Petition To Terminate Guardianship Form For Indiana

Description

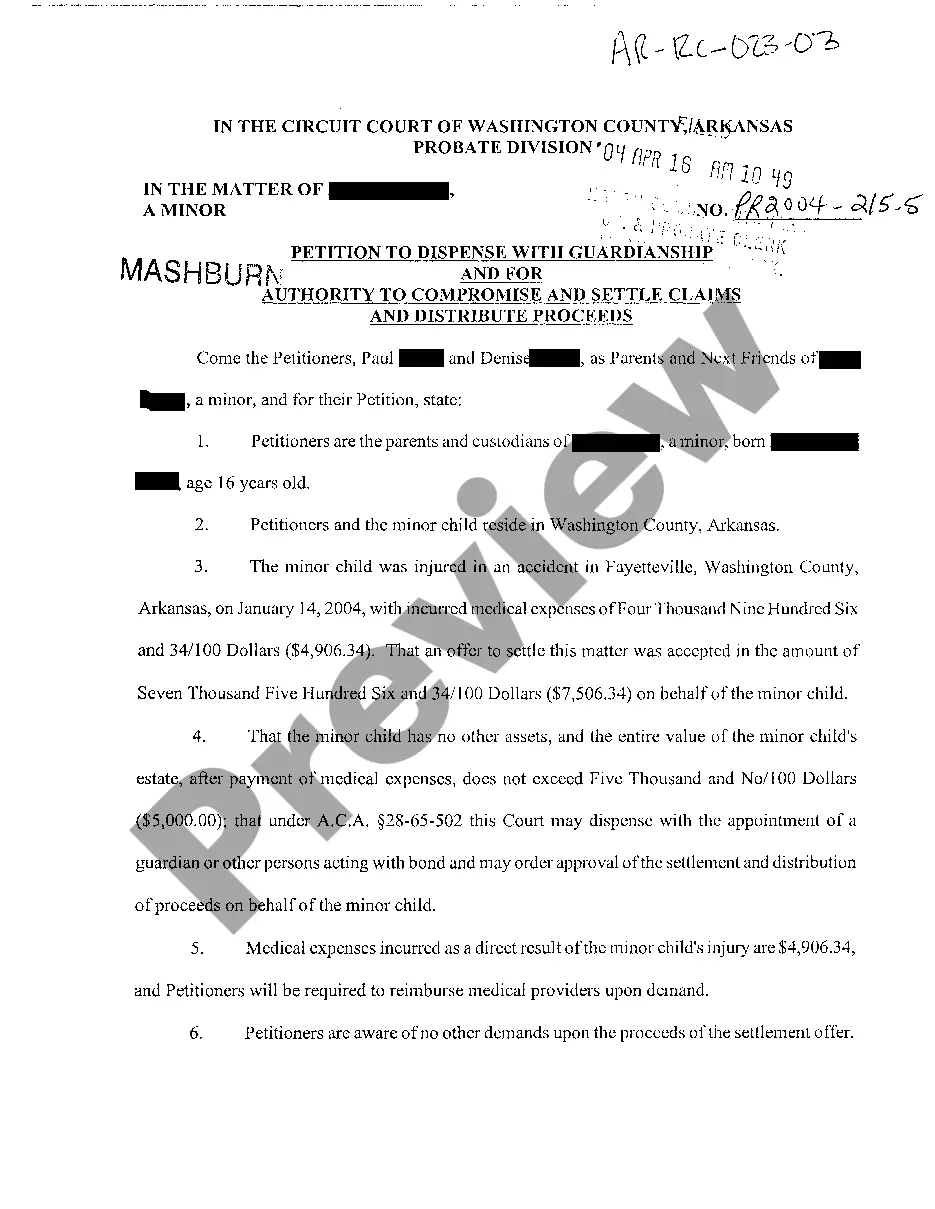

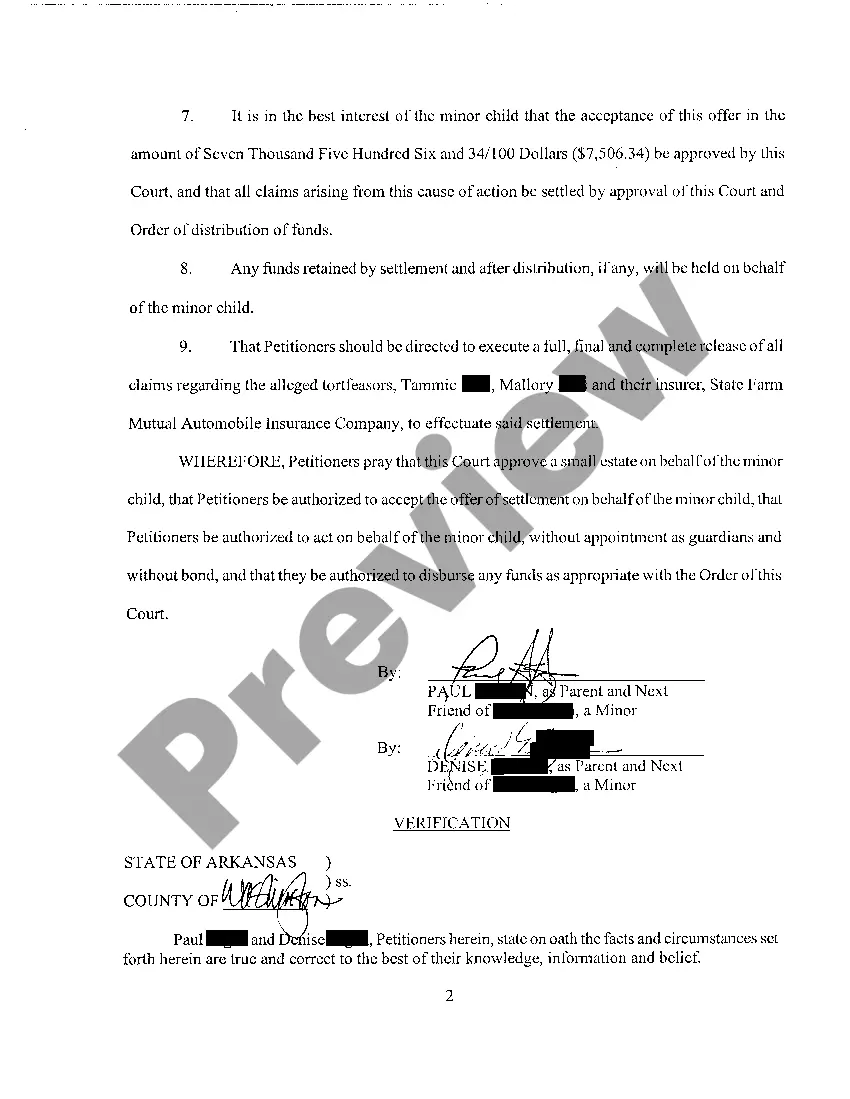

How to fill out Arkansas Petition To Dispense With Guardianship And For Authority To Compromise And Settle Claims And Distribute Proceeds?

Creating legal documents from the ground up can occasionally feel quite daunting.

Certain cases may require extensive research and significant financial investment.

If you’re seeking a more straightforward and cost-effective approach to producing the Petition To Terminate Guardianship Form For Indiana or any other type of legal documentation without unnecessary complications, US Legal Forms is readily available to assist you.

Our online repository of over 85,000 current legal forms covers almost every facet of your financial, legal, and personal issues.

But before diving straight into downloading the Petition To Terminate Guardianship Form For Indiana, consider these suggestions: Review the form preview and details to ensure you have located the document you need. Verify that the template you select meets the standards of your state and county. Opt for the correct subscription plan to acquire the Petition To Terminate Guardianship Form For Indiana. Download the document, then fill it out, sign it, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience in the field. Connect with us today and make document completion a simple and efficient process!

- With just a few clicks, you can promptly access state- and county-specific forms meticulously crafted for you by our legal professionals.

- Utilize our website whenever you require trusted and dependable services through which you can swiftly locate and obtain the Petition To Terminate Guardianship Form For Indiana.

- If you’re already familiar with our services and have previously set up an account with us, simply Log In to your account, choose the form, and download it or re-download it at any time from the My documents section.

