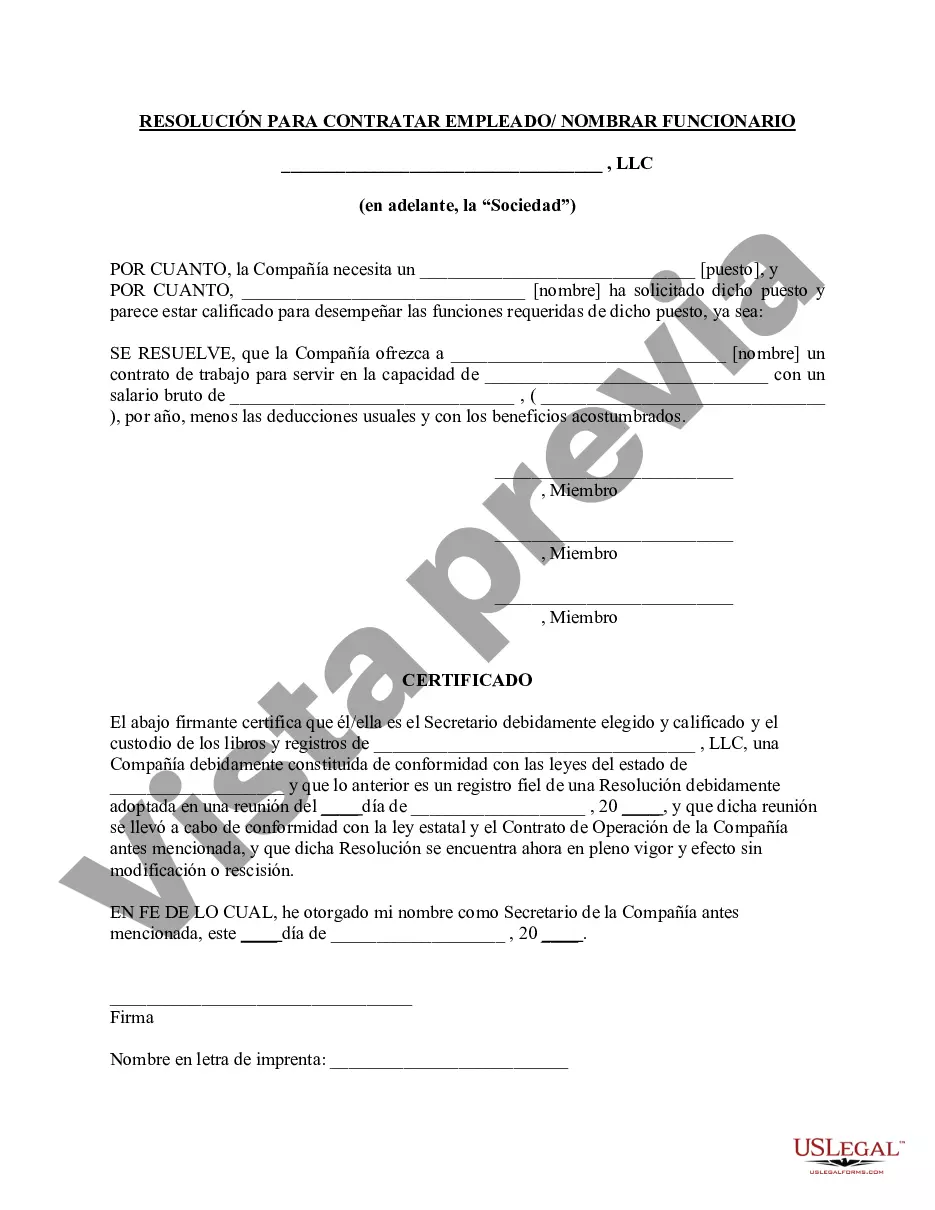

San Jose California Resolución de la reunión de miembros de la LLC para contratar empleados y nombrar funcionarios - Resolution of Meeting of LLC Members to Hire Employee and Appoint Officer

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Resolución De La Reunión De Miembros De La LLC Para Contratar Empleados Y Nombrar Funcionarios?

