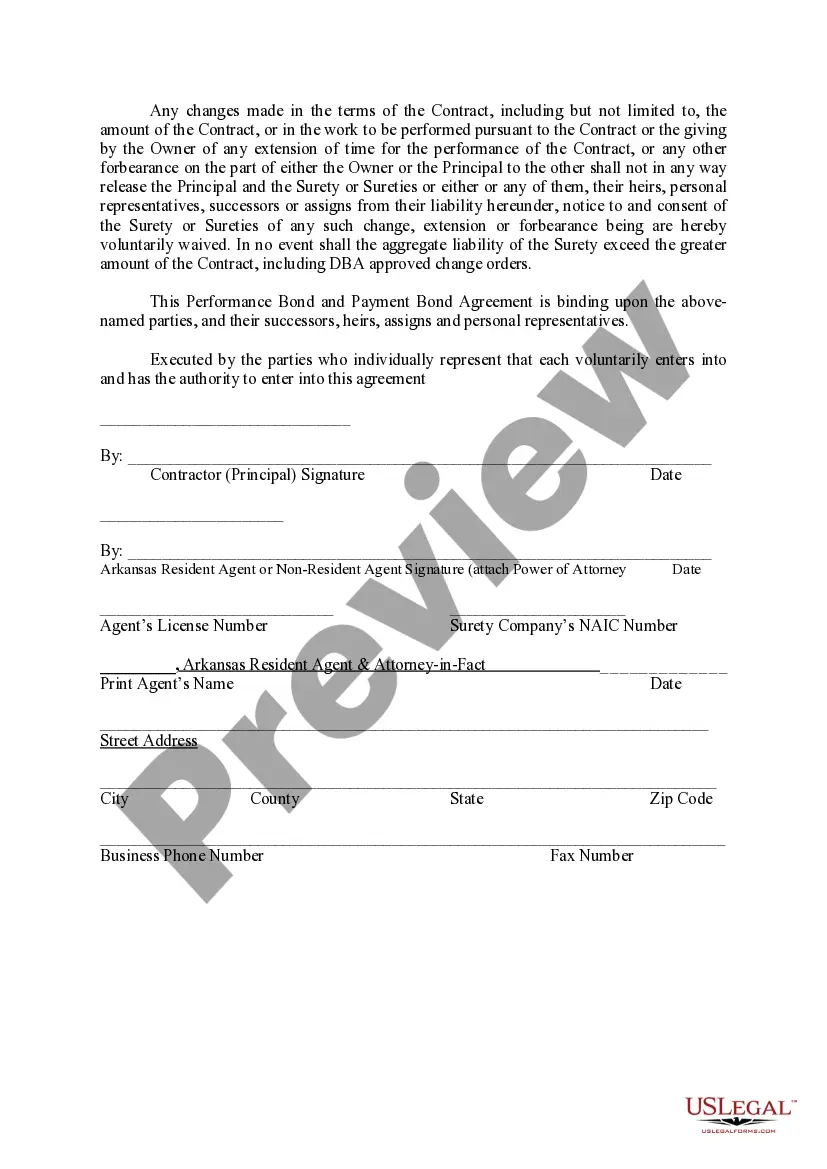

Payment Bond Form

Description

How to fill out Arkansas Performance And Payment Bond?

Precisely composed formal documents serve as a critical assurance for preventing issues and legal disputes; however, acquiring them without the guidance of an attorney may require some time.

Whether you are in need of promptly locating a current Payment Bond Form or other templates for employment, family, or business purposes, US Legal Forms is always available to assist.

The procedure is even easier for existing users of the US Legal Forms library. If your subscription is active, simply Log In to your account and click the Download button next to the selected document. Additionally, you can access the Payment Bond Form at any time since all documents previously acquired on the platform are stored in the My documents section of your profile. Conserve time and resources on drafting formal documents. Experience US Legal Forms today!

- Verify that the form aligns with your circumstances and locality by reviewing the description and preview.

- If necessary, search for additional samples using the Search bar in the header of the page.

- Once you find the suitable template, click on Buy Now.

- Choose the pricing plan, Log In to your account or establish a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Decide between PDF or DOCX file format for your Payment Bond Form.

- Press Download, then print the document to complete it or upload it to an online editing tool.

