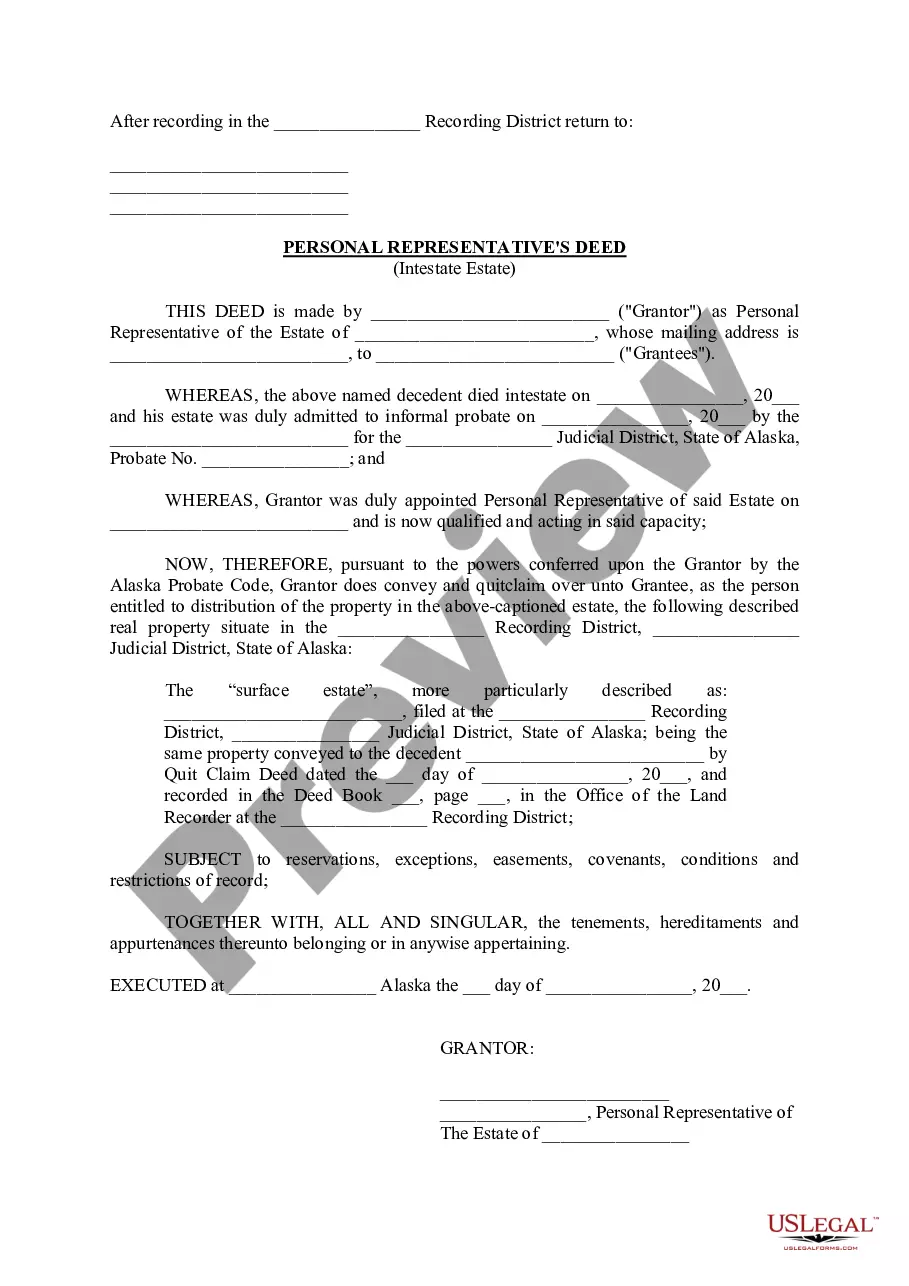

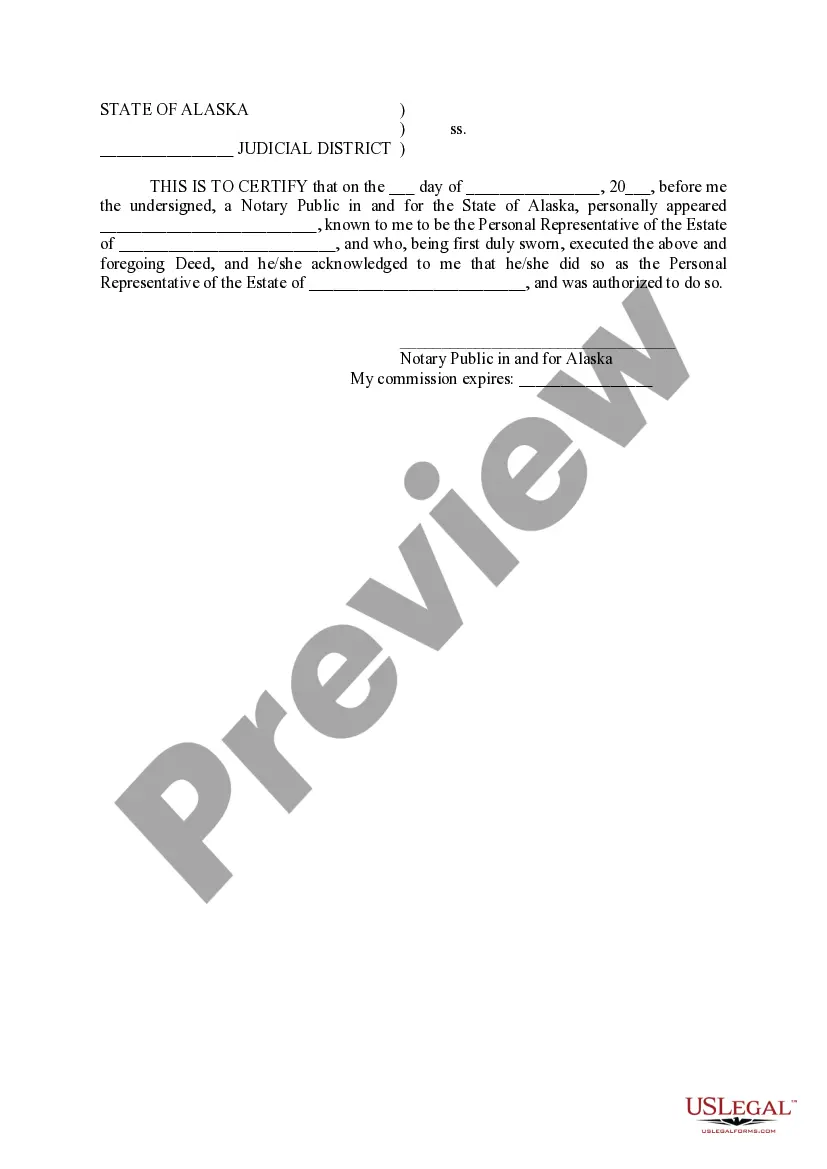

The Deed of Personal Representative for Estate is a legal document that serves as evidence of the authority and responsibilities given to a personal representative, also known as an executor or administrator, in administering an estate. It outlines the powers and limitations of the personal representative, as well as the duties they are required to fulfill during the estate administration process. This deed is crucial in providing clarity and transparency in estate proceedings, ensuring that the decedent's assets are properly managed and distributed according to their wishes. There are different types of Deeds of Personal Representative depending on the specific circumstances and the level of authority granted to the representative. The main types include: 1. General Deed of Personal Representative: This is the most common form, which provides the personal representative with comprehensive powers to manage all aspects of the estate. It includes responsibilities such as collecting and safeguarding assets, paying debts and taxes, resolving claims against the estate, and distributing assets to beneficiaries as per the decedent's will or intestacy laws. 2. Limited Deed of Personal Representative: In certain situations, the court may restrict the powers of a personal representative due to potential conflicts of interest or disagreements among beneficiaries. A limited deed grants the representative specific powers to carry out certain tasks or manage particular assets, while other duties may be assigned to alternative decision-makers or require court approval. 3. Temporary Deed of Personal Representative: In cases where urgent estate administration is required, such as imminent asset sales or pending legal matters, a temporary deed may be granted to a representative. This allows for the swift management and protection of assets until a permanent representative is appointed by the court. 4. Special Deed of Personal Representative: This form of deed is typically utilized when the estate involves unique circumstances or complex assets that require specialized knowledge or expertise. Specialized personal representatives, such as accountants or lawyers, may be appointed to carry out specific tasks or manage specific aspects of the estate. 5. Joint Deed of Personal Representative: In situations where multiple individuals are appointed as co-executors or co-administrators, a joint deed may be executed. This deed clarifies the powers and responsibilities of each representative, emphasizing that decisions must be made unanimously or with a specific voting mechanism. Overall, a Deed of Personal Representative is vital in providing a legal framework for the administration of an estate. It ensures that the personal representative acts in accordance with the decedent's wishes, protects the interests of the estate and beneficiaries, and minimizes the potential for disputes or mismanagement.

Deed Of Personal Representative For Estate

Description

How to fill out Alaska Personal Representative's Deed?

Using legal templates that meet the federal and local regulations is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the right Deed Of Personal Representative For Estate sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and life scenario. They are easy to browse with all files collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when getting a Deed Of Personal Representative For Estate from our website.

Obtaining a Deed Of Personal Representative For Estate is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the steps below:

- Analyze the template using the Preview feature or through the text description to ensure it fits your needs.

- Locate a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Deed Of Personal Representative For Estate and download it.

All templates you find through US Legal Forms are reusable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

A personal representative is under a duty to settle and distribute the estate of the decedent in ance with the terms of any probated and effective will and this Code, and as expeditiously and efficiently as is consistent with the best interests of the estate.

Some traits that can be important ones for a personal representative to have include: Strong organizational skills. Good financial acumen. Sound judgment. Strong integrity (so as not be tempted to misuse their role for personal gain).

A personal representative typically performs a number of tasks when acting as the executor of a deceased person's estate, including arranging funeral services, notifying those who are entitled to part of the estate's property, and determining the value of the estate, minus any debts.

A copy of the recorded Deed of Distribution needs to be filed at the Probate Court. Real property located in other South Carolina counties will require the Deed of Distribution be recorded in that location. You should then deliver the recorded Deed of Distribution to the new owners of the property.

A legal personal representative (referred to as an executor or administrator) is responsible for administering an estate. The executor will be named in the person's will, if they have one. The legal personal representative makes sure the deceased person's final wishes are carried out.