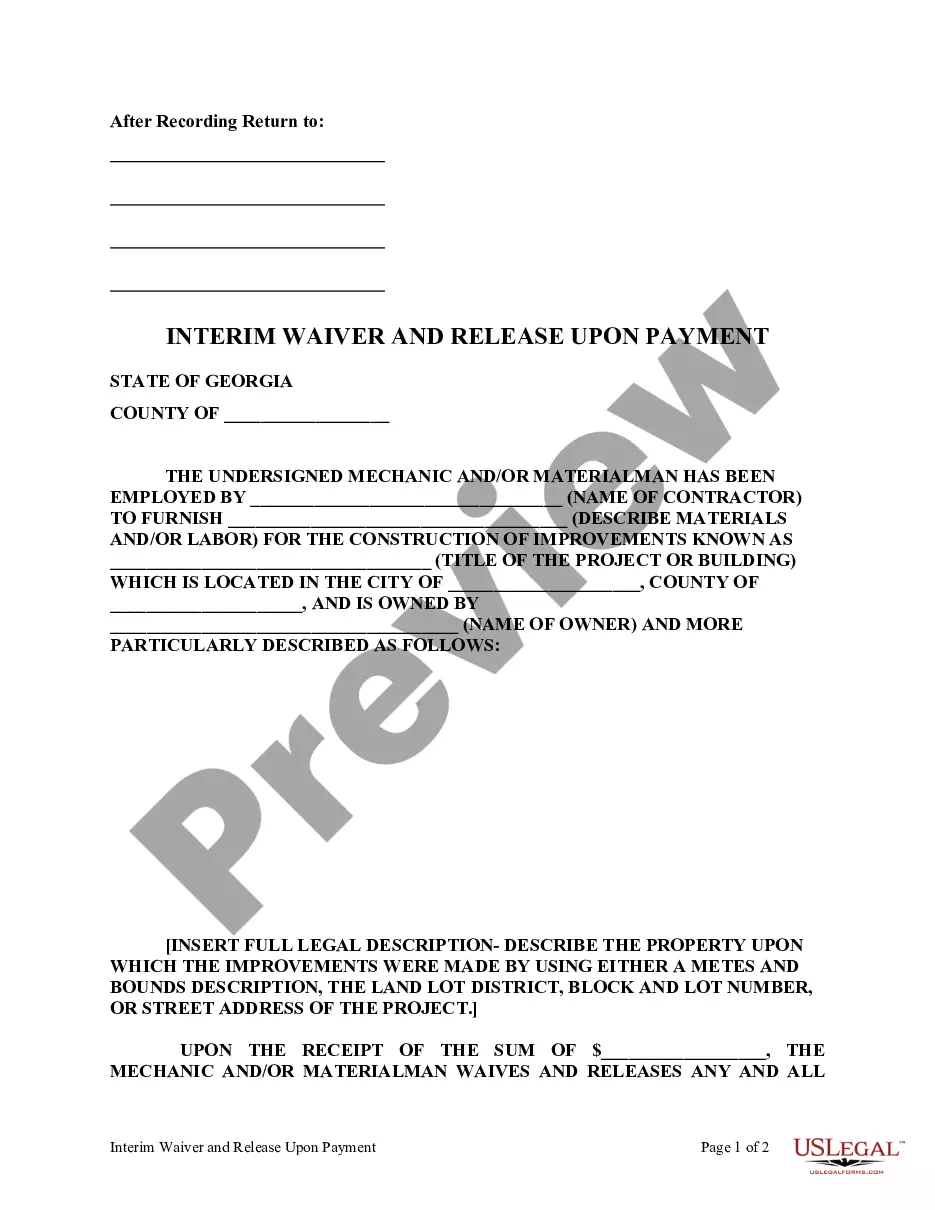

Order of Commitment to Jail, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statutes and law.

Order Of Commitment To Jail For Protective

Description

How to fill out Alabama Order Of Commitment To Jail?

The Document of Commitment to Incarceration for Safeguarding displayed on this page is a reusable legal blueprint created by expert attorneys in accordance with national and state regulations.

For over 25 years, US Legal Forms has delivered individuals, enterprises, and legal practitioners with more than 85,000 validated, jurisdiction-specific forms for various business and personal situations. It is the quickest, simplest, and most dependable method to acquire the documents you require, as the service ensures bank-level data security and malware protection.

Choose the format you prefer for your Document of Commitment to Incarceration for Safeguarding (PDF, Word, RTF) and save the sample to your device. Complete and endorse the documents. Print the template to fill it out manually. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately complete and endorse your document with a legally binding electronic signature.

- Search for the document you require and examine it.

- Browse the sample you sought and view it or review the form description to verify it meets your needs. If it does not, utilize the search function to find the suitable one. Click Buy Now once you have found the template you seek.

- Sign up and Log Into your account.

- Select the payment plan that fits you best and register for an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

In Virginia, the minimum mandatory sentencing for violating a protective order for the third time within 20 years can lead to serious legal consequences, including the possibility of a jail sentence. Specifically, individuals may face up to six months in jail and a fine. It is important to recognize the gravity of repeated violations, as the law aims to protect victims. Our platform offers resources for understanding the order of commitment to jail for protective offenses.

The five debt-relief programs offered in North Carolina include debt management programs, debt settlement, debt consolidation loans, nonprofit debt settlement and bankruptcy. Each program has pluses and minuses to consider.

Debt settlement companies, also sometimes called "debt relief" or "debt adjusting" companies, often claim they can negotiate with your creditors to reduce the amount you owe. Consider all of your options, including working with a nonprofit credit counselor and.

In North Carolina, the statute of limitations for debt is three years from the last activity on your account. That is how much time a debt collector has to file a lawsuit to recover the debt through the court system,. It's one of the shortest such limits in the country.

Can a Debt Collector Collect After 10 Years? In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

In North Carolina, Section 1-52.1 of the North Carolina Rules of Civil Procedure explains the statute of limitations for debts is 3 years for auto and installment loans, promissory notes, and credit cards. The statute of limitations in North Carolina for private student loans is also three years.

North Carolina Free Legal Answers is a virtual legal advice clinic in which qualifying users post civil legal questions at no cost to be answered by pro bono attorneys licensed in their state.

Debt collectors are allowed to contact you: In person, by mail, by telephone and by fax about the bills you owe. At home, between the hours of 8 a.m. and 9 p.m. At work. It is legal for debt collectors to contact you on the job unless they have a telephone number to reach you during non-working hours.

If your creditors want to sue you over unpaid debts, they have three years from when you defaulted on the debt . Therefore, any lawsuit filed more than three years after that date is not legally valid and should be rejected by the courts. A bankruptcy lawyer can explain more about how this impacts your rights.