Attorney Fee For Closing

Description

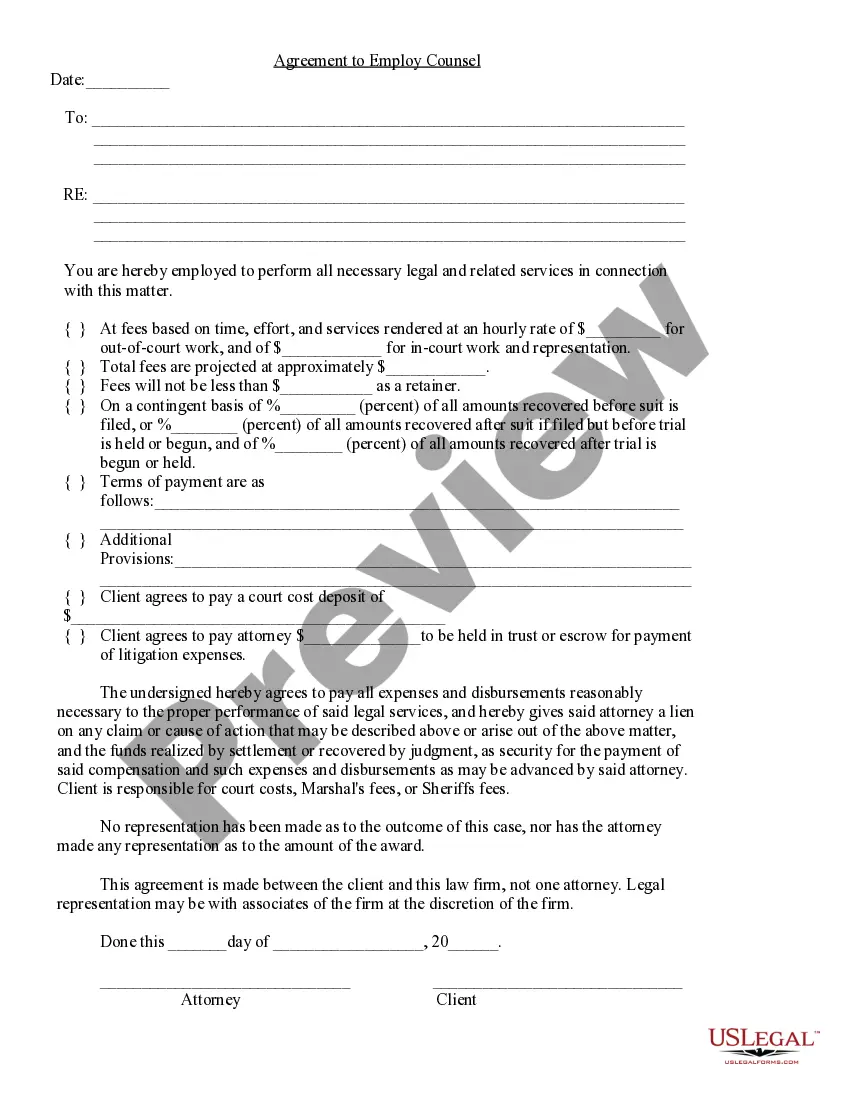

How to fill out Alabama Attorney Fee Agreement?

- If you're an existing user, log in to your account. Check your subscription status to ensure it's active before downloading the necessary form.

- For new users, start by exploring the Preview mode and form description. Confirm that it meets your requirements and complies with local laws.

- Should you need to search for another template, use the Search tab at the top. Finding the right form is crucial, so take your time.

- Once you identify the correct document, proceed by clicking the Buy Now button and select your preferred subscription plan. Registration is necessary for account access.

- After adding the document to your cart, enter your payment details or opt to use your PayPal account to finalize the purchase.

- Upon successful payment, download your form. It will also be available anytime in the My Forms section of your profile.

US Legal Forms sets itself apart with an extensive collection of over 85,000 fillable and editable forms, far exceeding competitors. Moreover, users can connect with premium experts for added support, ensuring their documents are both precise and compliant.

With US Legal Forms, you can navigate your legal needs with confidence. Start your journey today to access the forms that can facilitate your legal processes seamlessly!

Form popularity

FAQ

Yes, a trust typically needs to issue a 1099 for trustee fees if those fees reach $600 or more during the tax year. This also applies to attorney fees for closing if the trustee is an attorney. Accurate documentation ensures transparency and compliance with IRS rules.

When documenting attorney fees, make sure to clearly outline the services provided and the corresponding fees. Use clear descriptions to avoid confusion; this could include costs related to closing transactions. Properly noted attorney fees for closing can help both parties track expenses more efficiently.

Typically, you should issue a 1099 for management fees if you are paying an individual or a business $600 or more during the year for services. This includes attorney fees for closing if they meet the monetary threshold. It's essential to keep accurate records to comply with IRS regulations.

Yes, lawyer fees are included in closing costs and are often referred to as attorney fees for closing. These fees compensate the attorney for services rendered during the real estate transaction, ensuring all documents are compliant with local laws. It is wise to discuss this with your attorney upfront so you know what to expect regarding costs.

Yes, Massachusetts law mandates that a licensed attorney must oversee real estate closings. This requirement ensures that buyers and sellers have legal representation throughout the transaction. An attorney can address any legal complexities that arise and protect your interests. If you're looking for assistance, platforms like US Legal Forms can connect you with qualified attorneys familiar with Massachusetts real estate law.

Generally, the buyer is responsible for choosing an attorney for a real estate closing, although the seller may also have legal representation. It's crucial to select someone experienced in real estate transactions. You can consult with real estate agents for recommendations or consider utilizing platforms like US Legal Forms to find qualified attorneys in your area. Your choice will influence the level of support you receive during the closing process.