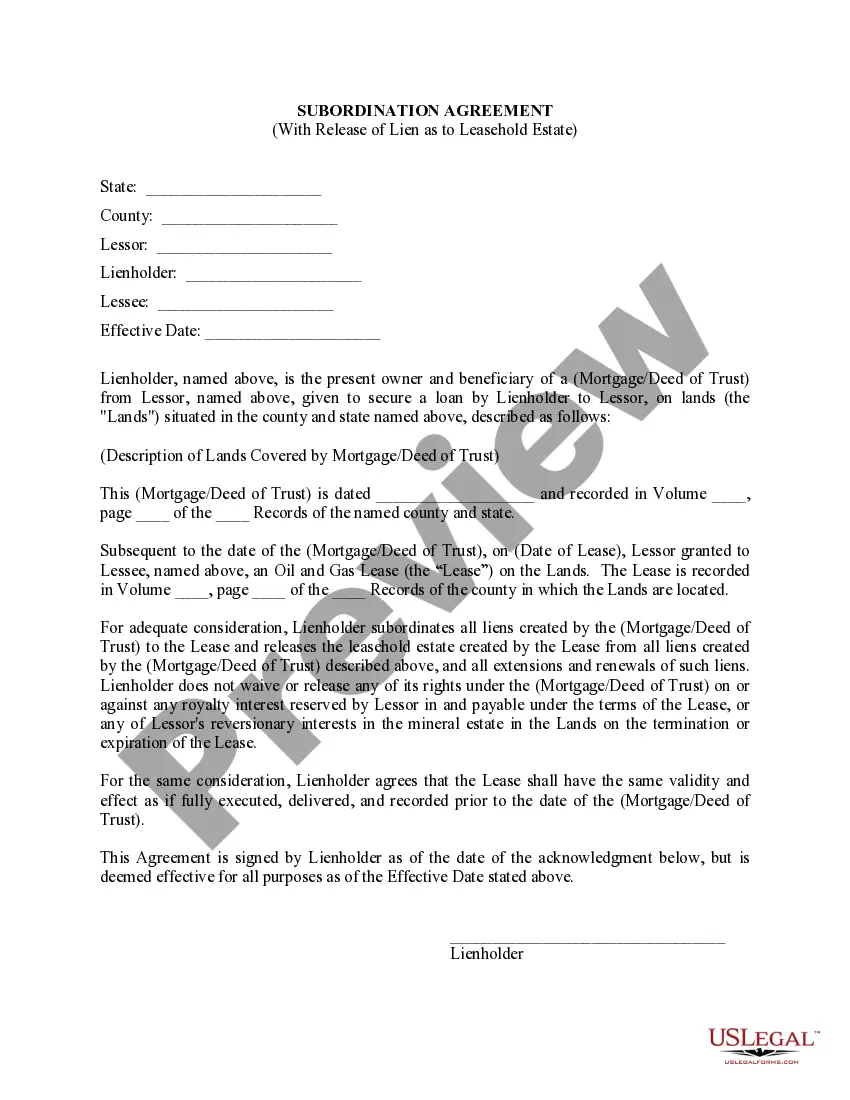

Subordination Agreement For A Loan

Description

How to fill out Alabama Lease Subordination Agreement?

Whether you engage with documents frequently or need to submit a legal report occasionally, it's essential to have a resource of information where all the samples are relevant and current.

One requirement for a Subordination Agreement For A Loan is to confirm that it is the latest version, as it determines if it can be submitted.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

To obtain a form without an account, follow these instructions: Use the search menu to locate the form you desire. Review the Subordination Agreement For A Loan preview and description to ensure it is exactly what you need. After confirming the form, just click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Provide your credit card details or PayPal account to complete the purchase. Choose the document format for download and confirm it. Eliminate the confusion of managing legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that features nearly any example you might need.

- Search for the templates you need, verify their relevancy immediately, and understand more about their application.

- With US Legal Forms, you have access to over 85,000 form templates across various fields.

- Obtain the Subordination Agreement For A Loan samples in just a few clicks and save them at any time in your account.

- A US Legal Forms account will enable you to access all of the samples you need with ease and minimal hassle.

- Simply click Log In in the website header and navigate to the My documents section for all the forms you need at your fingertips.

- You won't have to spend time searching for the right template or verifying its legitimacy.

Form popularity

FAQ

A subordinate loan agreement is a legal document that establishes the order in which creditors are paid. If a borrower is behind in payments on multiple debts, they may be able to use a subordinated loan agreement to help lenders collect on those debts.

Examples of subordinated debt include mezzanine debt, which is debt that also includes an investment. Additionally, asset-backed securities generally have a subordinated feature, where some tranches are considered subordinate to senior tranches.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.