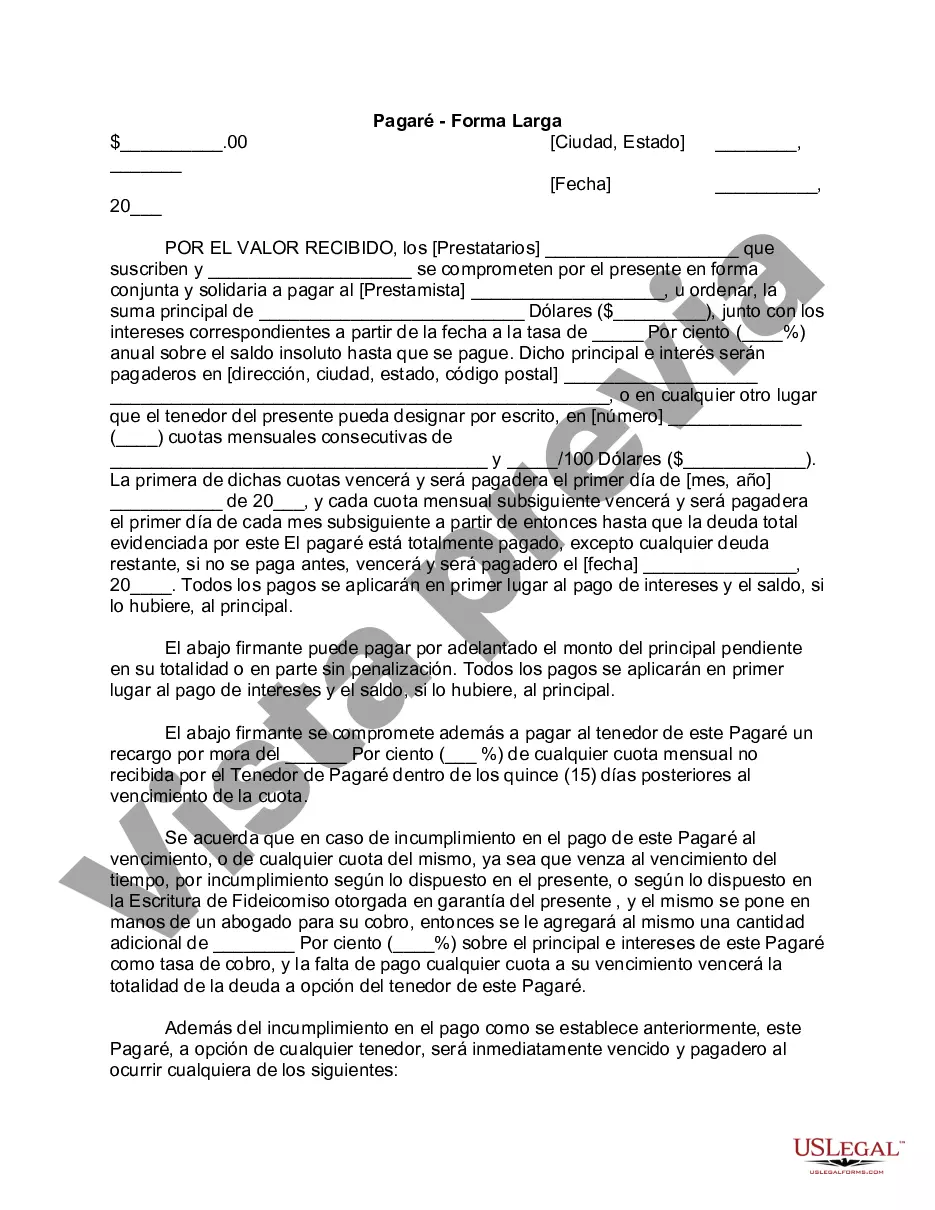

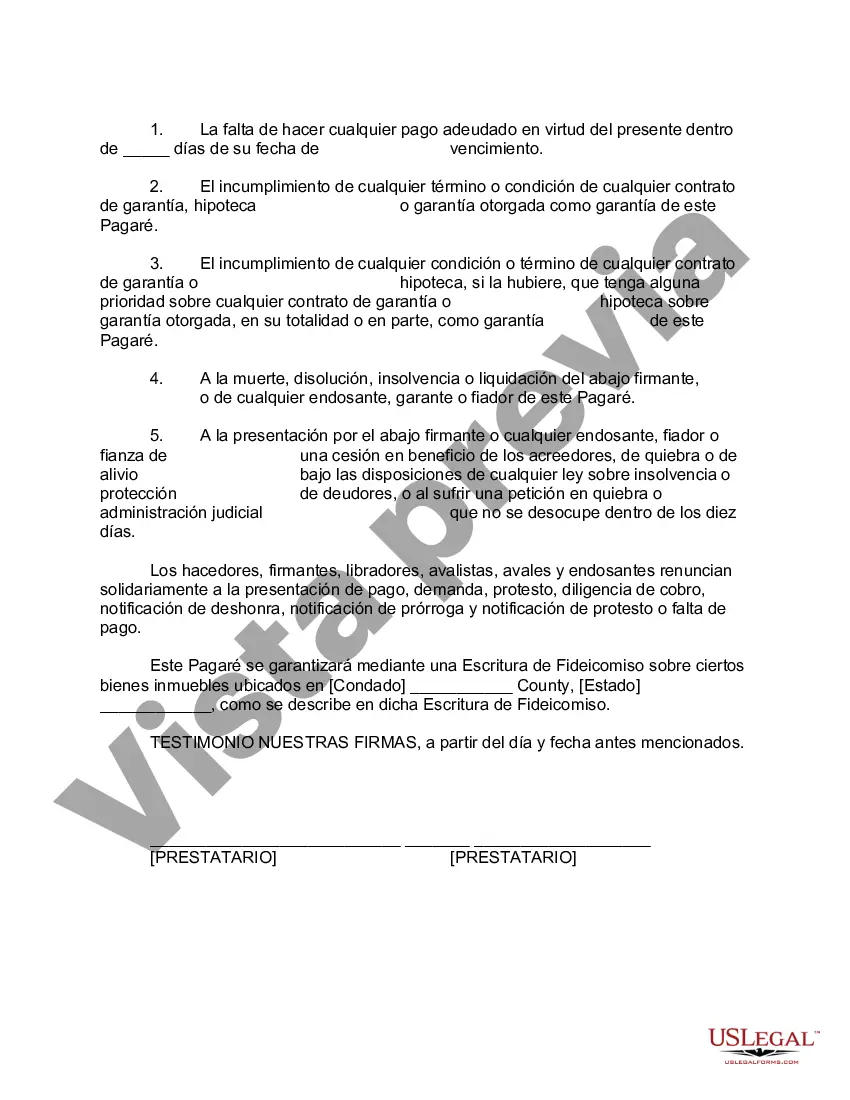

Gilbert Arizona Pagaré - Forma larga - Promissory Note - Long Form

State:

Multi-State

City:

Gilbert

Control #:

US-03116BG

Format:

Word

Instant download

Description

A promissory note is a written promise to pay a debt. It is an unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview