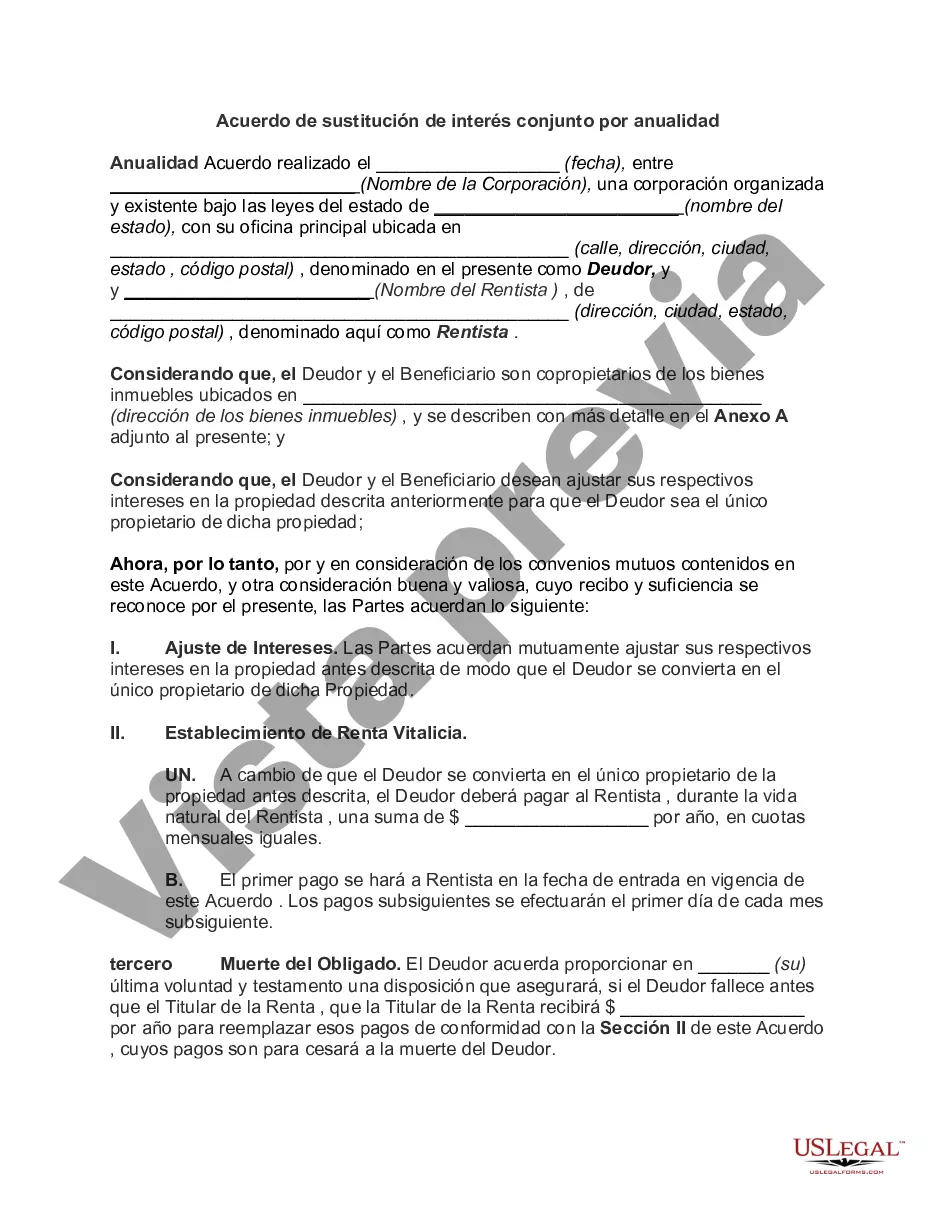

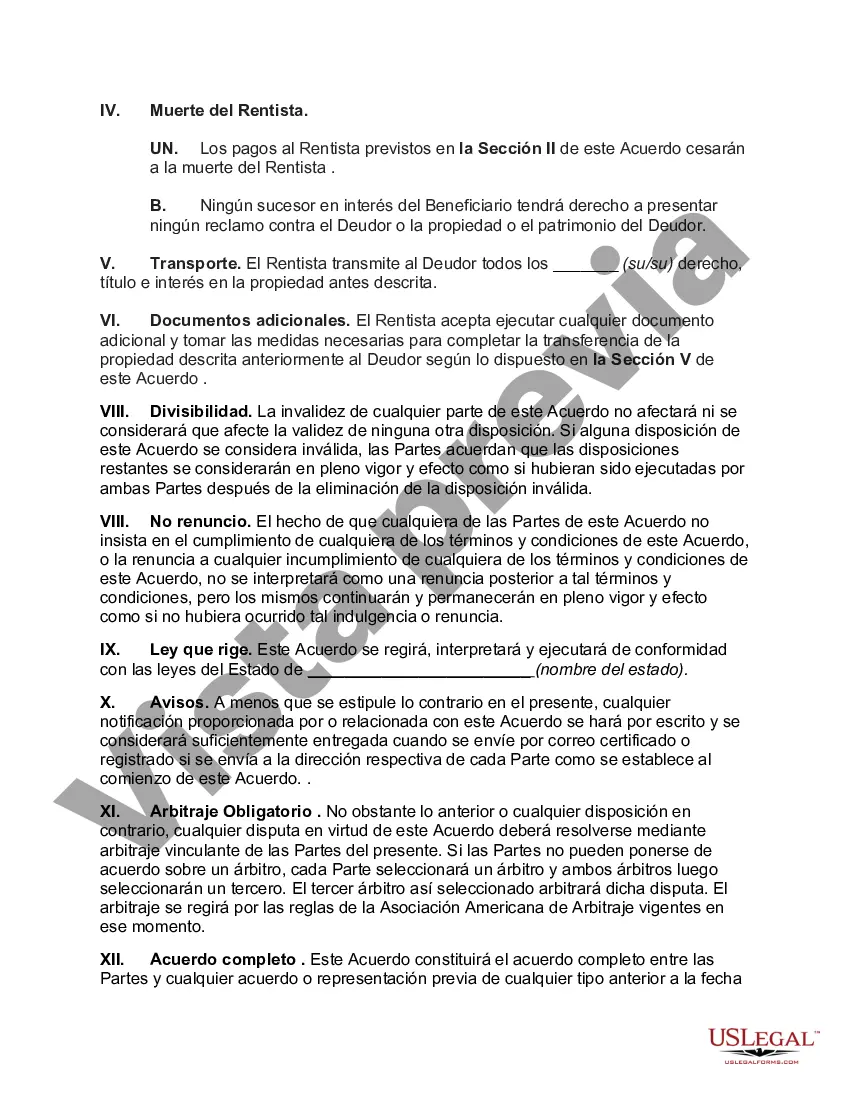

Newark New Jersey Acuerdo de sustitución de interés conjunto por anualidad - Agreement Replacing Joint Interest with Annuity

Category:

State:

Multi-State

City:

Newark

Control #:

US-1340753BG

Format:

Word

Instant download

Description

An annuity is a life insurance company contract that pays periodic income benefits for a specific period of time or over the course of the annuitant's lifetime. These payments can be made annually, quarterly or monthly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview