Bronx, New York is one of the five boroughs that make up New York City. It is known for its diverse communities, iconic landmarks, cultural institutions, and vibrant history. Adding a Bronx New York statement to your credit report is a way to provide additional information that may be relevant to your overall creditworthiness. This statement can be a valuable tool for individuals residing or conducting financial activities in the Bronx, as it highlights specific factors that may impact their creditworthiness. One type of Bronx New York statement that can be added to a credit report is related to the local economy. This statement may address the unique economic challenges and opportunities present in the Bronx, such as the presence of major industries, employment statistics, and economic development initiatives. Providing such information can give lenders a better understanding of the local economic conditions and how they may affect the creditworthiness of individuals in the Bronx. Another type of Bronx New York statement that can be included in a credit report is in relation to housing. This statement can detail the local housing market, rental prices, homeownership statistics, and any specific housing programs or initiatives available in the Bronx. By including this statement, individuals can shed light on their living conditions and potential financial commitments related to housing, giving lenders additional insights when evaluating their creditworthiness. Additionally, a Bronx New York statement can be focused on education and community achievements. The Bronx is home to several distinguished educational institutions, including universities, colleges, and renowned schools. Individuals can highlight their education background or involvement in community organizations, providing lenders with a comprehensive picture of their accomplishments and commitment to personal and professional development. Ultimately, adding a Bronx New York statement to a credit report is an opportunity to provide context to your financial situation by highlighting factors that are specific to the Bronx. This approach can help lenders gain a better understanding of the borrower's creditworthiness beyond traditional credit scores. By including relevant keywords such as Bronx, New York, local economy, housing, and education, individuals can ensure that their statement is distinctly associated with the Bronx and its unique characteristics.

