Alaska Trust Act Withdrawal

Description

Form popularity

FAQ

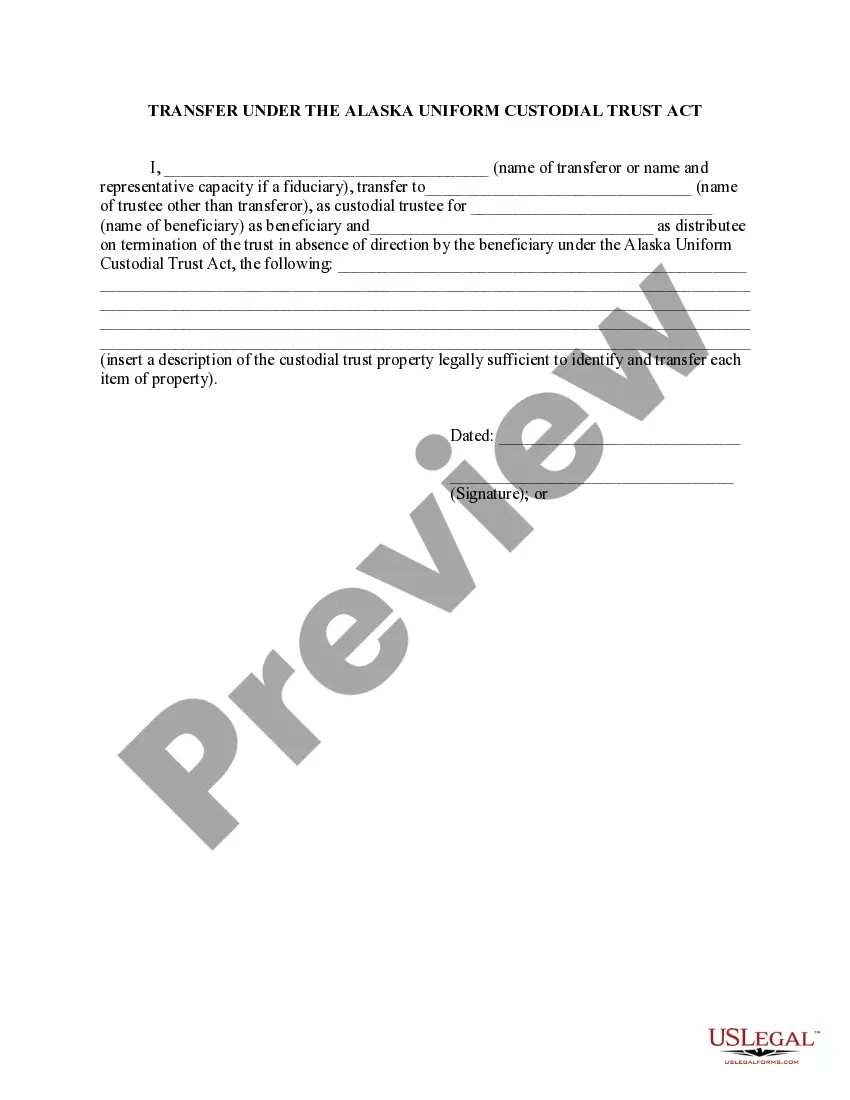

Filing a trust in Alaska involves several steps to ensure compliance with the Alaska Trust Act withdrawal guidelines. Start by drafting a trust document that outlines the terms and beneficiaries. Once you have your document ready, you can transfer assets into the trust. It is advisable to work with uslegalforms to simplify the process and ensure you meet all legal requirements.

Rich individuals often place their homes in a trust to facilitate the Alaska Trust Act withdrawal process, which helps in estate planning. This strategy allows them to bypass probate, ensuring a smoother transition of property ownership. Additionally, it protects assets from creditors and can provide tax benefits. Overall, trusts serve as a valuable tool for preserving wealth and maintaining family privacy.

To avoid probate in Alaska, you can utilize the Alaska Trust Act withdrawal strategy. By establishing a trust, you can transfer assets directly to beneficiaries without passing through probate court. This method simplifies the process, saves time, and maintains privacy. It's essential to consult with a legal expert to ensure your trust meets all necessary requirements.

Filling out form 1041 requires careful attention to detail, particularly regarding income and deductions for trusts or estates. Begin by gathering all necessary financial documents related to the trust and its beneficiaries. Then, follow the guidelines provided for each section of the form, specifically mentioning any Alaska trust act withdrawal transactions if applicable. For added convenience, uslegalforms offers step-by-step assistance and templates to help you complete form 1041 accurately.

Withdrawing from a trustee under the Alaska Trust Act involves a few important steps. First, you need to review the trust document to understand the terms regarding withdrawals. Next, initiate the process by formally notifying the trustee of your intent to withdraw, ensuring you follow any specified procedures in the trust. If you need assistance with the Alaska trust act withdrawal process, consider using the uslegalforms platform, which provides resources to guide you through the necessary documentation.

Withdrawal rights in a trust refer to the permissions granted to beneficiaries to access the trust's assets under certain conditions. These rights can vary based on the trust's terms, providing flexibility for beneficiaries when they need funds. Understanding withdrawal rights is crucial, especially in relation to the Alaska trust act withdrawal, as it directly affects how and when beneficiaries can receive their share.

The Alaska Trust Act is legislation that permits the creation and maintenance of trusts in Alaska, offering unique benefits not found in other states. This act allows for greater asset protection and flexibility in managing trust assets. Additionally, it establishes clear guidelines for withdrawals and distributions, making it easier to navigate the process of Alaska trust act withdrawal.

An Alaska trust offers several advantages, such as asset protection, tax benefits, and greater control over your estate. It allows you to shield your assets from creditors and can potentially reduce estate taxes. Moreover, the Alaska trust act withdrawal provisions provide flexibility, allowing you to access funds when necessary while maintaining security.