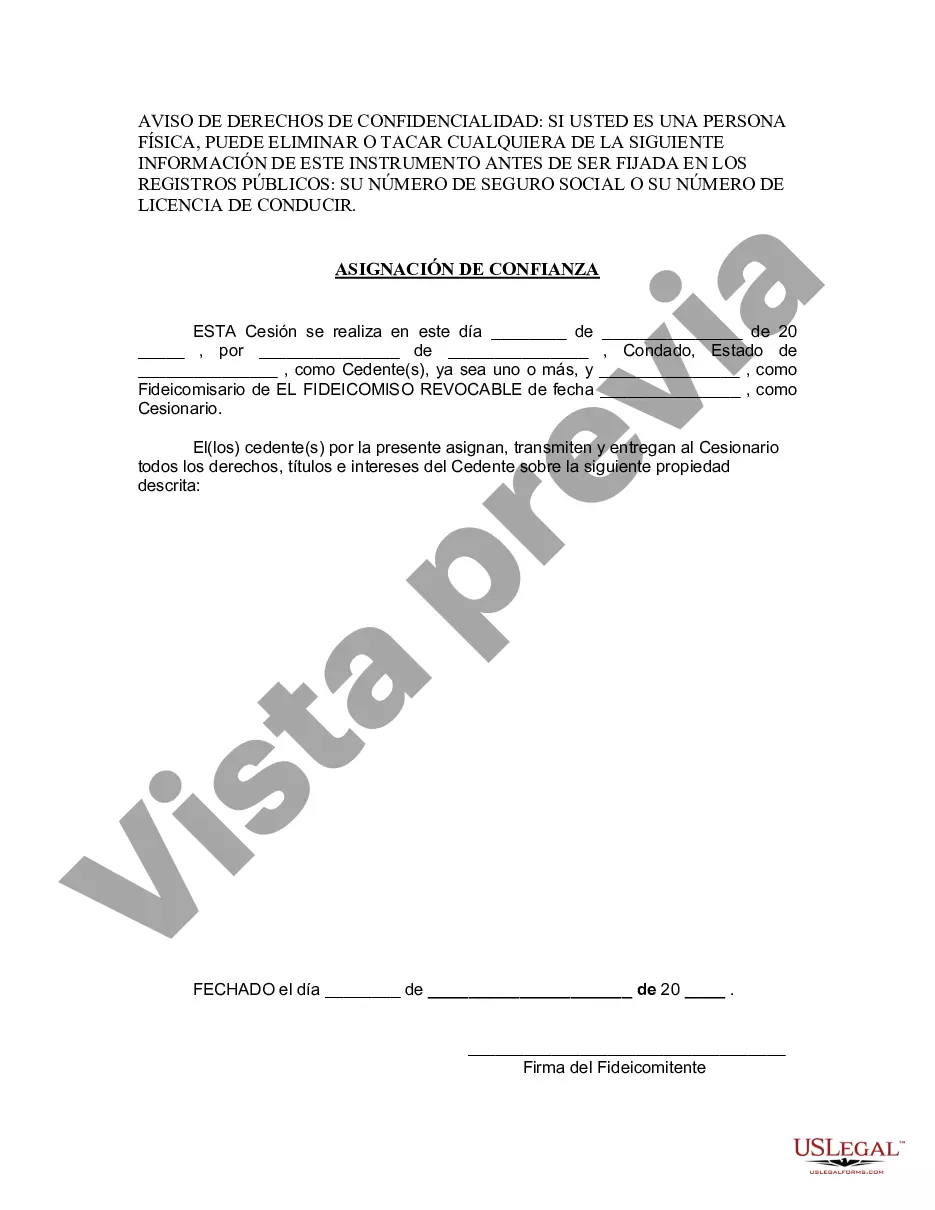

Harris Texas Asignación a un fideicomiso en vida - Texas Assignment to Living Trust

Description

How to fill out Texas Asignación A Un Fideicomiso En Vida?

Irrespective of societal or occupational standing, completing legal forms is a regrettable requirement in the present-day environment.

It is frequently nearly impossible for someone lacking legal expertise to generate this type of documentation independently, mainly because of the complex terminology and legal subtleties they encompass.

This is where US Legal Forms can be beneficial.

Ensure that the template you've located is suitable for your area, as the regulations of one state or county may not apply to another.

Review the form and peruse a brief description (if available) of the scenarios for which the document can be utilized.

- Our platform offers an extensive collection of over 85,000 state-specific templates suitable for virtually any legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors who wish to conserve time by using our DIY forms.

- Whether you require the Harris Texas Assignment to Living Trust or any other documentation pertinent to your state or county, US Legal Forms has everything readily available.

- Here’s how to obtain the Harris Texas Assignment to Living Trust swiftly using our dependable platform.

- If you are already a member, simply Log In to your account to download the necessary form.

- If you are not familiar with our platform, be sure to follow these steps before downloading the Harris Texas Assignment to Living Trust.

Form popularity

FAQ

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Un fideicomiso es un arreglo fiduciario que coloca bienes con un tercero (un administrador fiduciario) para que los guarde en nombre de los beneficiarios (por lo general, los hijos o los conyuges).

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

Es un producto financiero que ademas de ser parecido a un plan de ahorro, garantiza que el beneficiario, es decir tu hija o hijo, reciba el dinero acordado para continuar sus estudios en nivel superior aun cuando faltes.

Los fideicomisos patrimoniales no cuentan como un testamento, la diferencia se da en que un fideicomiso permite que las propiedades se distribuyan a los beneficiarios sin tener que pasar por el proceso testamentario, adicionalmente, los fideicomisos son documentos mas privados.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Para que exista el contrato de Fideicomiso basta con que esten estas dos partes; es decir, el Fideicomitente y el Fiduciario, y que los fines sean licitos y determinados. El (Los) Fideicomisario(s) son las personas fisicas o morales que reciben el o los provechos que el fideicomiso implica.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.