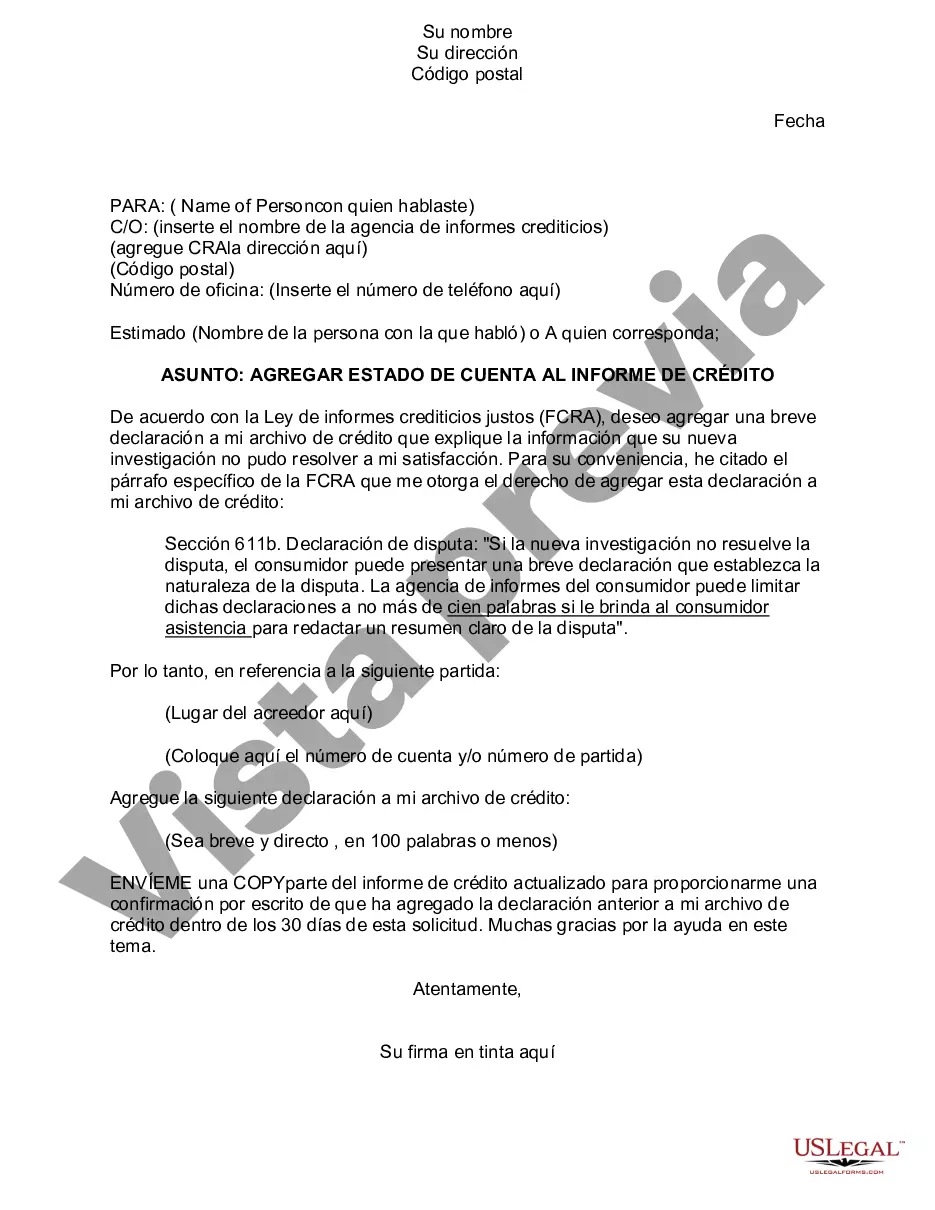

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

How to fill out Bronx New York Estado De Cuenta Para Agregar Al Informe De Crédito?

Draftwing documents, like Bronx Statement to Add to Credit Report, to take care of your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for different scenarios and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Bronx Statement to Add to Credit Report template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Bronx Statement to Add to Credit Report:

- Ensure that your template is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Bronx Statement to Add to Credit Report isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start using our website and download the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Aunque varia segun los modelos de calificacion crediticia, un puntaje de 670 o mas generalmente se considera bueno. Para FICO, un buen puntaje oscila entre 670 y 739.

Para corregir los errores de su informe de credito, comuniquese con la compania de informes crediticios correspondiente y con el negocio que le reporto la informacion. Digales que desea disputar esa informacion que figura en su informe.

Paga tus deudas a tiempo En tiempos pre-pandemia en Ecuador las deudas pasaban como vencidas a los 15 dias de falta de pago; por temas de pandemia hasta diciembre del 2021, las deudas pasaran como vencidas a los 61 dias de falta de pago. Mientras mas tiempo pagues puntualmente tus deudas, mejor score tendras.

Ocho pasos para eliminar deudas antiguas de tu reporte crediticio Verifica la antiguedad.Confirma la antiguedad de la deuda saldada.Obten los tres reportes de credito.Envia cartas a las agencias de credito.Envia una carta al acreedor informante.Consigue una atencion especial.

Reporte de Credito Tu reporte de credito es un registro de tu actividad y tu historial crediticio. Incluye los nombres de las companias que te han otorgado credito, asi como los limites de los creditos y los montos de los prestamos. Tu historial de pagos tambien es parte de este registro.

El puntaje crediticio minimo para tener una tarjeta de credito es mayor a 730 puntos en tu score. Si la entidad financiera se encuentra con un score bajo, por ejemplo, en 330, quiere decir que el cliente no paga sus deudas a tiempo, esto es desalentador para el banco y te deja como un mal candidato.

¿Esta tratando de aumentar su puntuacion de credito? Lleve un registro de su progreso.Siempre pague sus cuentas puntualmente.Mantenga saldos bajos en sus cuentas de credito.Haga mas pagos en sus tarjetas de credito que el pago mensual.Considere la posibilidad de solicitar un aumento de su limite de credito.

Aunque varia segun los modelos de calificacion crediticia, un puntaje de 670 o mas generalmente se considera bueno. Para FICO, un buen puntaje oscila entre 670 y 739.

¿Como limpiar tu Buro de Credito? - Ponte al corriente con los pagos. - Si tu situacion economica no te permite regularizar pagos, contacta con la institucion financiera que tienes el adeudo para negociar una reestructura de tu credito. - En caso de no llegar a un acuerdo para reestructurar tu deuda, negocia una quita.