Form popularity

FAQ

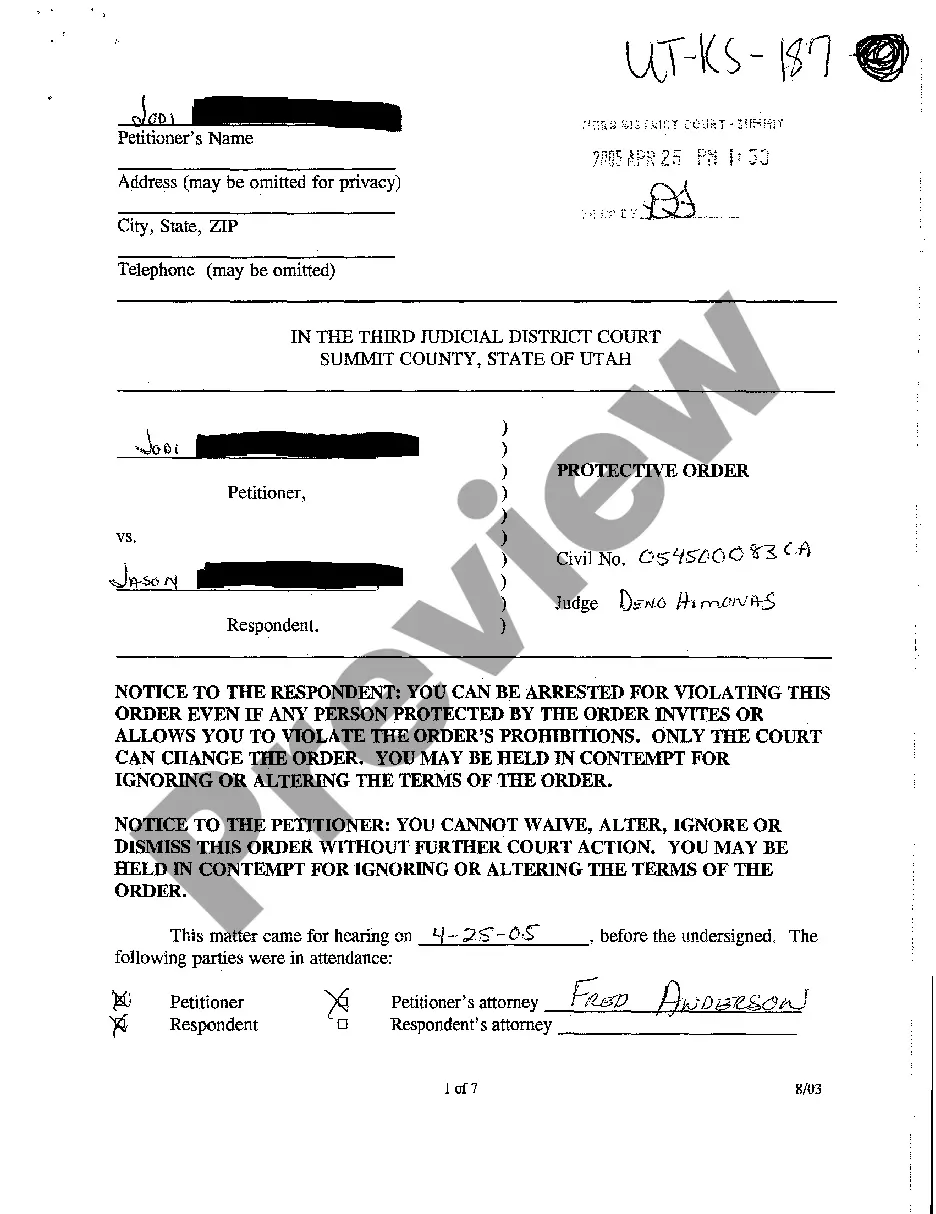

Bond claims are requests made by parties involved in a contract when one party fails to meet their contractual obligations. These claims seek compensation for financial losses incurred due to non-compliance. For effective management of bond claims, using a payment bond form can clarify terms and solidify protections for all parties involved, facilitating a smoother resolution process.

A surety bond claim arises when a principal, like a contractor, does not fulfill contractual obligations. For example, if a contractor abandons a project, the project owner can initiate a claim against the surety bond. This action ensures that the owner can recover costs for project completion. Leveraging a payment bond form can be vital in streamlining this process and protecting the interests of everyone involved.

Filing a bond typically involves completing a bond application, providing necessary documentation, and paying the required premium. After submitting the payment bond form and the needed papers, the surety company will review your application. If approved, they will issue the bond, allowing you to begin the project while protecting all parties involved. Utilizing an established platform like US Legal Forms can simplify this process.

A bid bond claim occurs when a contractor fails to honor their bid after winning a project. For instance, if a contractor underestimates their costs and withdraws from the project, the project owner can claim against the bid bond. This ensures that the project owner is compensated for the inconvenience and the need to find a new contractor. To safeguard your project, consider using a payment bond form to protect against such situations.

