Mesa Arizona Garantía Personal - General - Personal Guaranty - General

Instant download

Description

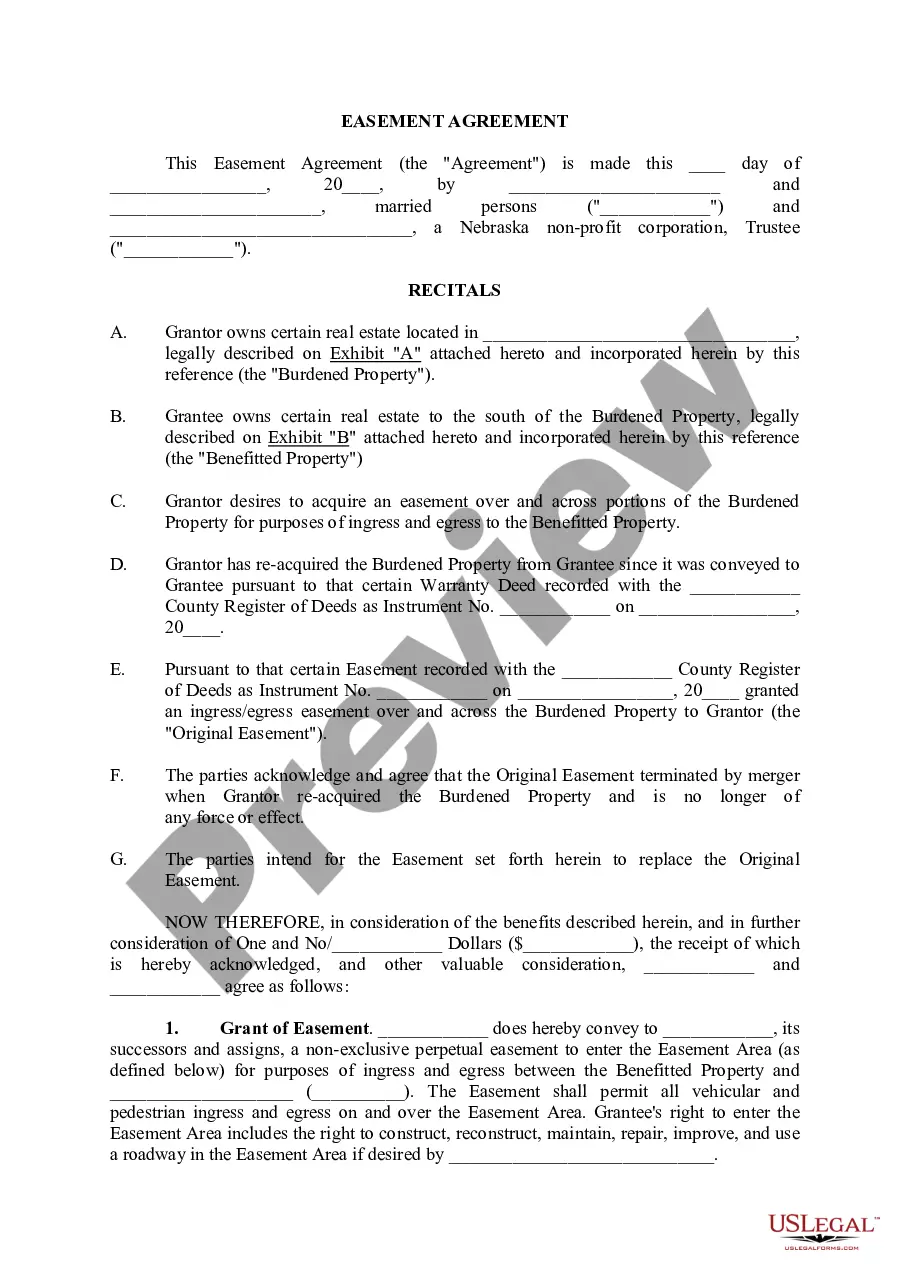

This form is a Guaranty. The form provides that the guarantor assures the full and prompt payment of all obligations incurred by the payor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview