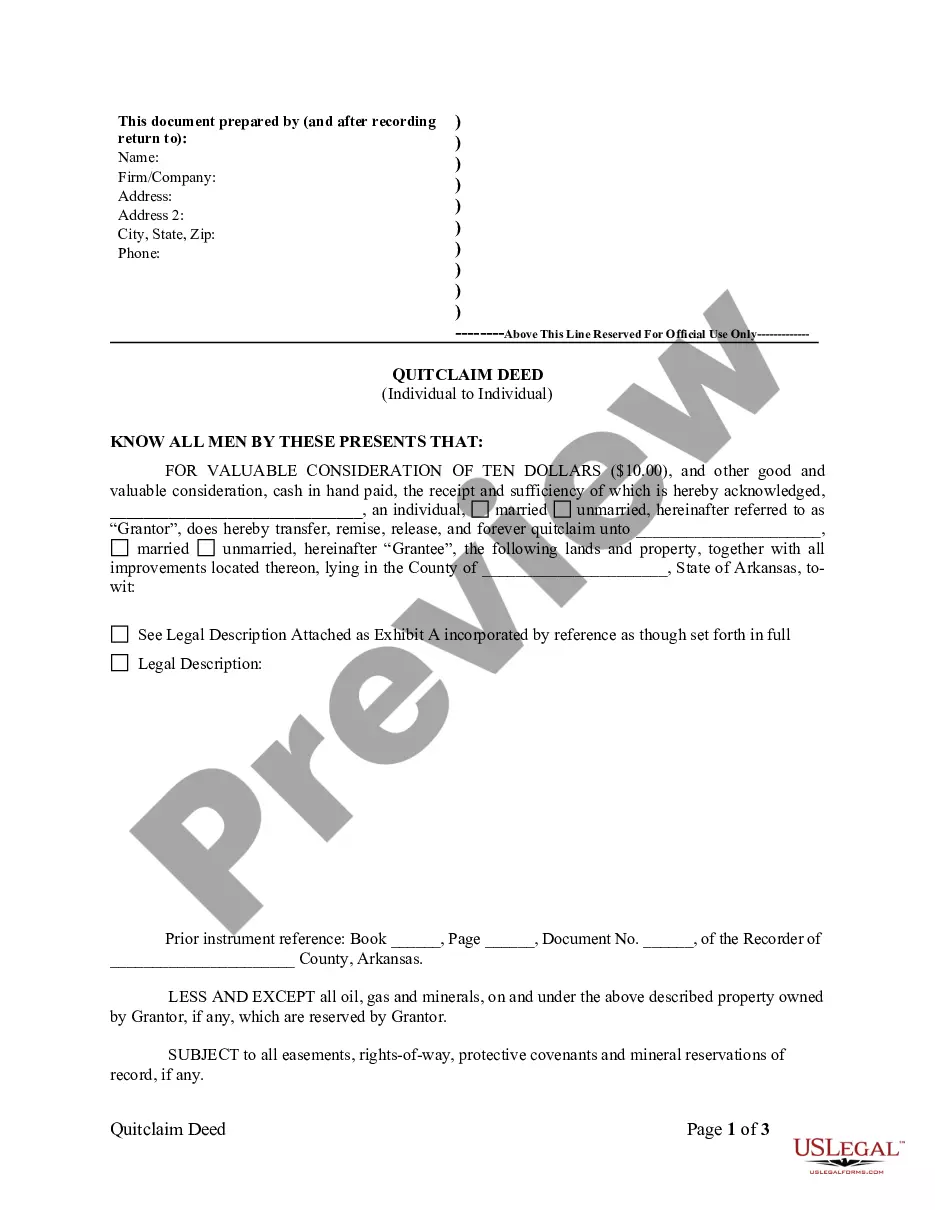

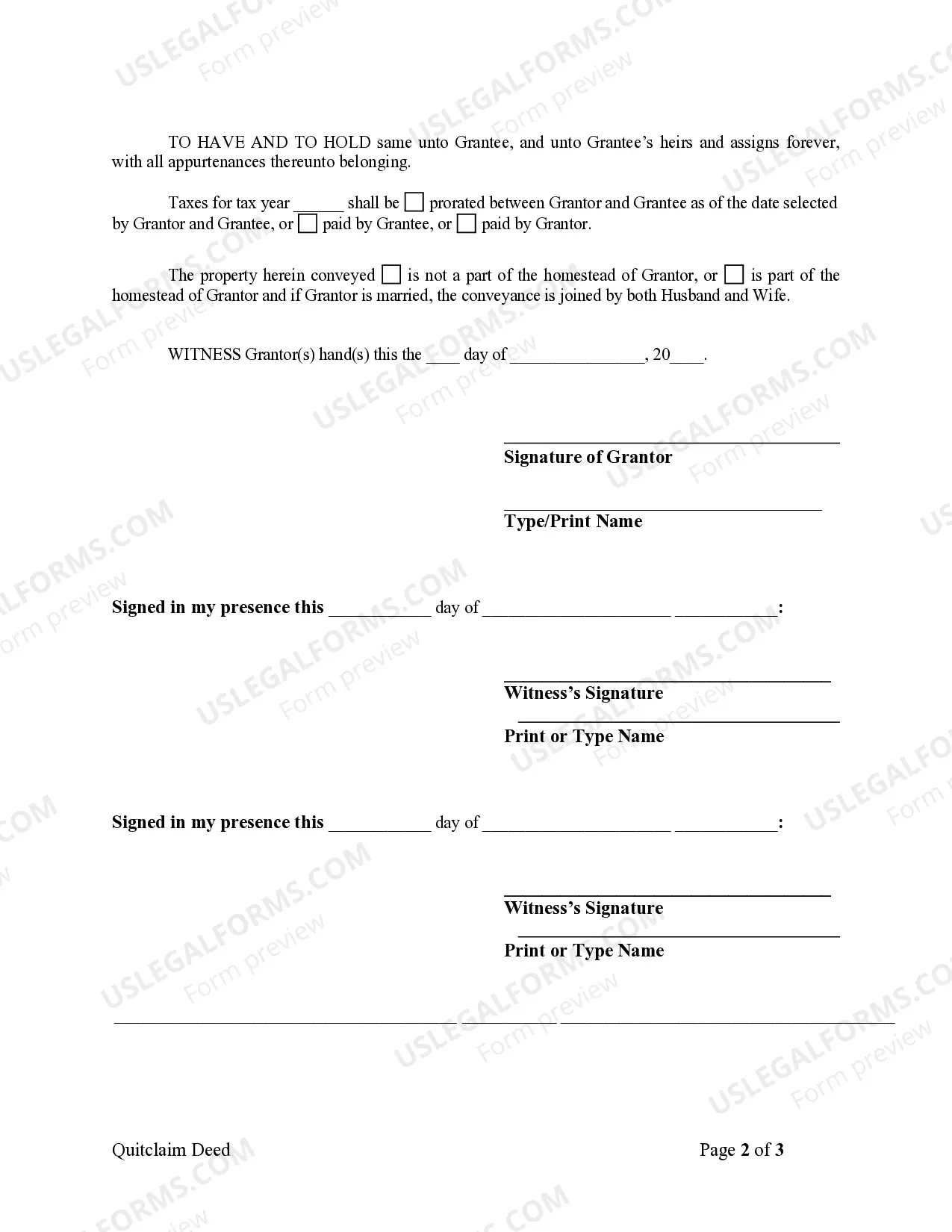

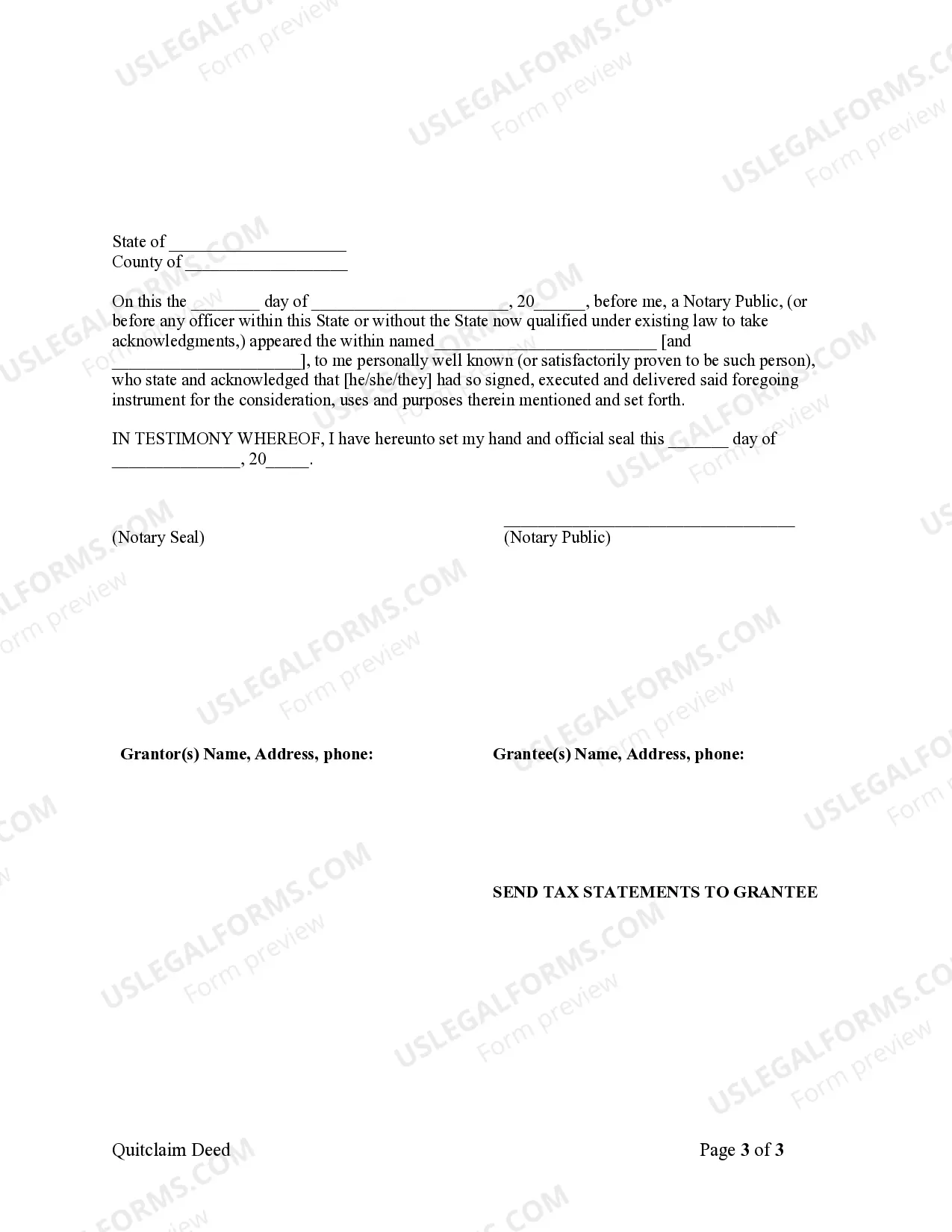

This Quitclaim Deed from Individual to Individual form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Quitclaim Deed Real Estate With Mortgage

Description

Form popularity

FAQ

In California, a quitclaim deed can be prepared by the property owner, an attorney, or a legal form service like US Legal Forms. It's crucial to ensure that the quitclaim deed clearly states the intentions of the owner, especially in real estate transactions involving a mortgage. By using a service like US Legal Forms, you can access templates that meet state requirements, simplifying the process. This approach helps ensure that your quitclaim deed real estate with mortgage is properly documented, safeguarding your interests.

