Irvine California Acuerdo de Depósito Directo - Direct Deposit Agreement

Category:

State:

Multi-State

City:

Irvine

Control #:

US-00416BG

Format:

Word

Instant download

Description

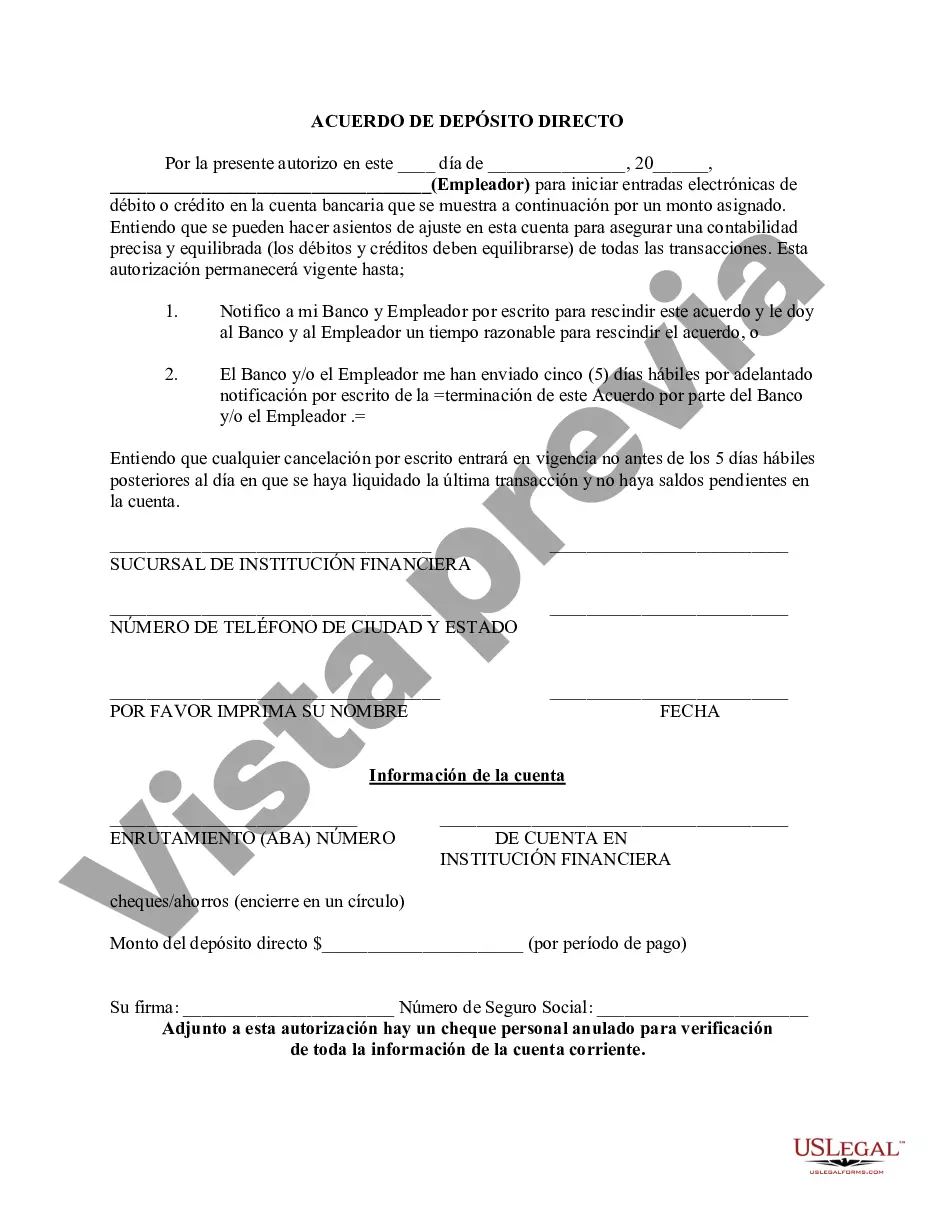

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security, is sent the payment owed to them into their checking or savings account. The reasons for doing this include:

- Instant access to the funds via an ATM or check card;

- A check can be lost or stolen anywhere between the sender and the intended payee;

- Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

- Instant access to the funds via an ATM or check card;

- A check can be lost or stolen anywhere between the sender and the intended payee;

- Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview