Tucson Arizona Lista de verificación: mantenimiento de registros clave - Checklist - Key Record Keeping

State:

Multi-State

City:

Tucson

Control #:

US-03080BG

Format:

Word

Instant download

Description

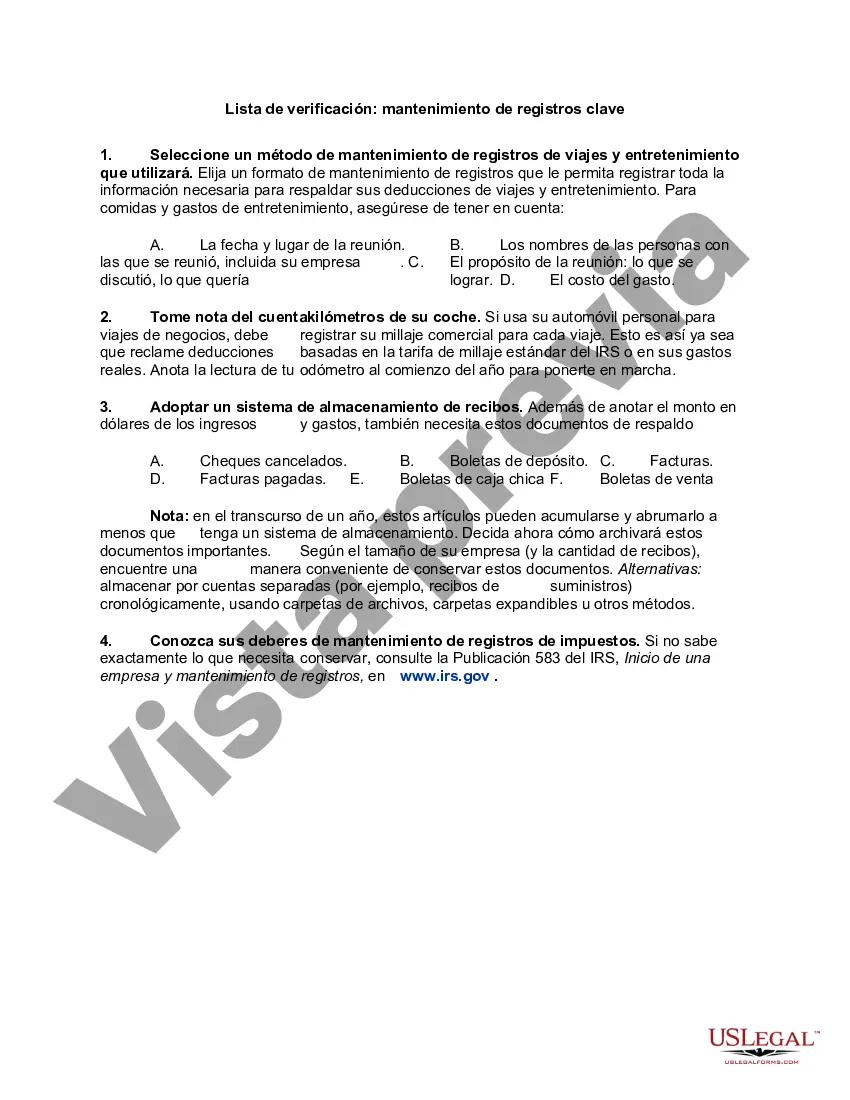

Records are an essential element in claiming deductions on your taxes. Record keeping is important to help you track your business activities so you know where you stand at all times. Records also enable you to prepare financial statements for your bank and creditors. But for tax purposes, records are essential. You must have them in order to prepare your return and claim certain deductions. This checklist may help.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.