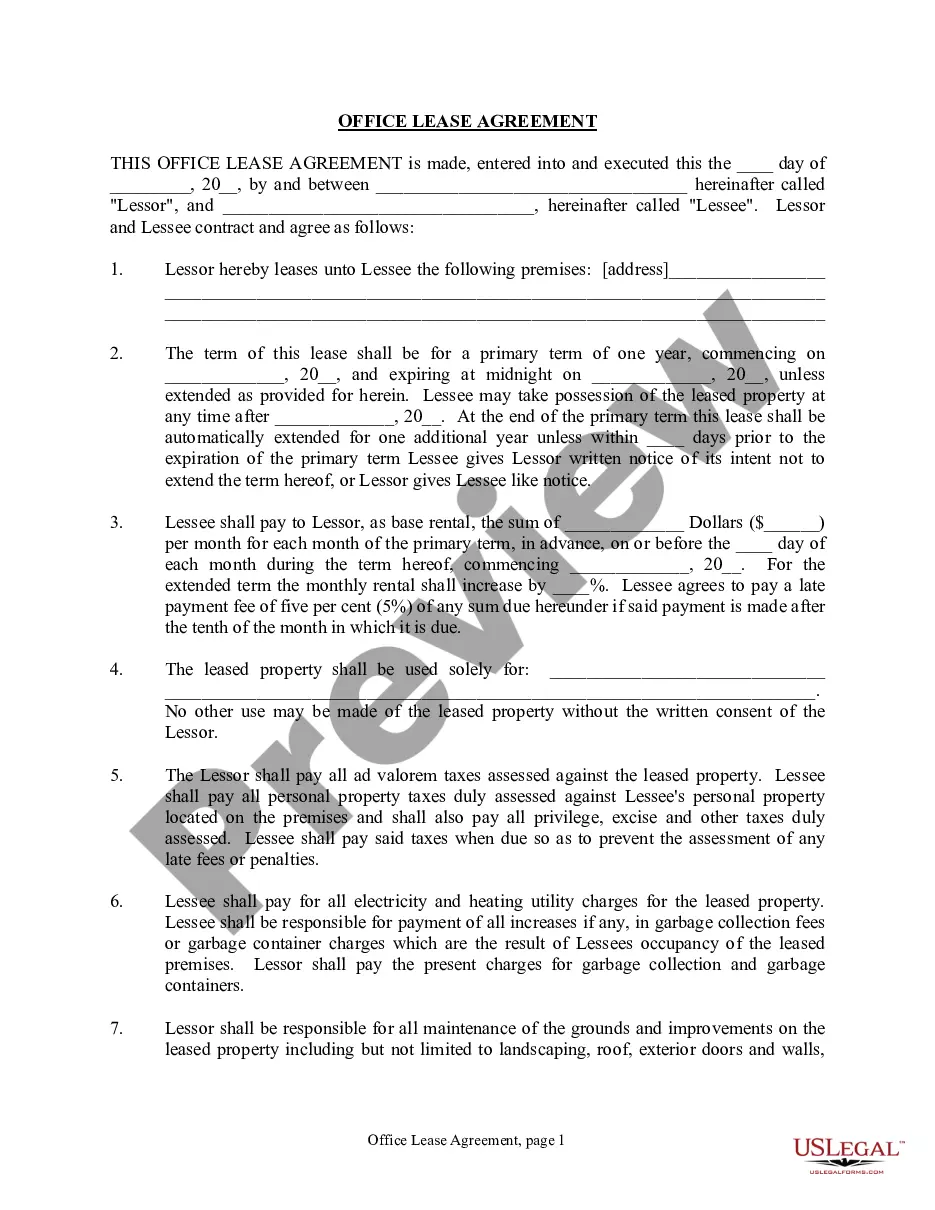

Quitclaim deeds are most often used for transferring property between family members or in divorce settlements. They efficiently transfer ownership without the need for title guarantees, making them practical for personal situations. When dealing with quitclaim deed real estate with mortgage, these transfers can be completed swiftly, allowing for uncomplicated division of assets.

A warranty deed offers the most protection for property buyers. It guarantees that the seller has the right to transfer the property and warrants that the title is clear of any encumbrances. Unlike a quitclaim deed real estate with mortgage, which carries no such guarantees, a warranty deed helps safeguard against future claims or legal issues.

Yes, a quitclaim deed must be notarized in the Philippines to ensure its validity. Notarization provides a level of assurance that the transaction is genuine and that all parties have executed the document willingly. Similar to the quitclaim deed real estate with mortgage in other countries, this notarization process helps to prevent disputes later on.

Individuals commonly benefit from a quitclaim deed when they wish to transfer property ownership quickly and without complications. Family members often use this type of deed to pass on property, especially when real estate with a mortgage is involved. In such cases, the incoming party can receive the property without intricate legal processes, making it ideal for simple transfers.