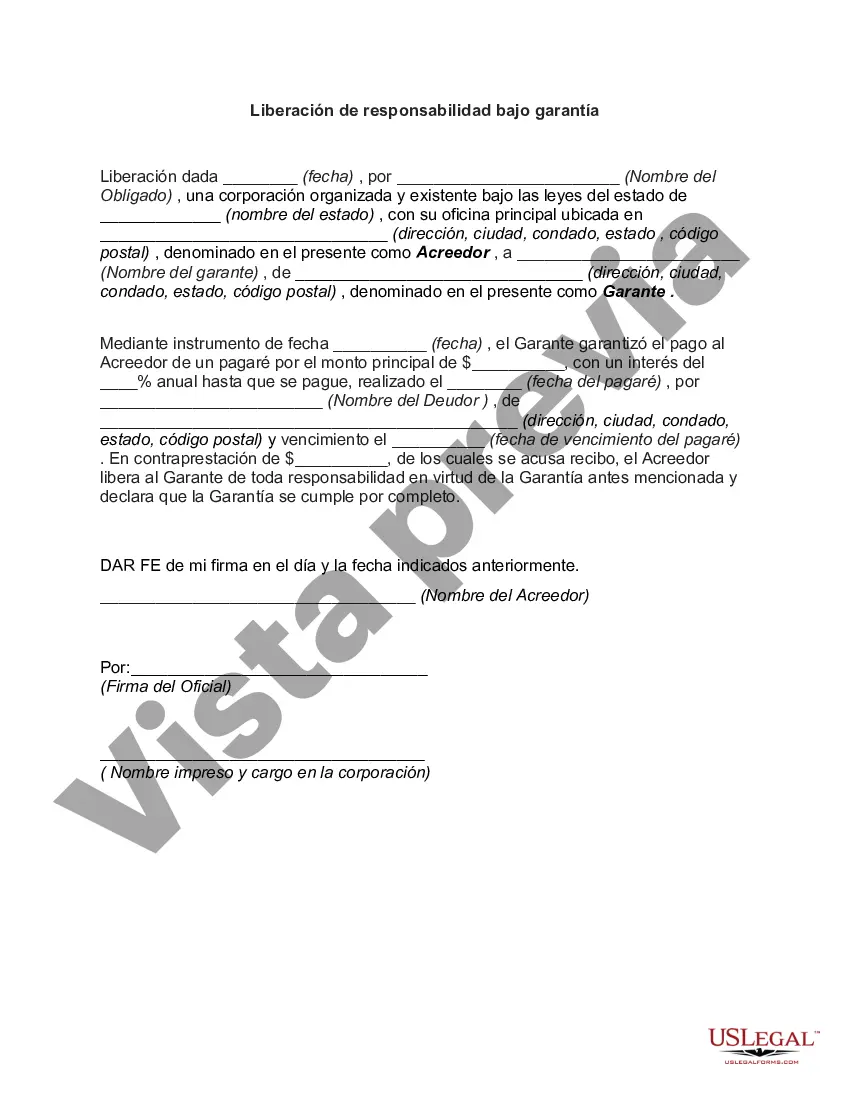

Irvine California Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

State:

Multi-State

City:

Irvine

Control #:

US-1087BG

Format:

Word

Instant download

Description

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.