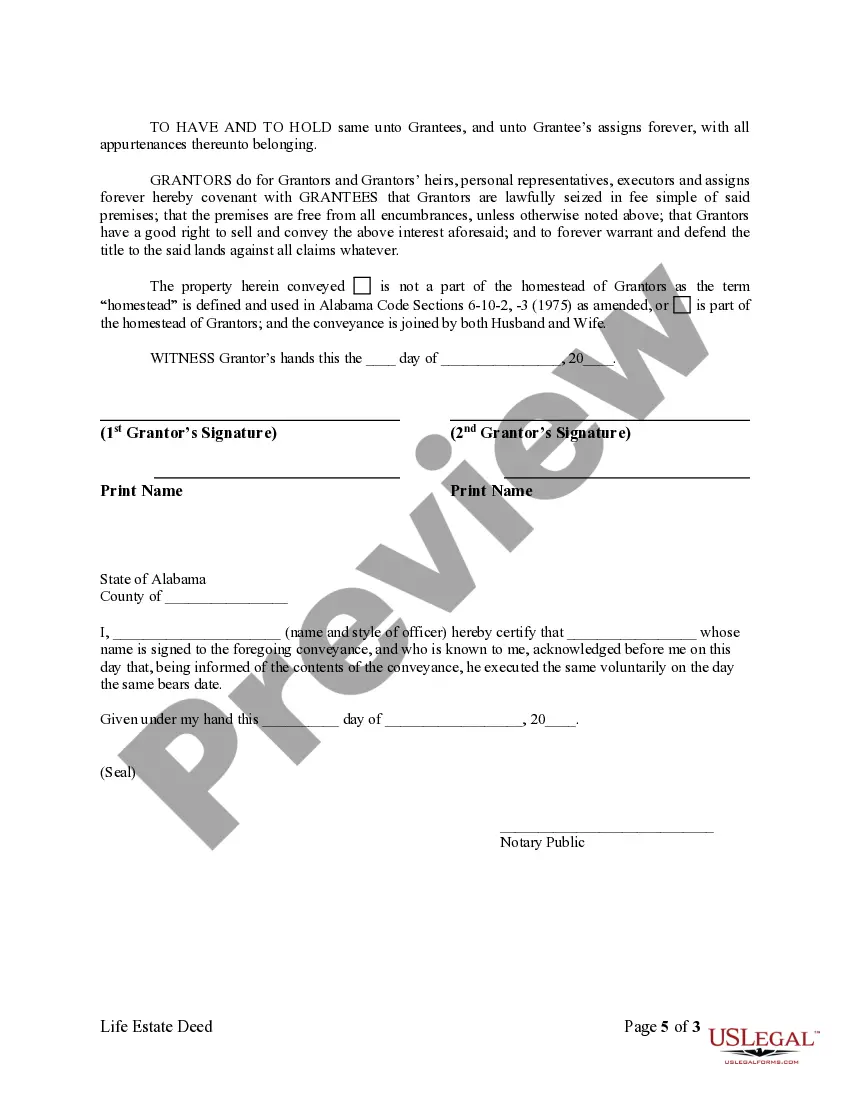

Life Estate Deed With Mortgage

Description

How to fill out Alabama Warranty Deed For Retention Of Life Estate (Husband And Wife To Husband And Wife)?

- Start by accessing the US Legal Forms website. If you’re already a member, simply log in to download your desired document. Ensure that your subscription remains active.

- For new users, begin by examining the Preview mode and detailed form descriptions to find the right life estate deed with mortgage that aligns with your state’s regulations.

- If you require a different form, utilize the Search tab to find alternatives that best suit your needs.

- Purchase your selected document by clicking the Buy Now button. Choose the subscription plan that works for you. Be prepared to register for an account to unlock full access.

- Complete the transaction by entering your credit card information or using your PayPal account for payment.

- Finally, download your form and save it for easy access in the My documents section of your profile.

In conclusion, obtaining a life estate deed with mortgage through US Legal Forms not only saves you time but also ensures that you have access to expertly crafted legal documents. With a library larger than competitors, preparing legal paperwork has never been easier.

Start your journey with US Legal Forms today and secure your documents with confidence.

Form popularity

FAQ

Yes, you can create a life estate deed with mortgage, but there are some important considerations. The mortgage lender typically holds a security interest in the property, which can affect the life estate. You must ensure that the life tenant understands their responsibilities regarding mortgage payments and property maintenance. It may be wise to seek assistance from a legal platform like US Legal Forms to navigate this process effectively.

Selling a house in life estate requires cooperation from the life tenant. Since they hold the rights to live in the property, their approval is essential for any transaction. If the life tenant agrees, you can proceed, keeping in mind that the property may still carry a mortgage. It's beneficial to consult resources like US Legal Forms to ensure you meet all legal requirements.

You can sell a house that is in a life estate, but it requires the consent of the life tenant. The life tenant retains rights to live in or use the property during their lifetime, so their agreement is necessary for a sale to proceed. In some cases, you might also need to address any outstanding mortgage on the property. Consider using services like US Legal Forms for guidance on how to properly structure the sale.

Transferring ownership of a house with a mortgage after death can be straightforward if the property has a life estate deed with mortgage in place. The life estate grants rights of occupancy, so the remaining beneficiaries will inherit the property according to the deed’s terms. It is essential to notify the lender of the owner’s passing, and you may need legal assistance to navigate the mortgage obligations. Utilizing platforms like US Legal Forms can help streamline the necessary documentation.

Getting around a life estate deed with mortgage typically involves legal approaches, such as negotiating with the life tenant. If both parties agree, the life estate can be terminated, allowing for a full transfer of ownership. Alternatively, you might explore the option of buying out the life tenant's rights, which can simplify the process. However, it's essential to consult a legal expert before making these decisions.

Generally, a will does not override a life estate deed with mortgage. The life estate creates a legal right to live in or use the property for the duration of a person's life. Upon their death, the property automatically passes to the remainder beneficiaries, as specified in the deed. Therefore, your will cannot change this transfer of ownership.

One disadvantage of a life estate deed with mortgage is that it can complicate property sales. When you create a life estate, you give someone else rights to the property for their lifetime, which can limit your control over it. Additionally, if the life tenant dies, the property may still be encumbered by the mortgage, making transfers tricky. Therefore, it's crucial to understand these implications before proceeding.

One downside of a life estate is that it limits the life estate holder's ability to alter or sell the property without the remainderman's consent. This restriction can be challenging if circumstances change or if the holder encounters financial difficulties. Additionally, the life estate holder remains responsible for property taxes and maintenance costs, even if they can’t control the sale. Assessing these factors carefully will help you determine if a life estate deed with mortgage is suitable for your situation.

A mortgage on a life estate is not void after the life estate holder dies; instead, it continues to affect the property. The remainderman inherits the property with the existing mortgage obligations still in place. It's vital to recognize that not addressing these issues can lead to foreclosure or other financial problems for the inheritor. Thorough planning and legal adjustments, possibly through tools like a life estate deed with mortgage, can safeguard future interests.

Yes, a life estate can take out a mortgage, allowing the life estate holder to leverage the home while retaining the right to live on the property. However, the mortgage will impact the remainderman's interest in the property, as the mortgage lender will hold a lien. This can be beneficial for the life estate holder, but it's essential to consult legal resources, like USLegalForms, to understand the implications fully. This way, you can make informed decisions about your property.