An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

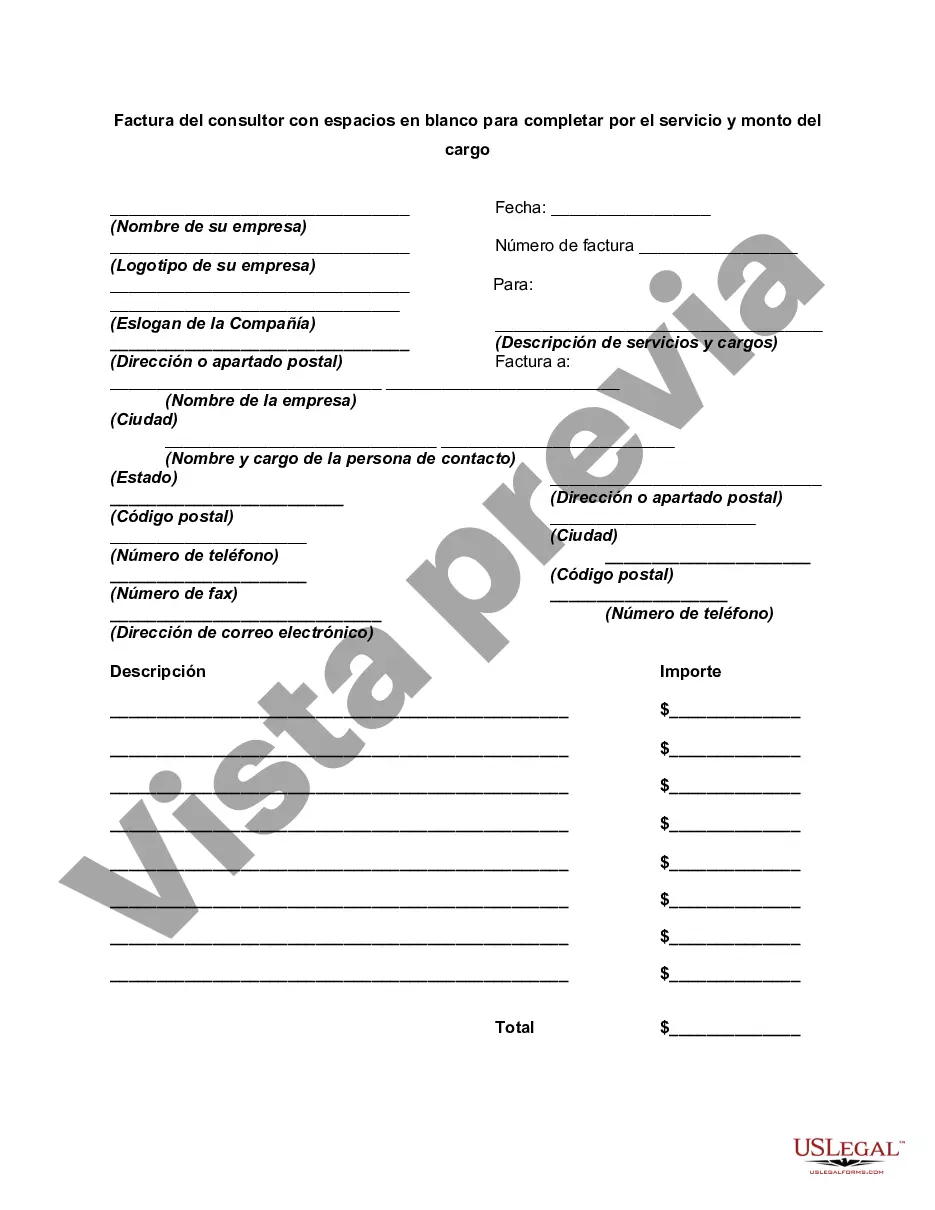

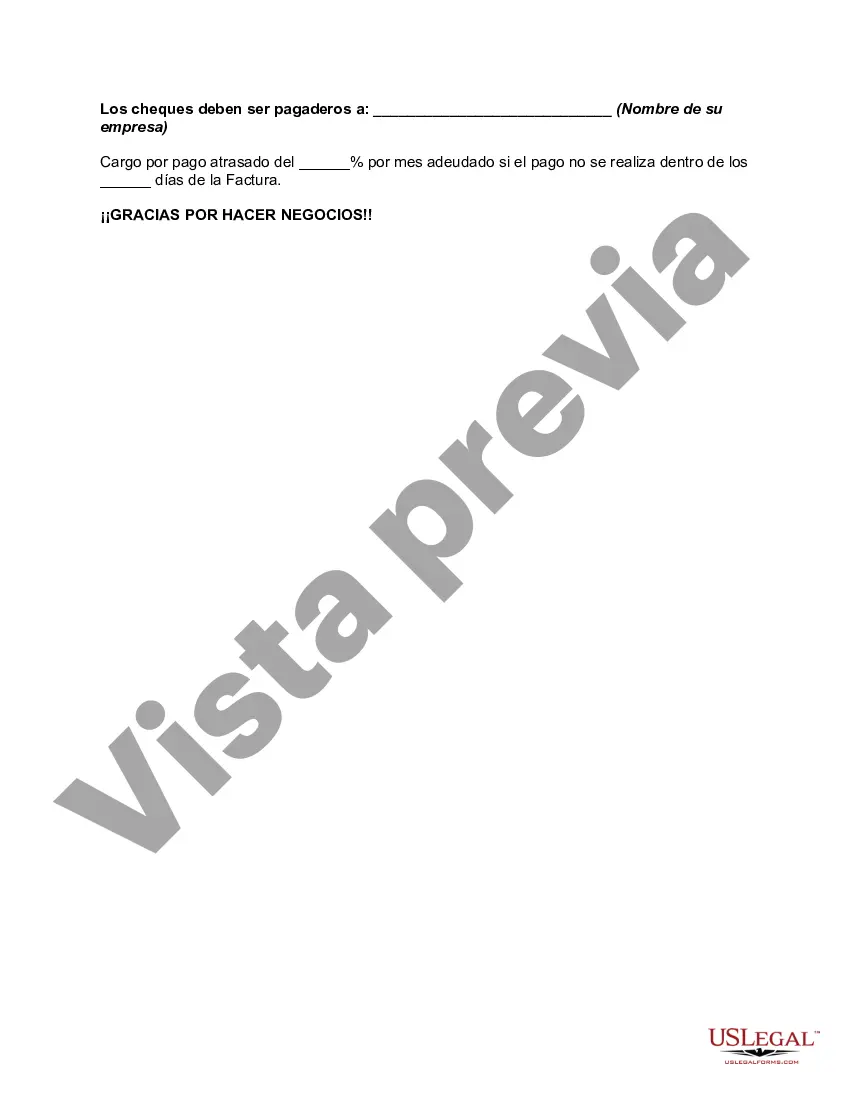

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Factura del consultor con espacios en blanco para completar por el servicio y monto del cargo - Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge

Description

How to fill out Factura Del Consultor Con Espacios En Blanco Para Completar Por El Servicio Y Monto Del Cargo?

A document process is always involved in any legal action you undertake.

Starting a business, applying for or accepting a job offer, transferring property, and numerous other life scenarios require you to prepare formal documentation that differs across the nation.

That is why having everything organized in one location is incredibly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

This is the easiest and most dependable method to obtain legal documentation. All the templates available in our library are professionally prepared and verified for compliance with local laws and regulations. Prepare your documents and manage your legal matters efficiently with US Legal Forms!

- On this platform, you can easily find and download a document for any personal or business purpose required in your county, including the Travis Invoice of Consultant with Blanks to be Completed for Service and Amount of Charge.

- Finding templates on the platform is extraordinarily simple.

- If you already have a subscription to our service, Log In to your account, locate the template through the search bar, and click Download to save it to your device.

- After that, the Travis Invoice of Consultant with Blanks to be Completed for Service and Amount of Charge will be accessible for further usage in the My documents section of your profile.

- If you are using US Legal Forms for the first time, follow these quick instructions to acquire the Travis Invoice of Consultant with Blanks to be Completed for Service and Amount of Charge.

- Ensure you have accessed the correct webpage with your local form.

- Utilize the Preview mode (if available) and navigate through the template.

- Read the description (if any) to confirm the form meets your requirements.

- Look for a different document via the search tab if the sample does not suit you.

