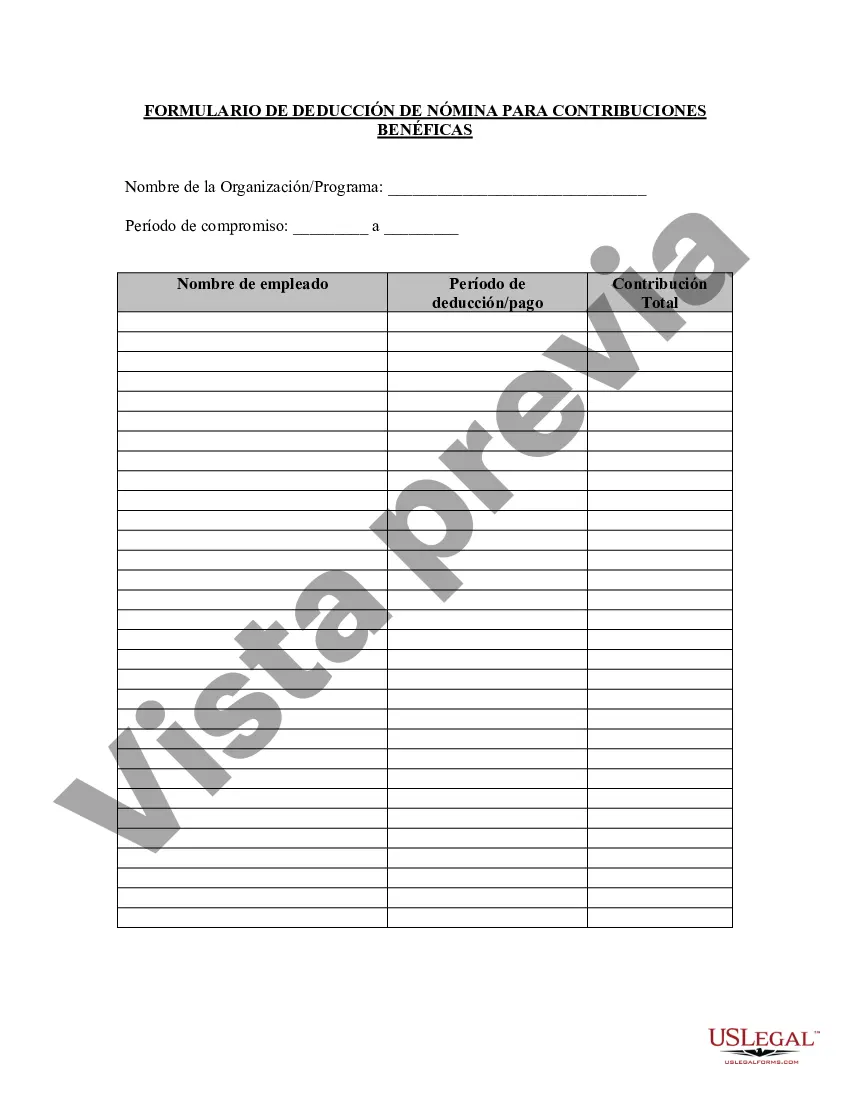

Phoenix Arizona Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

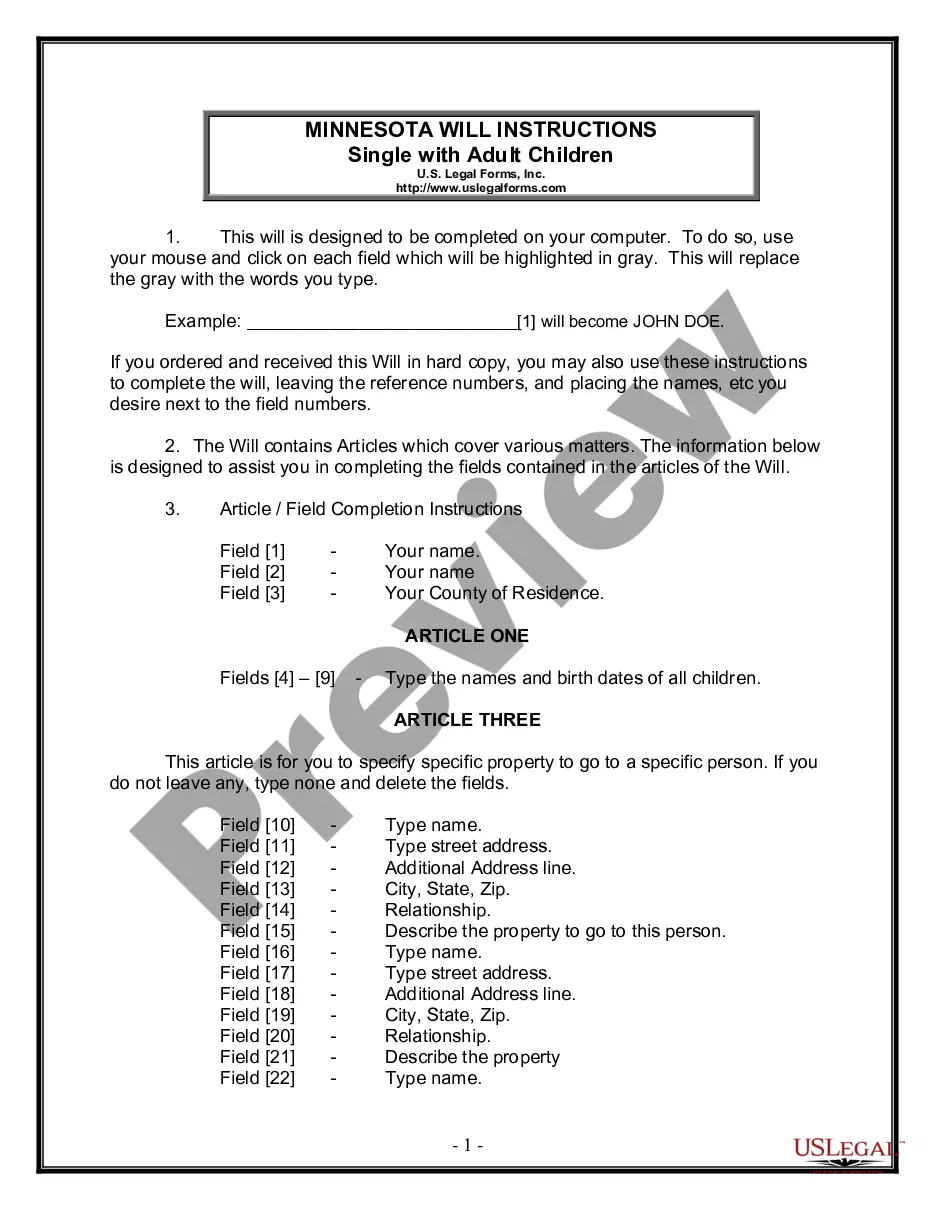

How to fill out Formulario De Deducción De Nómina De Contribución Benéfica?

If you are looking for a dependable provider of legal documents to acquire the Phoenix Charitable Contribution Payroll Deduction Form, think about US Legal Forms. Whether you aim to establish your LLC business or oversee your asset distribution, we have you covered.

US Legal Forms is a reliable service delivering legal forms to millions of users since 1997.

Just type to search for or browse the Phoenix Charitable Contribution Payroll Deduction Form, whether by keyword or by the intended state/county.

After finding the necessary template, you can Log In and download it or save it in the My documents section.

Don't have an account? It's simple to start! Just locate the Phoenix Charitable Contribution Payroll Deduction Form template and review the form's preview and description (if available). If you feel certain about the template’s language, proceed and click Buy now. Create an account and choose a subscription plan. The template will be ready for download immediately after the payment is completed. You can then fill out the form.

- You don't have to be an expert in law to locate and download the suitable template.

- You can choose from over 85,000 forms categorized by state/county and circumstance.

- The user-friendly interface, diverse educational resources, and committed support simplify the process of finding and completing various paperwork.

Form popularity

FAQ

La tasa vigente de impuestos de seguro social es del 6.2% para el empleador y del 6.2% para el empleado, o un total del 12.4%.

Las deducciones son descuentos que estan establecidos en la ley como obligatorios, aunque hay algunas deducciones que no son obligatorias. La misma ley establece en su articulo 110, que las deducciones no deben ser superiores, en ningun caso, al 30% del salario base del empleado.

Como revisar y entender el formulario W-2 Casilla a: Numero de seguro social (SSN) del empleado. Casilla b: Numero de identificacion del empleador (EIN). Casilla "c": Nombre del empleado, domicilio, y codigo postal. Casilla e: Nombre del empleado. Casilla "f": Direccion postal del empleado.

El porcentaje de Seguro Social (OASDI, por sus siglas en ingles) es 6.20% que se aplica a los ingresos hasta la cantidad maxima sujeta a impuestos (vea la tabla a continuacion).

El porcentaje de Seguro Social (OASDI, por sus siglas en ingles) es 6.20% que se aplica a los ingresos hasta la cantidad maxima sujeta a impuestos (vea la tabla a continuacion).

La porcion que el empleador asume es de 12.25% del salario. Por su parte, el trabajador asume una porcion de 9.75%, que el empleador debe retener y remitir mensualmente a la Caja. Por lo tanto, la cuota de seguro social asciende al 22% del salario mensual de trabajador.

El empleador paga 1.45% de los salarios y el empleador retiene otro 1.45% del empleado. Los salarios para fines de seguridad social incluyen 401 (k) contribuciones y compensacion diferida.

Las deducciones pueden ser de varios tipos: retenciones del IRPF, cuotas (sindicales y a la Seguridad Social), pagos en especie, anticipos y otras.

El Formulario W-4 (SP) le indica a usted, como empleador, el estado civil, los ajustes por multiples empleos, las cantidades de creditos, otros ingresos y deducciones del empleado, ademas de toda cantidad adicional a retener de la paga del empleado.

Estados Unidos - Impuestos sobre la renta de los trabajadores FechaTipo medio: Individuo SMTipo maximo201823,8%46,0%201923,9%46,0%202021,3%46,0%202122,6%46,0%18 more rows