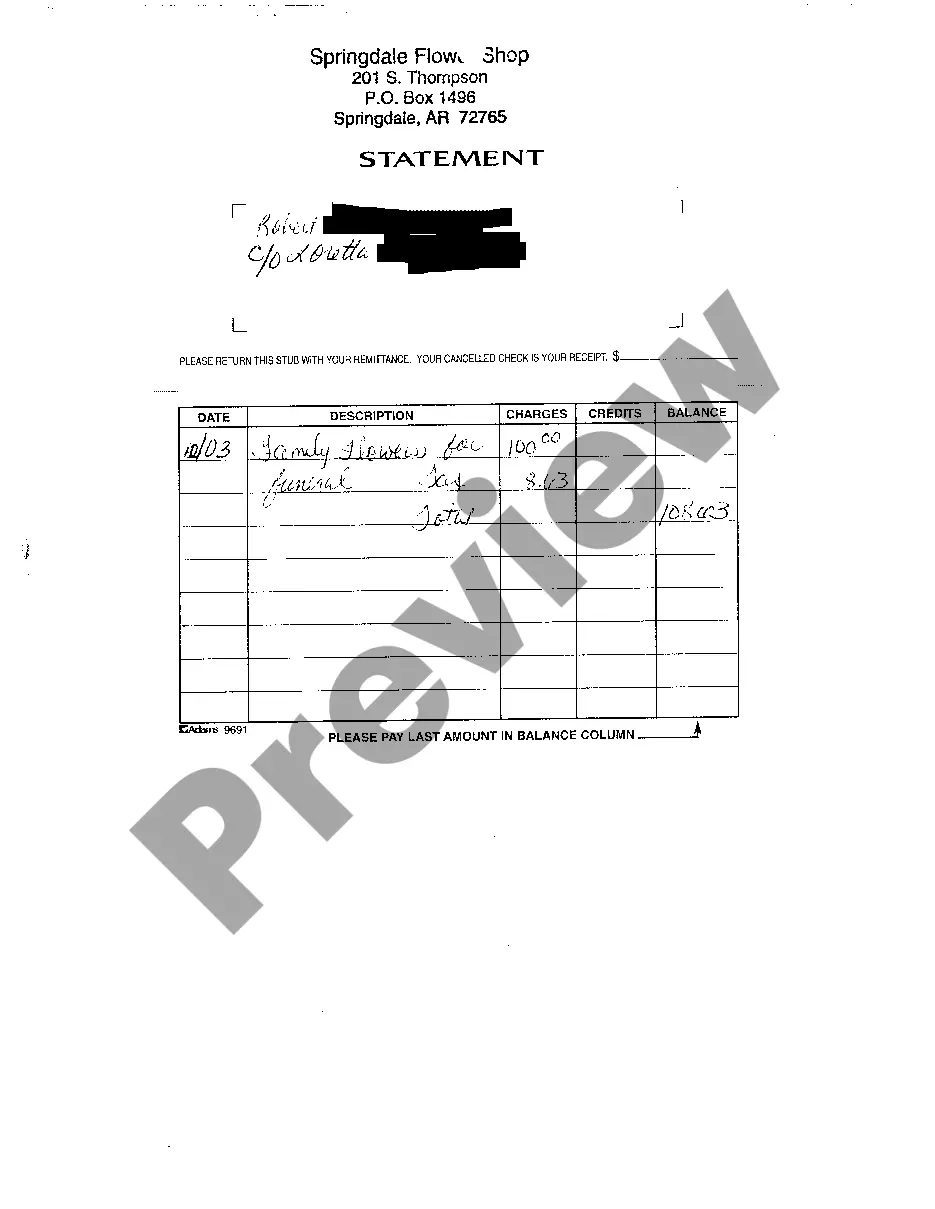

An example of a waiver could be a document where an individual agrees to waive their right to receive a detailed financial report in a trust situation. With a Waiver of accounting form for covid 19, beneficiaries may decide to skip the usual accounting processes during the pandemic to alleviate pressure on trustees. This mutual agreement can be particularly beneficial in maintaining a harmonious relationship while adapting to difficult financial circumstances. Using trusted platforms like uslegalforms can simplify the creation of such waivers and ensure all parties are properly informed.

An accounting waiver is a specific type of waiver that permits parties to bypass the typical requirements for financial disclosures associated with trust management. By utilizing a Waiver of accounting form for covid 19, trustees can maintain more flexibility while focusing on essential management tasks rather than extensive record-keeping during the pandemic. This approach can ease the burden on trustees and help protect the interests of beneficiaries amid challenging times. It is designed to facilitate smoother operations while ensuring mutual consent.

A waiver is a legal agreement that relinquishes a person's right to claim something or enforce a rule. Specifically, the Waiver of accounting form for covid 19 allows parties to agree that accounting will not be necessary under certain circumstances. It helps streamline processes in situations where financial reporting may be burdensome or impractical, especially during the ongoing challenges presented by the pandemic. This form is a critical tool for minimizing conflicts while maintaining a clear record of agreement.

If a trustee fails to provide accounting, it can lead to legal complications and a lack of confidence from beneficiaries. Without proper accounting, the beneficiaries may not know how their assets are being managed or whether their interests are being adequately preserved. In such cases, a Waiver of accounting form for covid 19 can help simplify the process and clarify responsibilities. Using this waiver, beneficiaries can consent to less frequent or no accounting reports during these extraordinary times.

A financial waiver is a legal document that allows an individual to forgo certain financial obligations. In the context of a Waiver of accounting form for covid 19, it serves as a formal request to skip accounting procedures typically required for financial transparency. This can be particularly useful during challenging times when resources are limited. Individuals may utilize this form to protect both parties involved while ensuring compliance with legal requirements.

Telehealth services have shown their effectiveness, leading many stakeholders to advocate for their extension. While temporary waivers related to COVID-19 may have an expiration date, there is considerable interest in making telehealth a lasting aspect of healthcare. Utilizing resources like uslegalforms can help you stay informed and compliant as policies evolve around the waiver of accounting form for covid 19.

The final rule for telehealth in 2025 aims to establish permanent policies that enhance access and quality of care. While specific details are still unfolding, the emphasis will likely be on integrating telehealth into standard healthcare practices. Understanding how to use the waiver of accounting form for covid 19 will be essential as these rules develop further.

Yes, multiple waivers were established to allow telehealth services during COVID-19. These waivers made it easier for patients to access necessary healthcare while minimizing exposure risks. To navigate complex regulations, including any related to the waiver of accounting form for covid 19, consider platforms like uslegalforms, which simplify the documentation process.

The COVID waivers varied by state and specific regulations, but many were set to end in 2022. However, some waivers may continue as healthcare systems transition back to regular operations. If you are dealing with documentation issues, using the waiver of accounting form for covid 19 can help ensure compliance with current regulations.

Currently, Medicare is not completely eliminating telehealth services but is evaluating how to integrate them into future healthcare plans. The waiver of accounting form for covid 19 played a crucial role in allowing Medicare to expand access to telehealth during the pandemic. Continuing this practice promotes better patient outcomes and accessibility, but future adjustments may occur.