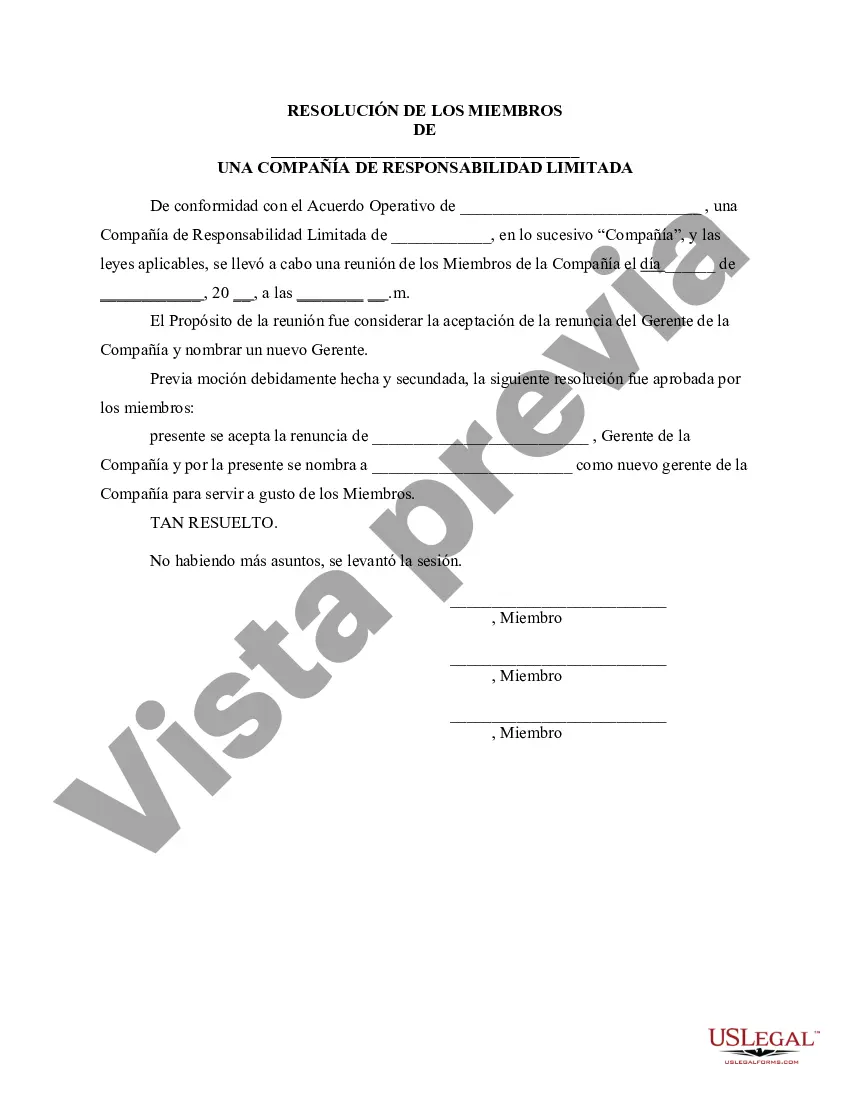

Salt Lake Utah Resolución de la reunión de miembros de la LLC para aceptar la renuncia del gerente de la empresa y nombrar un nuevo gerente - Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Resolución De La Reunión De Miembros De La LLC Para Aceptar La Renuncia Del Gerente De La Empresa Y Nombrar Un Nuevo Gerente?

Drafting legal paperwork can be taxing.

Moreover, if you opt to request assistance from a legal expert to create a business contract, documents for ownership transfer, prenuptial agreement, dissolution papers, or the Salt Lake Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager, it could cost you a significant amount.

Browse the page and check if a template for your location is available.

- What is the most cost-effective strategy to conserve time and money while preparing authentic forms that fully comply with your state and local laws.

- US Legal Forms serves as a perfect answer, regardless if you require templates for personal or commercial purposes.

- US Legal Forms is the largest web-based collection of state-specific legal documents, offering users current and professionally verified templates for any situation compiled all in one location.

- As a result, if you're searching for the latest edition of the Salt Lake Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager, you can effortlessly find it on our site.

- Acquiring the documents takes very little time.

- Those with an existing account should confirm their subscription is active, Log In, and select the example using the Download button.

- If you have not yet subscribed, here is how to obtain the Salt Lake Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager.

Form popularity

FAQ

An LLC, or limited liability company, is a type of business entity that a company can form by filing paperwork with the state. An LLC can have one owner (known as a "member") or many owners. The words "limited liability" refer to the fact that LLC members cannot be held personally responsible for business debts.

Para las LLC de un solo miembro que actuan como entidades excluidas, los propietarios deben presentar el formulario 1040 si ganan mas de $400 (USD) del trabajo por cuenta propia. Como propietario, completaras tu declaracion de impuestos personal normalmente, pero con el Anexo C adjunto.

For example, Anheuser-Busch, Blockbuster and Westinghouse are all organized as limited liability companies.

A Limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the business debts and liabilities.

Una Compania de Responsabilidad Limitada (LLC, por sus siglas en ingles) es una estructura de negocio permitido conforme a los estatutos estatales. Cada estado puede utilizar regulaciones diferentes y usted debe verificar con su estado si esta interesado en iniciar una Compania de Responsabilidad Limitada.

Para formar una nueva LLC en Florida, debe presentar los articulos de organizacion en la oficina del Secretario de Estado de Florida y pagar una tarifa de presentacion de $ 100. Si necesita una copia certificada de los Articulos de Organizacion, hay una tarifa de $ 30.

El principal beneficio de una LLC (Limited Liability Company) es que protege el patrimonio personal de los propietarios al ser de responsabilidad limitada. Esto evita poner en riesgo los activos de los duenos en caso de problemas. Tienen flexibilidad tributaria, pueden evitar la doble imposicion.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business.

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial.

¿Y cuanto voy a tener que pagar? ImpuestoRangoA pagar10%$0 a $9,95010% de la base imponible12%$9,951 a $40,525$995 mas el 12% del excedente por encima de $9,95022%$40,526 a $86,375$4,664 mas el 22% del excedente por encima de $40,52524%$86,376 a $164,925$14,751 mas el 24% del excedente por encima de $86,3754 more rows