A mortgage bond is also known as a 'mortgage-backed security.' This type of bond is backed by a pool of mortgage loans. Using a payment bond form in this context can provide clarity on obligations and enhance security for investors.

Another common name for contract bonds is 'construction bonds.' These bonds are essential for ensuring that contractors fulfill their obligations on a project. Utilizing the right payment bond form as part of your contract bonds can provide additional security for all parties involved.

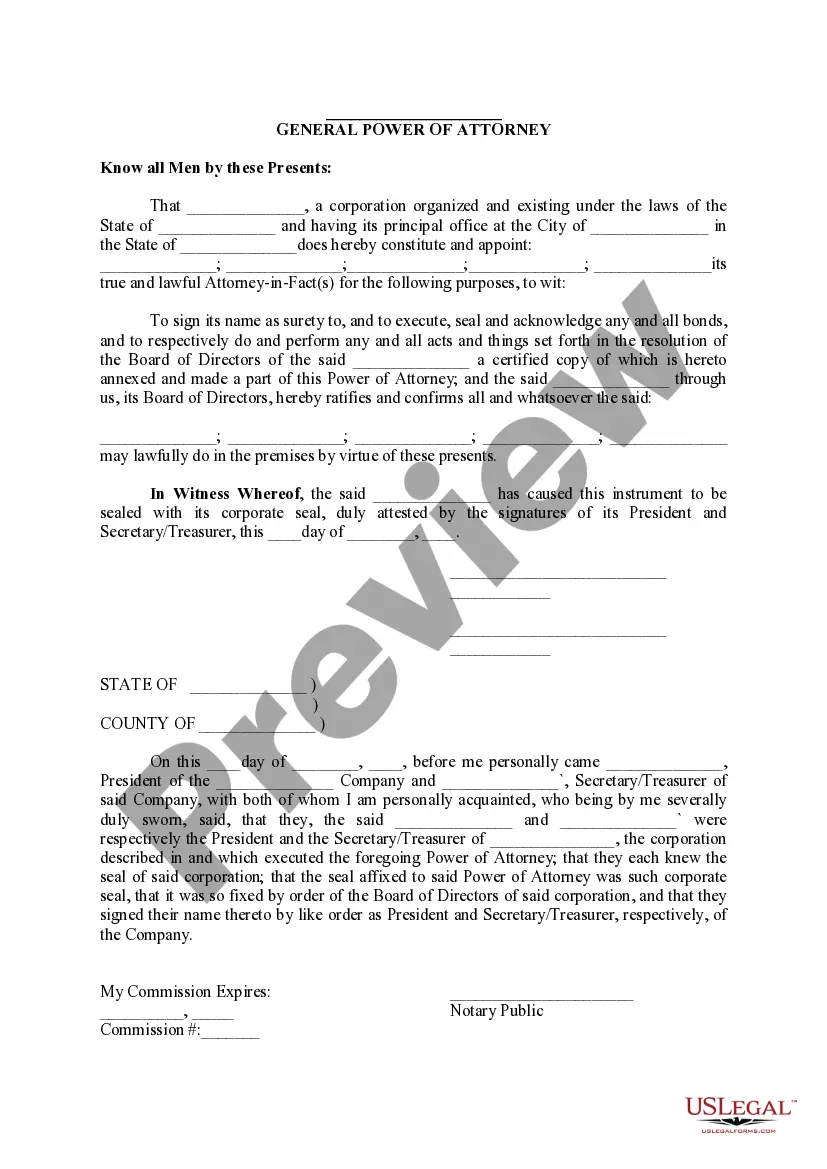

A surety bond is a broader term that encompasses various types of bonds, including performance bonds and payment bonds. A P&P bond, which stands for performance and payment bond, covers both the performance of the contract and the payment for subcontractors. Understanding these distinctions can help you choose the right payment bond form for your project's specific requirements.

Another common name for a payment bond is a 'surety bond.' This term emphasizes the role of the surety company in guaranteeing the payment obligations. A payment bond form effectively creates a safety net for subcontractors and suppliers, ensuring they receive payment as agreed.

Yes, a payment bond is similar to a labor and material bond as both ensure payment to those who provide labor or materials for a project. However, the term 'payment bond' is more commonly used in a general context, while 'labor and material bond' specifically refers to obligations regarding laborers and suppliers. It is crucial to use the correct payment bond form to clarify these roles.

To obtain a payment bond, you should start by finding a licensed surety company that specializes in bond services. Generally, you will need to provide information about your project, financial background, and business history. After submitting the necessary documents, the surety will evaluate your application and determine if they can issue a payment bond form for your needs.