Sample Church Resolution Letter To Open Bank Account

Description

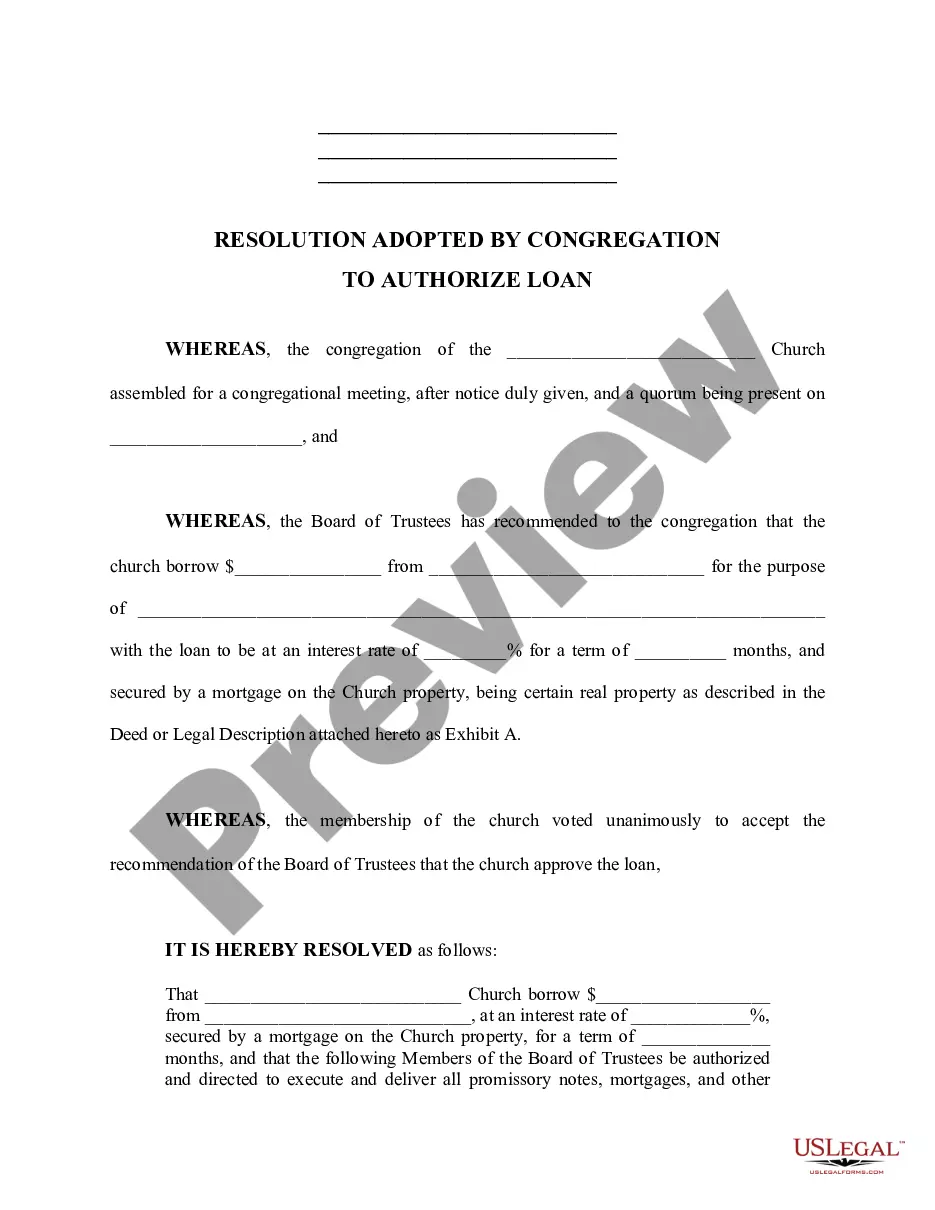

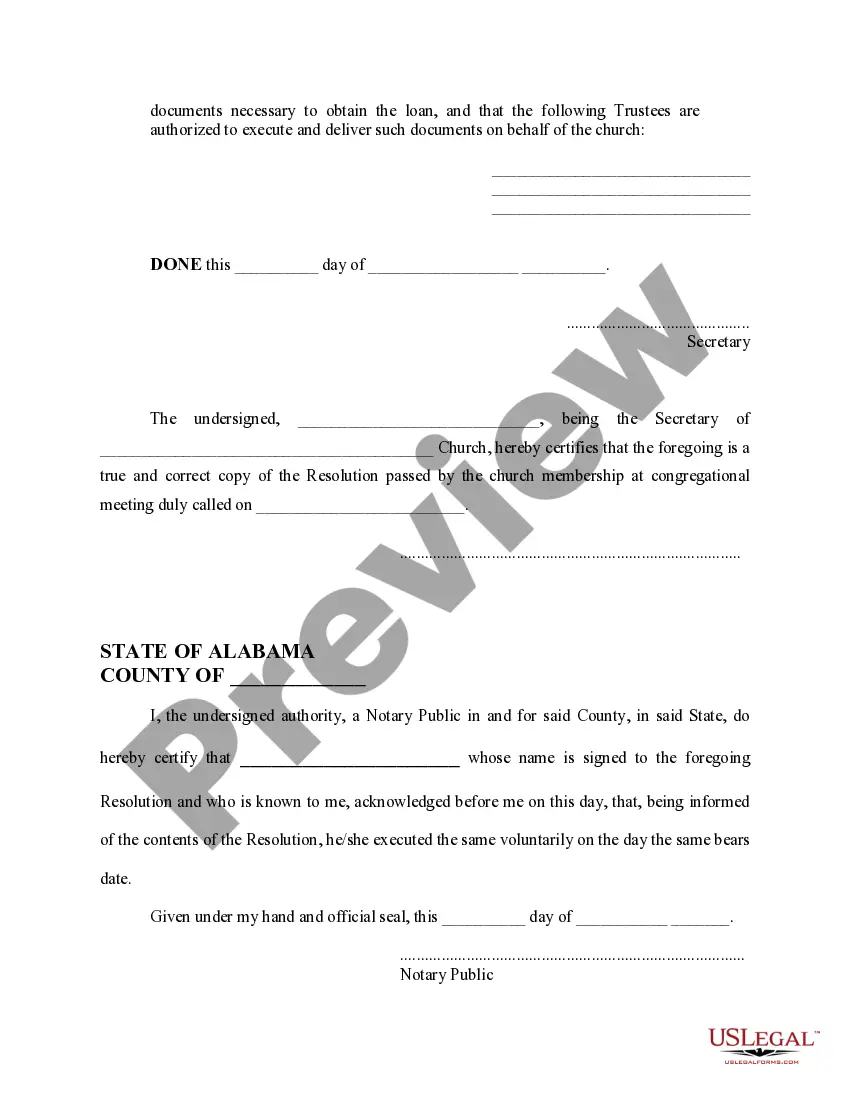

How to fill out Alabama Church Resolution To Authorize Loan?

It's clear that you cannot transform into a legal expert instantly, nor can you swiftly master how to compose a Sample Church Resolution Letter To Open Bank Account without possessing a distinct skill set.

Drafting legal documents is a lengthy undertaking that demands specific training and expertise. So why not entrust the development of the Sample Church Resolution Letter To Open Bank Account to experienced professionals.

With US Legal Forms, one of the most extensive libraries of legal templates, you can find everything from official court documents to templates for internal communication.

You can regain entry to your documents from the My documents section whenever necessary. If you are an existing customer, simply Log In, and find and download the template from that same area.

Regardless of your forms' intent—whether financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Understand the form you need using the search feature at the top of the website.

- Examine it (if this option is available) and review the accompanying description to see if the Sample Church Resolution Letter To Open Bank Account meets your needs.

- If you require a different template, start your search again.

- Create a complimentary account and choose a subscription plan to obtain the form.

