Lease Cancellation Fee

Description

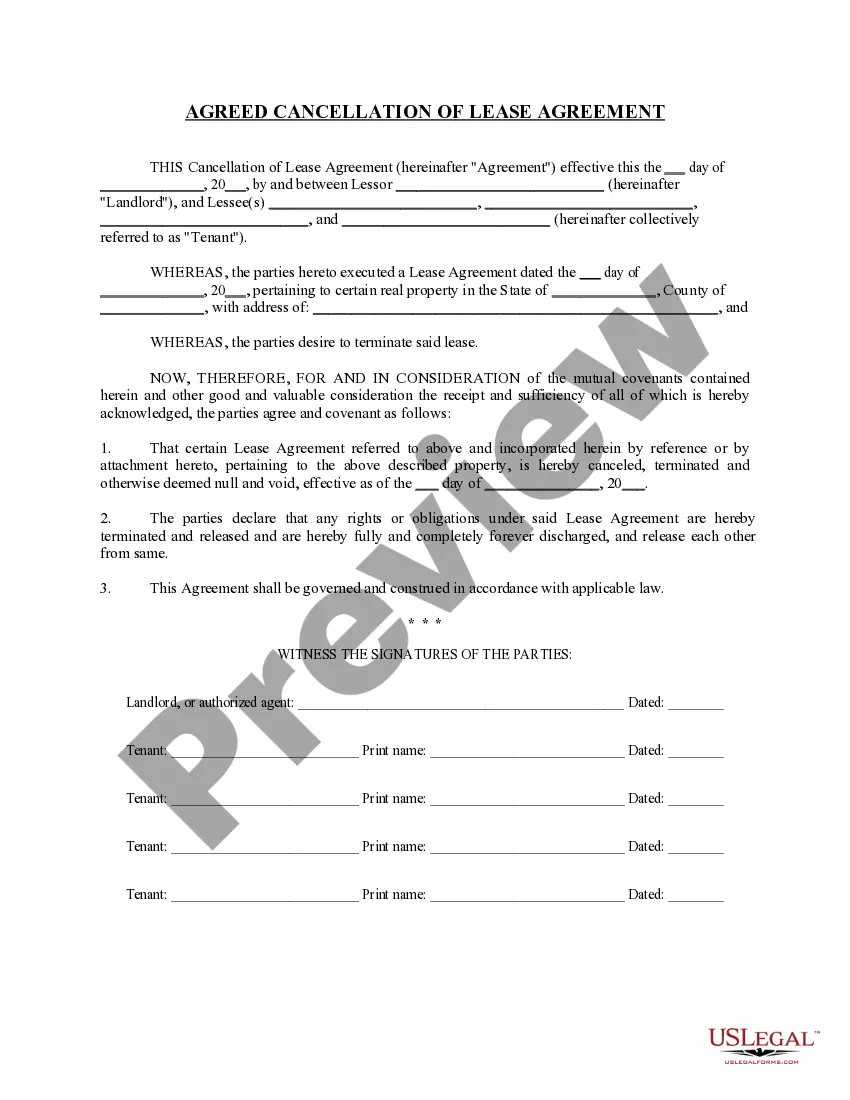

How to fill out Alabama Agreed Cancellation Of Lease?

- If you're an existing user, log in to your account and locate the necessary form template. Ensure your subscription is active; renew if necessary.

- For first-time users, start by reviewing the available document previews and descriptions to find one that fits your requirements and adheres to your local jurisdiction.

- If needed, utilize the Search function to find alternative templates. Once you've found the correct document, you can proceed.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You'll need to create an account to access our expansive library.

- Complete your purchase using your credit card or PayPal account. Confirm your transaction to access your documents.

- Finally, download your form directly to your device or access it anytime via the My Forms section of your profile.

By following these steps, you can ensure that you obtain the proper documentation needed to handle your lease cancellation fee with confidence.

Explore the benefits of using US Legal Forms today and empower yourself with the right legal tools—visit us for more information!

Form popularity

FAQ

Returning a lease, in itself, generally does not affect your credit score. However, if there are outstanding lease cancellation fees or damages, they might be reported to credit agencies. To keep your credit intact, it’s best to manage your lease obligations and resolve any issues directly with your landlord.

Canceling a lease can potentially hurt your credit if you leave unpaid fees or damages. Landlords have the option to report these issues to credit bureaus, which can influence your score. To avoid this outcome, ensure you settle any related lease cancellation fees before leaving.

Terminating a lease might have a varying impact on your credit. If your landlord reports any unpaid lease cancellation fees to credit agencies, your credit score could suffer. It is essential to communicate with your landlord to understand how they handle lease terminations.

Yes, breaking a lease usually impacts your rental history negatively. Landlords often report lease violations to credit bureaus, which could create difficulties when applying for future rentals. To mitigate negative effects, consider discussing lease cancellation fees and conditions with your landlord.

Yes, you can terminate your lease early in Texas, but terms may depend on your lease agreement and local laws. It is crucial to check if your contract includes a specific clause for lease cancellation fees. If you need assistance, uslegalforms provides resources and templates that can help you navigate this situation effectively. Always review your lease terms carefully to understand your obligations and rights.