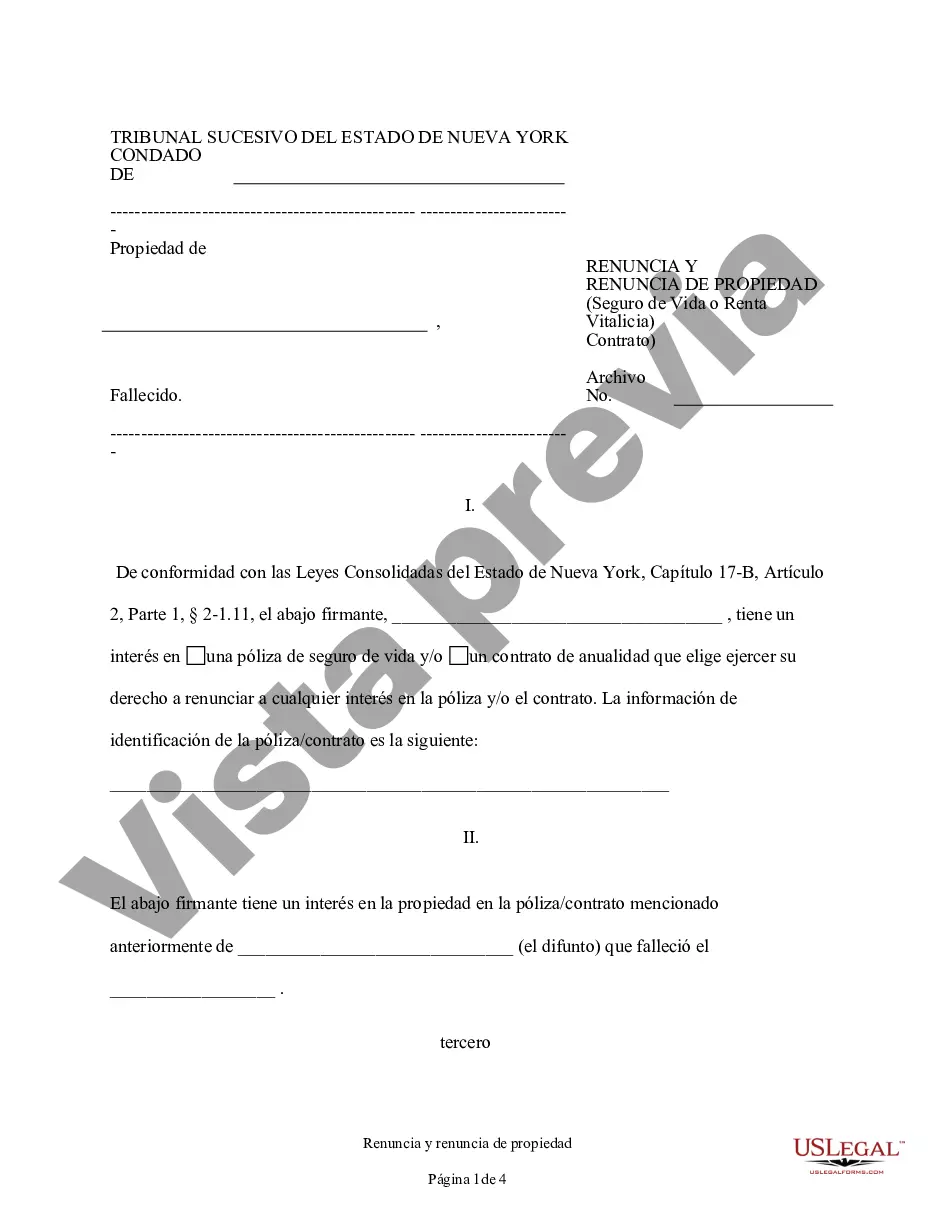

A Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract refers to a legal process where an individual voluntarily gives up their right to receive the proceeds or benefits from a life insurance or annuity contract. This renouncement and disclaimer can occur within the context of various scenarios, including estate planning, asset protection, or disinheritance. In Suffolk County, New York, there are different types of renunciations and disclaimers that individuals can pursue, depending on their specific circumstances. One type of renunciation and disclaimer is related to estate planning. In this case, an individual may choose to renounce their rights to the proceeds or benefits from a life insurance or annuity contract in order to minimize their estate's overall tax liability or to facilitate the distribution of assets according to their desired estate plan. By renouncing the property or benefits, they effectively relinquish any control or claim over the policy, allowing it to be distributed or used as directed by the policyholder's estate plan. Another type of renunciation and disclaimer involves asset protection. Individuals facing potential creditors or legal actions may choose to renounce ownership rights to their life insurance or annuity contracts, thereby shielding the proceeds or benefits from being accessed by those seeking to satisfy outstanding debts or legal judgments. This type of renunciation can be a strategic move to safeguard valuable assets and protect the financial well-being of loved ones. Moreover, renunciation and disclaimer of property from life insurance or annuity contracts can also be utilized in cases of disinheritance. When an individual wishes to exclude a specific beneficiary from receiving benefits from their life insurance or annuity contracts, they can renounce and disclaim their rights to the policy. This action ensures that the excluded party will not be able to claim or access the proceeds or benefits, aligning with the policyholder's intentions for the distribution of their estate. In Suffolk County, New York, individuals pursuing renunciation and disclaimer of property from life insurance or annuity contracts must adhere to state-specific laws and regulations. Legal formalities, such as filing a written renunciation or disclaimer with the appropriate authorities, may be required to ensure the renunciation is valid and legally binding. It is essential to consult an experienced attorney or estate planner when considering Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. They can provide guidance tailored to the individual's unique circumstances, helping them make informed decisions and navigate the legal process effectively. By understanding the various types and implications of renunciation and disclaimer, individuals can protect their assets, structure their estates, and ensure their wishes are realized.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Renuncia y Renuncia de Bienes del Seguro de Vida o Contrato de Renta Vitalicia - New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Suffolk New York Renuncia Y Renuncia De Bienes Del Seguro De Vida O Contrato De Renta Vitalicia?

If you are searching for a legitimate form, it’s extremely challenging to select a more suitable service than the US Legal Forms website – likely the most comprehensive collections on the web.

With this collection, you can discover thousands of document examples for business and personal needs by categories and states, or keywords.

With our enhanced search feature, obtaining the latest Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and download it to your device.

- Additionally, the accuracy of every record is validated by a group of proficient lawyers who consistently review the templates on our platform and refresh them according to the most recent state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to access the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the template you require. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn’t fulfill your needs, employ the Search option at the top of the page to find the necessary document.

- Confirm your selection. Click the Buy now button. After that, select your preferred pricing plan and provide details to register an account.

Form popularity

FAQ

Renta Vitalicia Inmediata: Es aquella modalidad de pension que contrata un afiliado con una Compania de Seguros de Vida, obligandose dicha Compania al pago de una renta mensual, fija en UF, para toda la vida del afiliado y fallecido este, a sus beneficiarios de pension.

Renta Vitalicia Inmediata con Retiro Programado. En esta modalidad se dividen los fondos que el afiliado tiene en su cuenta individual de la AFP y contrata con ellos simultaneamente una renta vitalicia inmediata y una pension por Retiro Programado.

El beneficiario puede ser designado al momento de contratarlos seguros de vida, sin embargo, tambien puede hacerse posteriormente mediante un escrito que deberas entregar a la aseguradora o a tu agente de seguros, quien a su vez elaborara un documento llamado endoso, en el cual quedara establecido quienes seran los

Renta Vitalicia Inmediata: Es aquella modalidad de pension que contrata un afiliado con una Compania de Seguros de Vida, obligandose dicha Compania al pago de una renta mensual, fija en UF, para toda la vida del afiliado y fallecido este, a sus beneficiarios de pension.

Por ejemplo: el beneficiario puede ser el/la conyuge, hijo/a, o familiar cercano. Aunque, segun lo indique la poliza en sus condiciones, el que contrate (tomador del seguro) puede designar a cualquier persona de su eleccion como su beneficiario. Tambien puede darse el caso donde exista mas de un beneficiario.

Las rentas vitalicias percibidas tributan como rendimiento de capital mobiliario en el Impuesto de la Renta de las Personas Fisicas. El tipo de gravamen se fija en un 19% hasta 6.000 euros, un 21%, hasta los 50.000 y un 23% para el resto. Pero la ventaja fiscal es que hay una parte exenta.

El valor de rescate de un seguro de vida cuando existe y se refleja en la poliza- es la suma que el tomador puede recuperar cuando quiera. Se trata de una cantidad que se reembolsa a cuenta de la cuantia que en su dia pueda corresponderle sobre la provision matematica generada por su poliza.

Las rentas vitalicias son polizas de ahorro mediante las cuales se garantiza el pago de cierta cantidad de dinero, de forma periodica, luego del pago de una prima previa. Este tipo de seguro les permite a las personas planificar sus ahorros y recibirlos nuevamente en forma de renta a partir de un momento determinado.

Beneficiario: introducir el nombre y apellido de la persona o empresa a la que vamos a pagar. Pais de residencia del beneficiario. Numero de cuenta del beneficiario. Importe a pagar.

La renta vitalicia termina al fallecimiento del asegurado o del ultimo de los beneficiarios con derecho a pension.

Interesting Questions

More info

The court may also extend its personal jurisdiction by consent. When this occurs, personal jurisdiction is not based upon the existence of any other state law.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.