- Click Buy now. After the purchase is complete, you can access the Sample Church Resolution Letter To Open Bank Account, complete it, print it, and deliver or send it to the appropriate parties or organizations.

Form popularity

FAQ

How much does it cost to file for voluntary letters? If you prepare the papers on your own and file them yourself, the cost is minimal. The court fee for filing the Affidavit is $1.00.

Intestate. In the event that the decedent had a will, the executor named in the decedent's Last Will and Testament files a Small Estate Affidavit with the Surrogate's Court in the county in which the decedent resided. If the decedent died without a will, the closest heir should file the Small Estate Affidavit.

Through the use of the small estate affidavit (NY SCPA 1310), money or securities may be collected from the decedent's banks, insurers, government agencies, employers and other institutions.

You can use this program if: If the decedent (the person who died) had $50,000 or less in personal property.

Filing for a Small Estate If there is a Will, the Executor files the original Will and a certified death certificate with the small estate affidavit petition and other supporting documents in the Surrogate's Court in the county where the Decedent had their primary residence.

VOLUNTARY ADMINISTRATION or SMALL ESTATE PROCEEDING may be used when a fiduciary is needed to transfer estate assets (personal property only) and the value of the assets does not exceed $50,000, exclusive of property set off under EPTL 5-3.1. This is a legal proceeding and you may need the assistance of a lawyer.