- If you don’t have an account, no worries. It takes minimal time to register and browse the library.

Form popularity

FAQ

IRS Tax Form 1099-NEC. The IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

How to Write a Contractor Agreement Outline Services Provided. The contractor agreement should list all services the contractor will provide. ... Document Duration of the Work. Specify the duration of the working relationship. ... Outline Payment Terms. ... Outline Confidentiality Agreement. ... Consult with a Lawyer.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them.

Write the contract in six steps Start with a contract template. ... Open with the basic information. ... Describe in detail what you have agreed to. ... Include a description of how the contract will be ended. ... Write into the contract which laws apply and how disputes will be resolved. ... Include space for signatures.

9s and 1099s are tax forms that are required when employers work with an independent contractor. Form 9 is completed by the independent contractor and provides details on who they are. Form 1099NEC is completed by the employer and details the wages paid to the contractor.

An independent contractor agreement is a contract that lays out the terms of the independent contractor's work. It covers the contractual obligations, scope, and deadlines of the work to be performed. It affirms that the client and contractor are not in an employer-employee relationship.

Your independent contractor offer letter should include the following: Client name and address. Independent contractor name and address. Date of the contract. Services the independent contractor will provide. Compensation, including rates, payment frequency, and invoicing requirements.

MISC is used to report payments made to independent contractors (who cover their own employment taxes). A W2 form, on the other hand, is used for employees (whose employer withholds payroll taxes from their earnings). We know you have more questions, so let's dive in a little deeper.