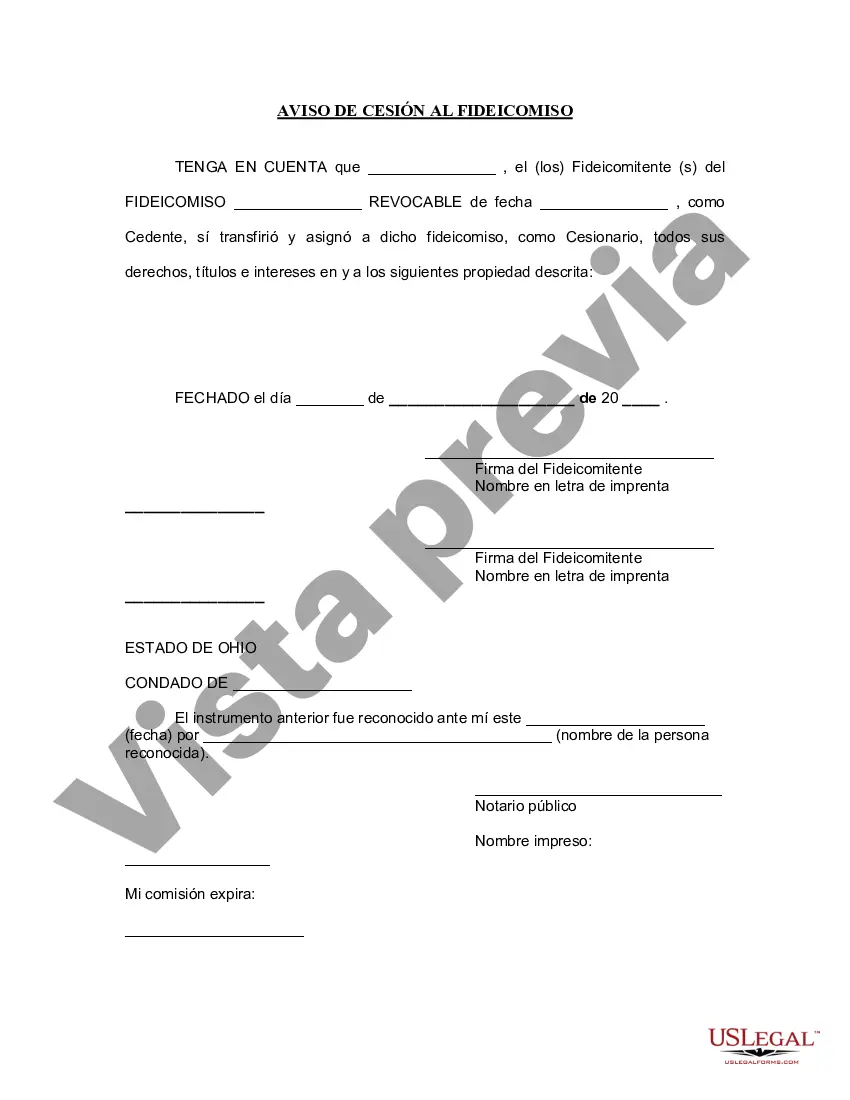

Franklin Ohio Aviso de cesión a un fideicomiso en vida - Ohio Notice of Assignment to Living Trust

Description

How to fill out Ohio Aviso De Cesión A Un Fideicomiso En Vida?

If you are in search of a suitable form template, it’s challenging to select a superior service than the US Legal Forms website – one of the most comprehensive collections on the web.

Here you can discover a vast array of document samples for business and personal use categorized by type and state, or by keywords.

With our premium search capability, locating the most recent Franklin Ohio Notice of Assignment to Living Trust is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Acquire the form. Choose the file format and save it to your device.

- Additionally, the relevance of each document is validated by a group of experienced attorneys who consistently review the templates on our platform and revise them according to the latest state and county laws.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Franklin Ohio Notice of Assignment to Living Trust is to Log In to your user account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the guidelines outlined below.

