Transfer On Death Deed Form Arkansas With Iowa

Description

How to fill out Arkansas Beneficiary Or Transfer On Death Deed Or TOD - Husband And Wife Or Two Individuals To Husband And Wife Or Two Individuals?

Handling legal paperwork and operations could be a time-consuming addition to your entire day. Transfer On Death Deed Form Arkansas With Iowa and forms like it typically require you to look for them and navigate the best way to complete them properly. Consequently, whether you are taking care of financial, legal, or individual matters, having a thorough and hassle-free web catalogue of forms when you need it will go a long way.

US Legal Forms is the number one web platform of legal templates, offering over 85,000 state-specific forms and a number of tools to help you complete your paperwork effortlessly. Explore the catalogue of relevant papers available to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any moment for downloading. Shield your document management processes using a high quality services that allows you to prepare any form in minutes without having extra or hidden cost. Just log in in your account, find Transfer On Death Deed Form Arkansas With Iowa and download it right away in the My Forms tab. You may also gain access to previously saved forms.

Is it your first time making use of US Legal Forms? Sign up and set up an account in a few minutes and you will gain access to the form catalogue and Transfer On Death Deed Form Arkansas With Iowa. Then, stick to the steps below to complete your form:

- Ensure you have found the correct form by using the Review feature and reading the form information.

- Select Buy Now once all set, and choose the subscription plan that is right for you.

- Select Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise helping consumers handle their legal paperwork. Discover the form you require today and streamline any process without having to break a sweat.

Form popularity

FAQ

Real Estate and TOD in Iowa In Iowa, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

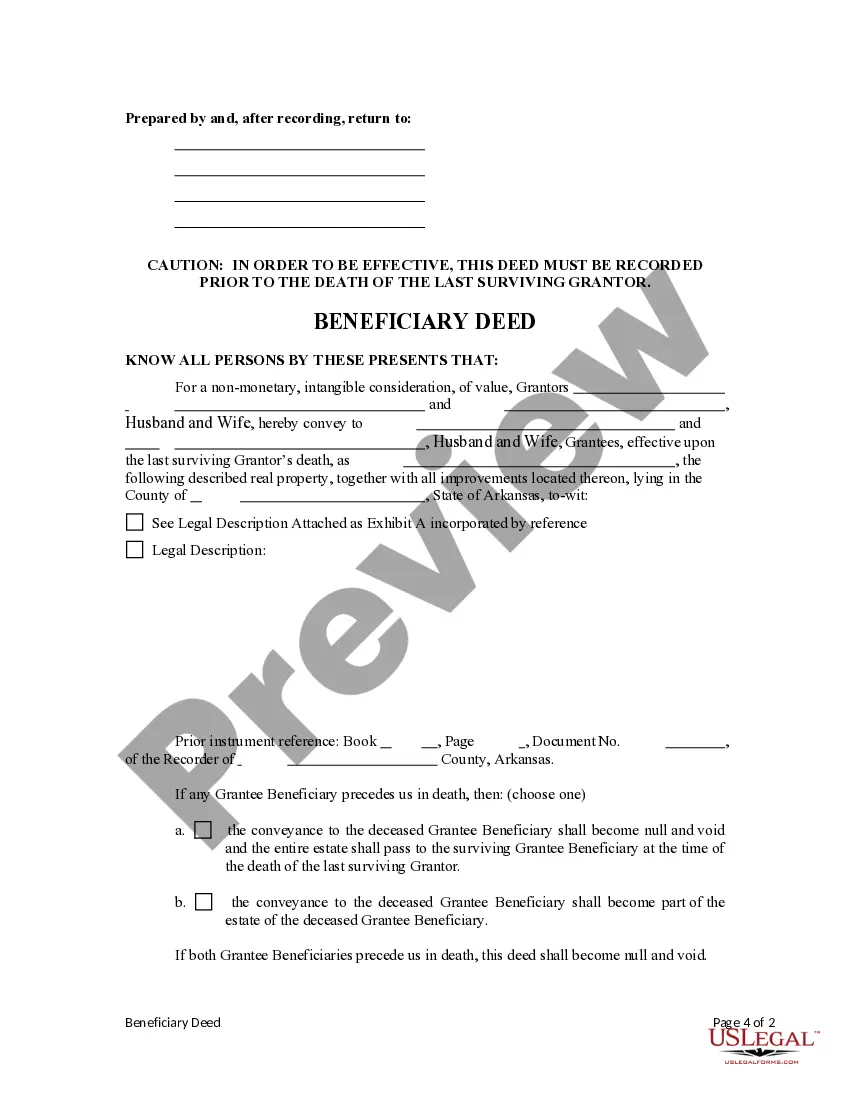

Arkansas allows you to leave real estate with transfer-on-death deeds. These deeds are also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death.

Arkansas Beneficiary (Transfer-on-Death) Deed (Ark. Code Ann. section 18-12-608.) You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death.

Arkansas Beneficiary (Transfer-on-Death) Deed Code Ann. section 18-12-608.) You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death. Otherwise, it won't be valid.

Transfer-on-death real estate, vehicles in Iowa In Iowa, transfer-on-death deeds or registration is not allowed for real estate or vehicles.