Declination Of Successor Trustee Form For Trust

Description

Form popularity

FAQ

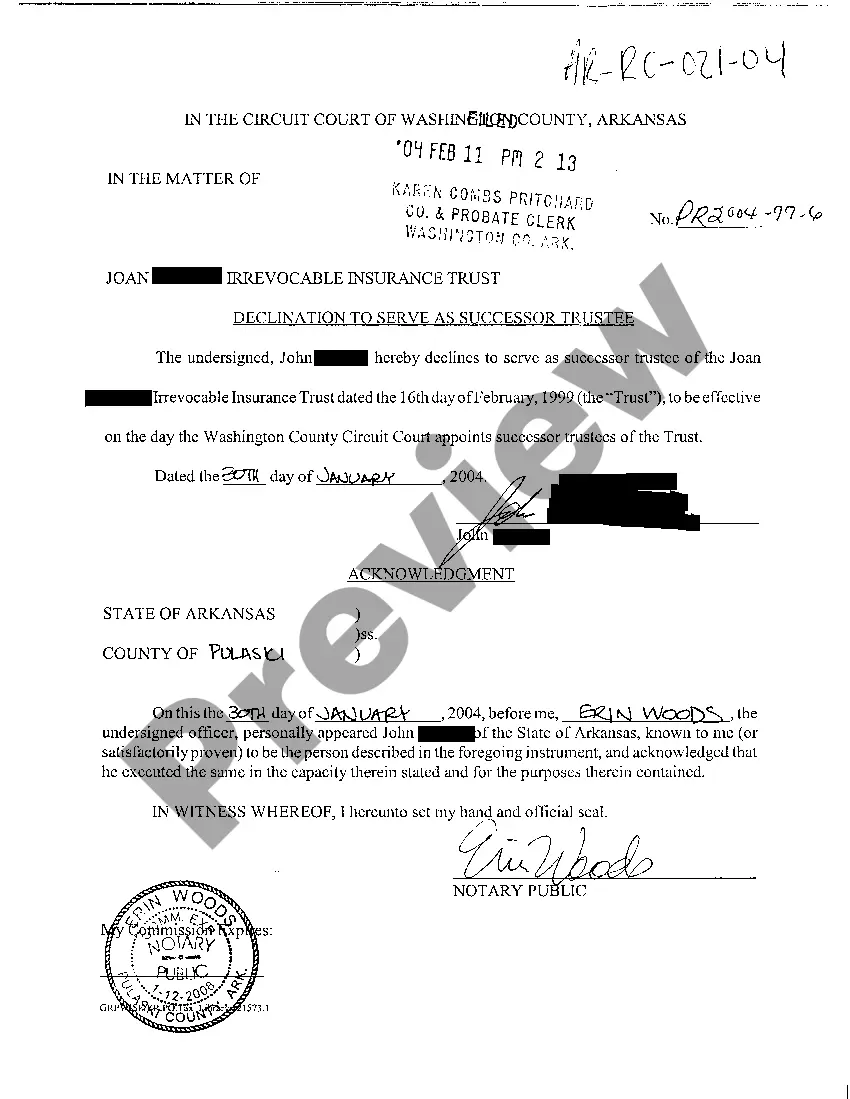

While it is not legally required to name a successor trustee, doing so is highly recommended to avoid future complications. Having a clear successor ensures smooth administration of the trust during transitions. In the absence of a chosen successor, a Declination of successor trustee form for trust can clarify intentions and streamline the appointment process. Consider working with a legal professional to understand your options.

If a trust does not name a trustee, it can create significant difficulties in managing the trust's assets. Typically, a court will need to appoint a trustee to ensure the trust operates properly. Utilizing a Declination of successor trustee form for trust can aid in explaining the situation and managing the process effectively. Seeking legal assistance can also provide guidance to navigate this challenge.

If no successor trustee is named, the trust may require court intervention to appoint a trustee. This can lead to delays and additional costs for the beneficiaries. Filing a Declination of successor trustee form for trust can clarify the situation and simplify the process. It is advisable to consult with a legal expert to determine the best course of action.

When there are no surviving trustees, the management of the trust can become complex. The trust document may allow for the appointment of a new trustee through a court process. Using a Declination of successor trustee form for trust can help document intentions and decisions, streamlining this process. You should consider legal advice to navigate this situation.

If a successor trustee dies, the trust may face uncertainty regarding its management. In this case, the trust document typically designates how to proceed. It is essential to prepare a Declination of successor trustee form for trust to document the transition. This ensures clarity and supports efficient trust administration.

If no successor trustee is named in the trust document, the trust may face complications once the original trustee is unable to act. In many cases, beneficiaries can petition the court to appoint a suitable trustee. Additionally, creating a Declination of successor trustee form for trust offers a way to establish who may take over if needed, helping to streamline this process and avoid potential disputes among beneficiaries.

Designating a successor trustee is an essential part of estate planning. To do this, you will need to create or amend your trust document to include the name of the successor trustee. It’s crucial to ensure that this individual understands their responsibilities and agrees to serve in this role. Additionally, using a Declination of successor trustee form for trust can help clarify the process if the designated trustee is unable or unwilling to fulfill those duties.

Changing a trustee requires careful attention to your trust's terms to comply with its provisions. You will need a Declination of Successor Trustee Form for Trust to officially document the change. Additionally, ensure that all relevant parties are notified, including beneficiaries and institutions that hold trust assets. This process guarantees that the transition is clear and legally upheld.

Instructions for a successor trustee typically include understanding their fiduciary duties and responsibilities outlined in the trust document. Additionally, they may need to familiarize themselves with the terms of the Declination of Successor Trustee Form for Trust, especially if they are transitioning from a declined trustee role. It's crucial for them to act in the best interests of the beneficiaries and maintain accurate records throughout the trust management process.

To decline a successor trustee, first, you should gather the necessary documentation, including the Declination of Successor Trustee Form for Trust. Fill out the form accurately, providing all required details regarding the trust and the trustee you wish to decline. Once completed, ensure you submit this form to the appropriate parties to formalize your decision and keep your trust administration on track.