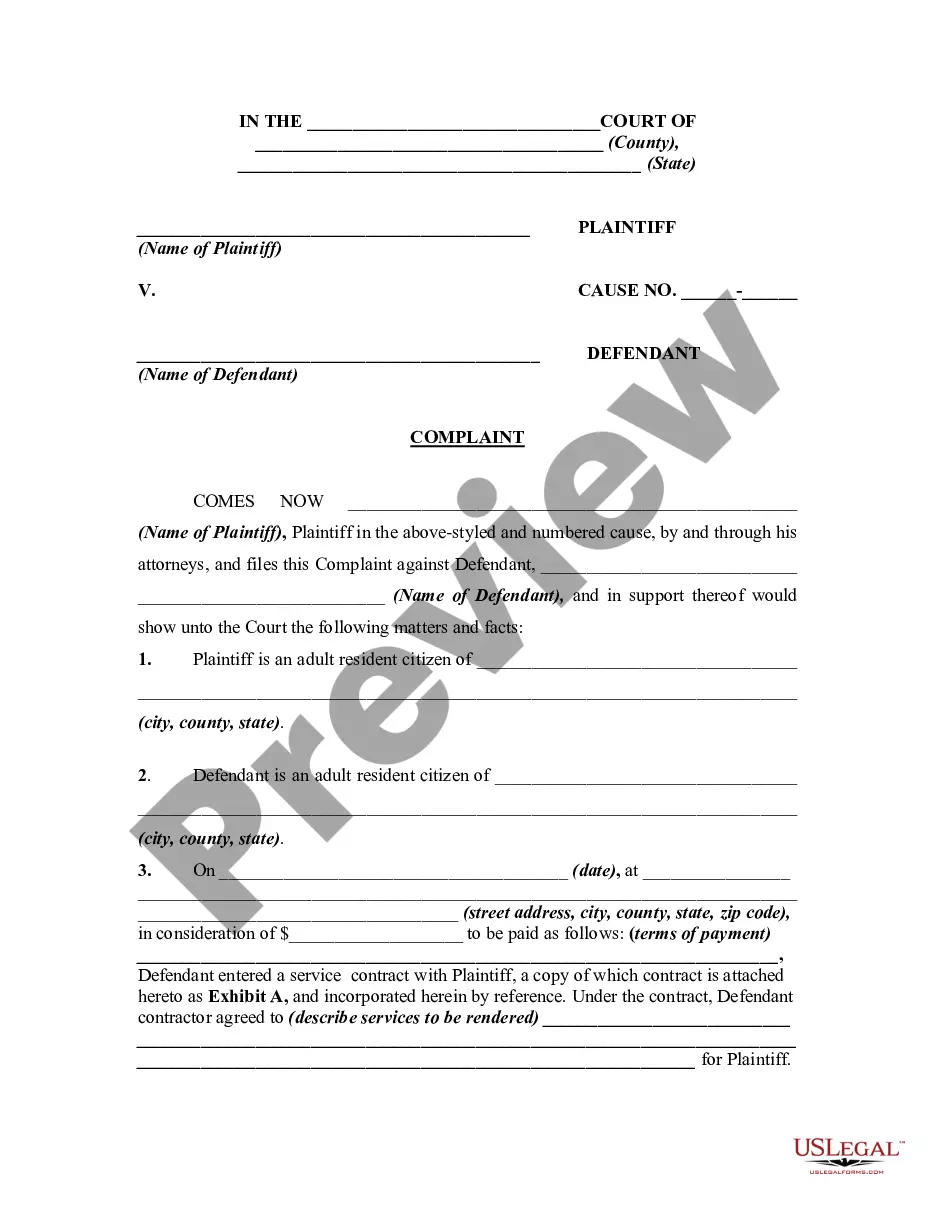

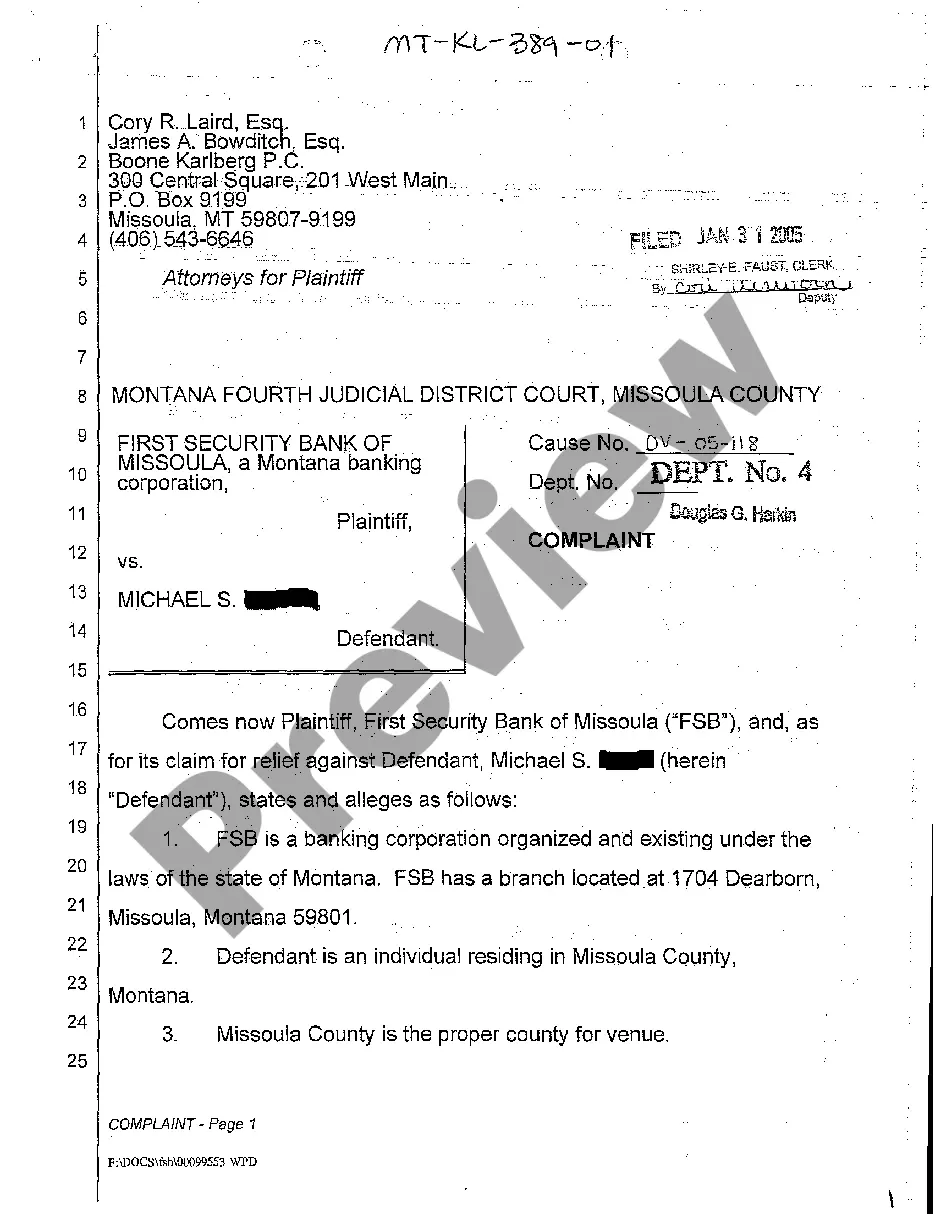

Alabama sample complaint filed in Circuit Court for Breach of Written Contract.

Breach Of Contract Alabama Withholding

Description

How to fill out Alabama Complaint For Breach Of Written Contract?

Drafting legal paperwork from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of preparing Breach Of Contract Alabama Withholding or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of over 85,000 up-to-date legal forms addresses almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant forms carefully put together for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Breach Of Contract Alabama Withholding. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes minutes to register it and explore the library. But before jumping directly to downloading Breach Of Contract Alabama Withholding, follow these tips:

- Review the document preview and descriptions to ensure that you are on the the document you are searching for.

- Check if form you select conforms with the requirements of your state and county.

- Choose the right subscription option to purchase the Breach Of Contract Alabama Withholding.

- Download the file. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and transform document execution into something simple and streamlined!

Form popularity

FAQ

Individual Income FormMaking a PaymentCurrent Form 40 ? Individual Income Tax ReturnAlabama Department of Revenue P. O. Box 2401 Montgomery, AL 36140 -0001Current Form E40- Individual Income Tax Return (Payments)Alabama Department of Revenue P. O. Box 327467 Montgomery, AL 36132-74676 more rows

Filing Form A-3, Annual Reconciliation of Alabama Income Tax Withheld, is a two-step process: submission of employee W-2 information and/or 1099s (with Alabama income tax withheld), and submission of Form A-3, the annual reconciliation of the monthly/quarterly taxes withheld and remitted to ALDOR.

U.S. States that Require State Tax Withholding Forms Alabama. Arizona. Arkansas. California. Connecticut. District of Columbia. Georgia. Hawaii.

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

Alabama is one of many states which impose a state tax on personal income. State withholding tax is the money an employer is required to withhold from each employee's wages to pay the state income tax of the employee.