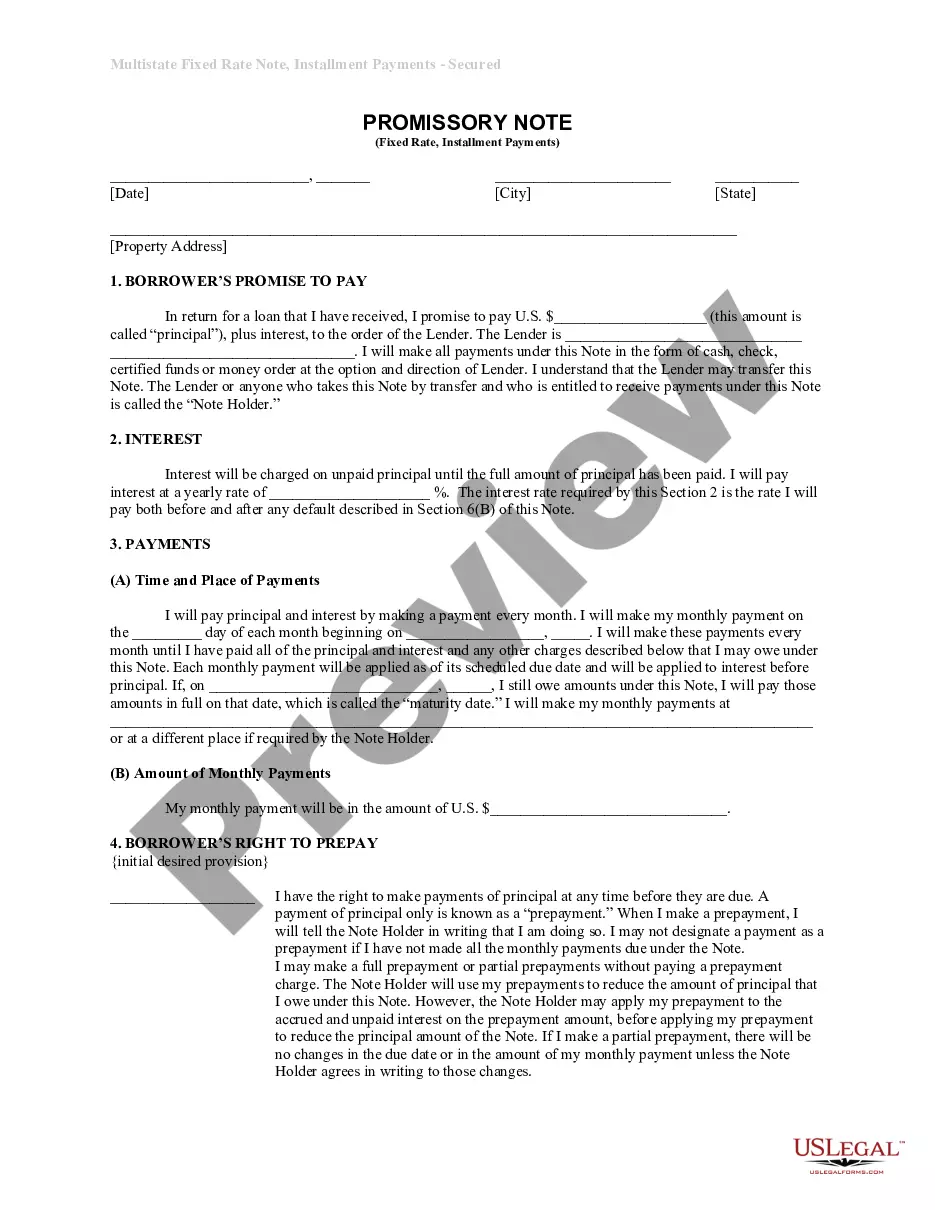

- Ensure you have selected the form you need. Review its description and utilize the Preview feature to assess its content. If it does not satisfy your needs, use the Search field at the top of the page to find the appropriate document.

- Verify your choice. Click the Buy now button. After that, select your preferred pricing option and enter the details to create an account.

Form popularity

FAQ

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

El articulo 822 del Codigo Civil colombiano, enumera seis causales por las cuales se extingue el fideicomiso: Por la restitucion.Por retroventa.Por la destruccion de la cosa.Por la renuncia del fideicomisario.Por faltar la condicion o no haberse cumplido en tiempo habil.

Las partes que intervienen en el contrato de fideicomiso son: Fideicomitente: Es la persona que destina bienes o derechos para constituir el fideicomiso. Fideicomisario: Es la persona que recibe el beneficio derivado del fideicomiso, puede ser el mismo fideicomitente.

Dentro del ambito fiduciario podemos definir al beneficiario o fideicomisario como aquella persona natural o juridica designada en un contrato fiduciario cuya constitucion se hizo en su favor.

El administrador fiduciario es una persona u organizacion encargada de administrar los bienes de un tercero. Esta persona o entidad es responsable del mantenimiento, desempeno y rentabilidad de los bienes del fideicomitente.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

La propiedad fiduciaria es administrada por el fiduciario en caso en que se haya designado, y si ese no ha sido el caso, la administracion le corresponde al fiduciante. El fiduciario es un mero tenedor de la propiedad fiduciaria, quien la administrara hasta tanto deba restituirla al fideicomisario o beneficiario.

¿Que sucede en caso de muerte del fiduciante? En el caso de muerte del fideicomitente o constituyente del fideicomiso, como ya lo expresamos con anterioridad, no da a lugar a la restitucion, y siguen quedando los bienes en cabeza de la entidad fiduciaria, mientras se liquida la sucesion.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.