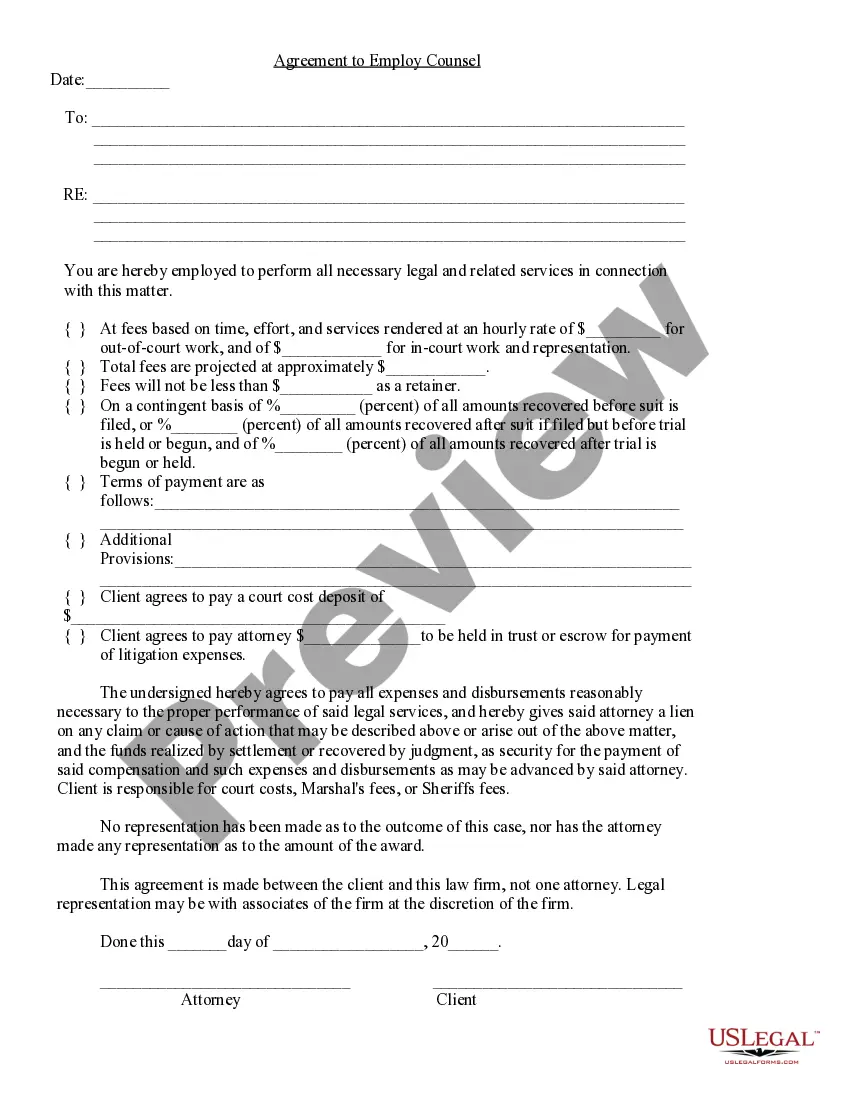

Attorney Fees

Description

How to fill out Alabama Attorney Fee Agreement?

- If you're a returning user, simply login to your account and download the necessary form by clicking the Download button. Ensure your subscription is active; if it isn't, renew it per your payment plan.

- For first-time users, start by checking the Preview mode and form description. Make sure the selected form aligns with your requirements and complies with local jurisdiction laws.

- If needed, use the Search tab to find alternative templates. Ensure that the newly selected form meets your specifications before proceeding.

- Click the Buy Now button to purchase the document and select your preferred subscription plan. You’ll need to create an account for full access to their extensive library.

- Provide your payment details through credit card or PayPal to finalize your purchase.

- Finally, download the form to your device. You can find your downloaded templates anytime in the My Forms section of your profile.

In conclusion, US Legal Forms empowers users with its robust collection of over 85,000 legal forms, ensuring precision and ease in your legal document needs. With premium expert assistance available, you can create legally sound documents without the stress.

Start your journey to simplify legal documentation today with US Legal Forms!

Form popularity

FAQ

You may be able to write off attorney fees, depending on the nature of the expenses incurred. For example, if the fees are related to earning income, they are often deductible. However, personal legal fees usually do not qualify for this deduction. Consulting with a tax professional can provide clarity on which attorney fees you can write off.

If your business pays legal fees exceeding $600 to an attorney, you are required to issue a 1099-MISC. This ensures proper tax documentation for both parties involved. It's essential to accurately capture the payments and maintain records for your own tax filing needs. Consider utilizing USLegalForms to streamline the 1099 filing process.

Legal fees cover any costs associated with hiring an attorney for various services. This can include court representation, document preparation, and legal advice, among other services. It's important to differentiate between legal fees and other types of expenses, as only attorney fees can be reported for tax purposes. You may want to consult a professional if you have questions about specific fees.

Attorney fees are generally reported on Form 1099-MISC if they exceed $600. This form is used by businesses to report payment to individuals outside of the company. When reporting attorney fees, make sure to verify that these fees are for services provided and not merely reimbursements for costs. Additionally, you should have the attorney fill out a W-9 form to ensure accurate reporting.

The American Rule on attorney fees asserts that individuals must bear their own legal costs unless specified otherwise by law or contract. Recognizing this can save you from unexpected financial challenges during legal proceedings. Awareness of this rule helps individuals budget for potential legal expenses more effectively.

When writing attorney fees, ensure clarity and itemization of services rendered. Provide a breakdown of charges, such as hourly rates and flat fees, along with the corresponding work performed. Clear documentation helps clients understand their financial obligations and facilitates timely payments.

The maximum income to qualify for legal aid varies by state and the type of legal issue you are facing. Generally, if your income is at or below 125% to 200% of the federal poverty level, you might be eligible. Legal aid programs aim to ensure that individuals can access legal support without the burden of high attorney fees. Check local legal aid organizations for specific income thresholds and eligibility criteria.

The American rule generally states that each party pays their own attorney fees in a legal dispute, regardless of the case outcome. This means that unless specified in a contract or statute, you cannot recover your attorney fees from the other party. Understanding this rule is crucial for managing expectations around attorney fees. Consult with a legal professional for guidance specific to your situation.