Transfer On Death Deed Form Arkansas For Medical Sciences

Description

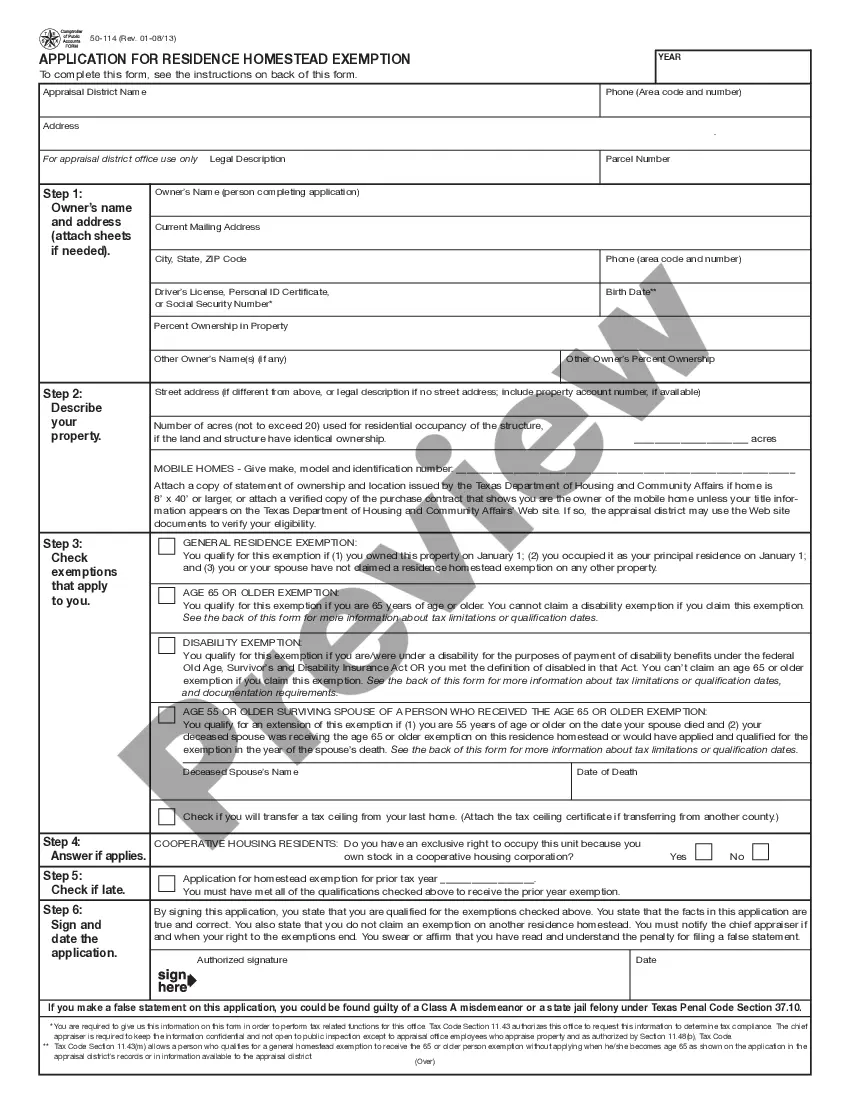

How to fill out Arkansas Beneficiary Or Transfer On Death Deed Or TOD - Husband And Wife Or Two Individuals To Husband And Wife Or Two Individuals?

Whether for professional reasons or for personal matters, everyone must confront legal situations at some time in their life.

Completing legal documents requires meticulous attention, beginning with selecting the suitable form template.

Once it is downloaded, you can complete the form with the assistance of editing software or print it and finish it manually. With a vast US Legal Forms catalog available, you never need to waste time searching for the right sample across the internet. Utilize the library's straightforward navigation to find the appropriate template for any occasion.

- For instance, if you select an incorrect version of a Transfer On Death Deed Form Arkansas For Medical Sciences, it will be denied once you submit it.

- Thus, it is crucial to find a trustworthy source for legal documents like US Legal Forms.

- If you need to acquire a Transfer On Death Deed Form Arkansas For Medical Sciences template, follow these simple steps.

- Locate the sample you require using the search bar or catalog navigation.

- Review the form's description to confirm it suits your situation, state, and locality.

- Click on the form's preview to view it.

- If it is the wrong document, return to the search feature to find the Transfer On Death Deed Form Arkansas For Medical Sciences template you need.

- Download the file if it satisfies your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you desire and download the Transfer On Death Deed Form Arkansas For Medical Sciences.

Form popularity

FAQ

Arkansas charges a real property transfer tax for real estate transfers involving more than $100.00 in payment. The total transfer tax rate is $3.30 per $1,000.00 of consideration?two-thirds of which is expressly the new owner's responsibility.

Arkansas allows you to leave real estate with transfer-on-death deeds. These deeds are also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death.

When transferring property, a seller (often called the grantor), writes out a deed, transferring property to the buyer (often called the grantee). The deed is then recorded with the recorder in the county in which the property is located. Recording ? All deeds are to be filed with the Circuit Court (See Map).

(Ark. Code Ann. § 18-12-608.) You must sign the deed and get your signature notarized, and then record (file) the deed before your death with the county clerk, circuit clerk, or recorder's office (the name varies by county) in the county where the real estate is located.

Transfer on Death Deeds are used in Estate Planning to avoid probate and simplify the passing of real estate to your loved ones or Beneficiaries. It's also known as a ?Beneficiary Deed? because in essence, you're naming a Beneficiary who will receive the deed to your property after you pass away.