Gilbert Arizona Gráfico de almacenamiento de registros financieros - Financial Record Storage Chart

State:

Multi-State

City:

Gilbert

Control #:

US-03088BG

Format:

Word

Instant download

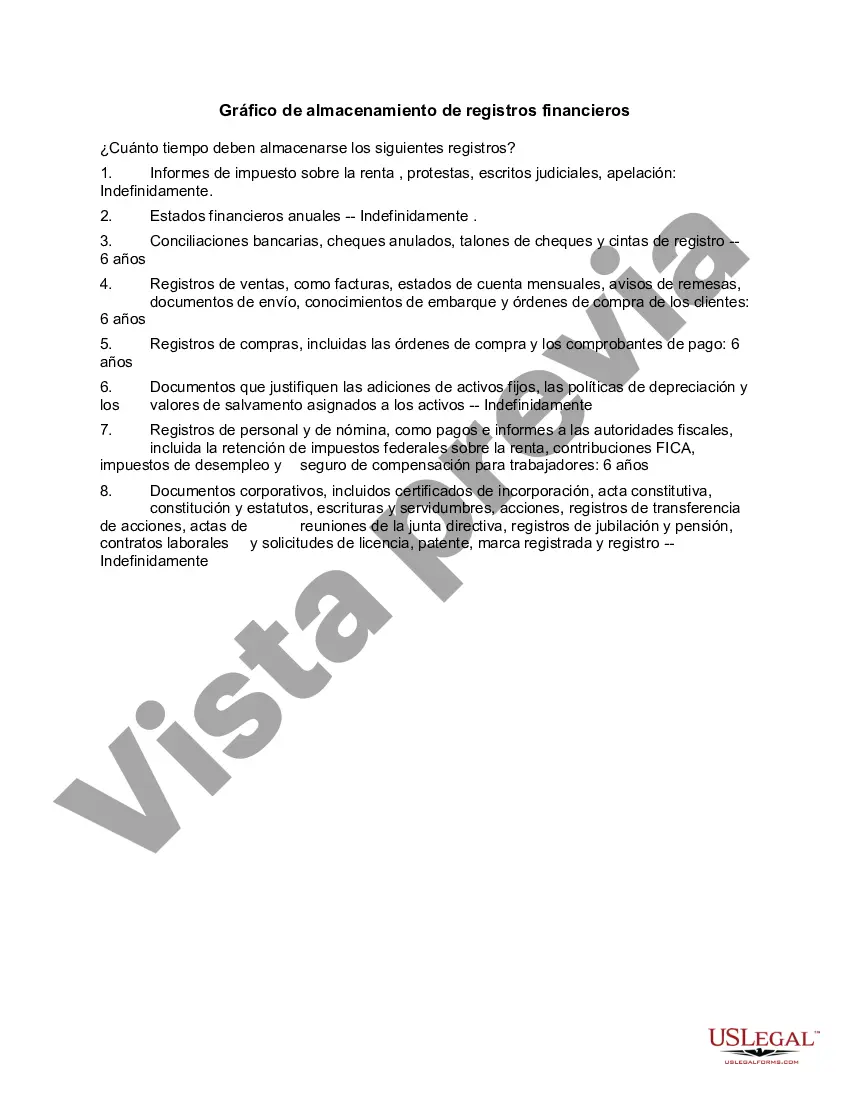

Description

Consider using this checklist to ensure that you are saving the right financial records for tax purposes and keeping them for an appropriate amount of time.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.