Form popularity

FAQ

Suggested clip · 47 seconds Como corregir errores y eliminar facturas en FORM 110- YouTube YouTube Start of suggested clip End of suggested clip

Suggested clip · 60 seconds TUTORIAL REGISTRO DEL FORMULARIO 110 V.4- YouTube YouTube Start of suggested clip End of suggested clip

Como parte de la Ley 1448 de Reduccion de la sancion por omision, recientemente promulgada, se determino que los profesionales independientes ya no tributaran el Impuesto a la Utilidad de las Empresas (IUE), sino mas bien el conocido RC-IVA (Regimen Complementario al IVA).

Si el profesional independiente percibe 100.000 bolivianos esta sujeto al pago de los siguientes impuestos: a) IVA: 13.000 bolivianos. b) Impuesto a las Transacciones (IT): 3.000 bolivianos. c) Base imponible para el IUE: 87.000 bolivianos (menos 13% del IVA).

El formulario 510 esta disenado para ser utilizado por personas fisicas que ejercen de manera independiente profesiones e industrias independientes, incluidos notarios, funcionarios de registro civil, comisionados, corredores, elementos o gerentes, casas de subastas o casas de subastas y administradores.

El consultor esta alcanzado por los siguientes impuestos: Impuesto al Valor Agregado IVA, Impuesto a la Transacciones IT y el Impuesto a las Utilidades de las Empresas IUE.

Seran validas las Facturas de la Modalidad de Facturacion Prevalorada, emitidas sin NIT o numero de Documento de Identificacion, sin nombre o razon social o nombre comercial, ni fecha de emision conforme las previsiones de la presente Resolucion.

Suggested clip · 52 seconds TUTORIAL REGISTRO DEL FORMULARIO 110 V.4- YouTube YouTube Start of suggested clip End of suggested clip

En el formulario 110 para la presentacion de facturas se registra el credito fiscal contenido en las facturas, notas fiscales o documentos equivalentes de compras, a efectos de computar como pago a cuenta del impuesto determinado para el Regimen Complementario al Impuesto al Valor Agregado (RC-IVA), al Impuesto sobre

El IVA e IT por operaciones vinculadas a la actividad Es preciso aclarar que los profesionales liberales y quienes ejercen oficios deben emitir facturas por la venta de sus servicios o bienes, por tanto, ademas del IUE, son tambien sujetos pasivos del IVA y del IT.