Are you trying to promptly formulate a legally-enforceable San Jose Resolution of Meeting of LLC Members to Hire Employee and Appoint Officer or perhaps another document to oversee your personal or business matters.

You can opt for two choices: engage a specialist to create a legal document for you or draft it entirely on your own. The positive aspect is that there’s an alternative choice - US Legal Forms. It will assist you in acquiring well-crafted legal papers without incurring exorbitant fees for legal expertise.

If the document doesn’t meet your needs, restart the search using the search box available at the top.

Choose the option that best fits your requirements and move forward to the payment. Select the file format you prefer to receive your document in and proceed with the download. Print it, complete it, and place your signature on the designated line. If you’ve already created an account, you can simply Log In to it, find the San Jose Resolution of Meeting of LLC Members to Hire Employee and Appoint Officer template, and download it. To re-download the form, just go to the My documents tab. It’s uncomplicated to purchase and download legal documents when utilizing our services. Furthermore, the papers we provide are refreshed by legal professionals, ensuring you greater reassurance when handling legal matters. Try US Legal Forms today and experience it for yourself!

- US Legal Forms presents an extensive collection of over 85,000 state-specific form templates, including the San Jose Resolution of Meeting of LLC Members to Hire Employee and Appoint Officer and various packages.

- We supply documents for a wide range of life situations: from marriage dissolution papers to real property agreements.

- Having been in the industry for over 25 years, we have built an impeccable reputation among our clientele.

- Here’s how you can join them and acquire the essential template without unnecessary hassle.

- Initially, meticulously check if the San Jose Resolution of Meeting of LLC Members to Hire Employee and Appoint Officer conforms to your state’s or county’s regulations.

- If the document has a description, ensure to validate its purpose.

Form popularity

FAQ

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business.

For example, Anheuser-Busch, Blockbuster and Westinghouse are all organized as limited liability companies.

Veamos cuales son los principales beneficios de abrir una LLC en Estados Unidos para extranjeros. Registro rapido y simple.Protege el patrimonio de los emprendedores.Simplifica el pago de impuestos.Permite aplicar a una visa de inversionista.Dan acceso a nuevos mercados.

El mayor beneficio de una LLC es la proteccion de responsabilidad personal que brinda. Esto significa que el propietario de una LLC no corre el riesgo de perder sus posesiones personales si la empresa quiebra o es demandada. Las empresas unipersonales y las sociedades generales no brindan esta proteccion.

Para mantener una LLC en Texas, no necesita pagar una tarifa anual. Sin embargo, se cobran impuestos sobre las ventas y el uso de 6.25%, impuestos estatales de franquicia e impuestos federales.

El principal beneficio de una LLC (Limited Liability Company) es que protege el patrimonio personal de los propietarios al ser de responsabilidad limitada. Esto evita poner en riesgo los activos de los duenos en caso de problemas. Tienen flexibilidad tributaria, pueden evitar la doble imposicion.

Esto significa que la LLC en si no paga impuestos y no tiene que presentar una declaracion ante el IRS. Es el propietario de la LLC quien debe reportar todas las ganancias o perdidas de su negocio en el Anexo C y presentarlo con la declaracion de impuestos individual (Formulario 1040).

An LLC, or limited liability company, is a type of business entity that a company can form by filing paperwork with the state. An LLC can have one owner (known as a "member") or many owners. The words "limited liability" refer to the fact that LLC members cannot be held personally responsible for business debts.

Una Compania de Responsabilidad Limitada (LLC, por sus siglas en ingles) es una estructura de negocio permitido conforme a los estatutos estatales. Cada estado puede utilizar regulaciones diferentes y usted debe verificar con su estado si esta interesado en iniciar una Compania de Responsabilidad Limitada.

A Limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the business debts and liabilities.