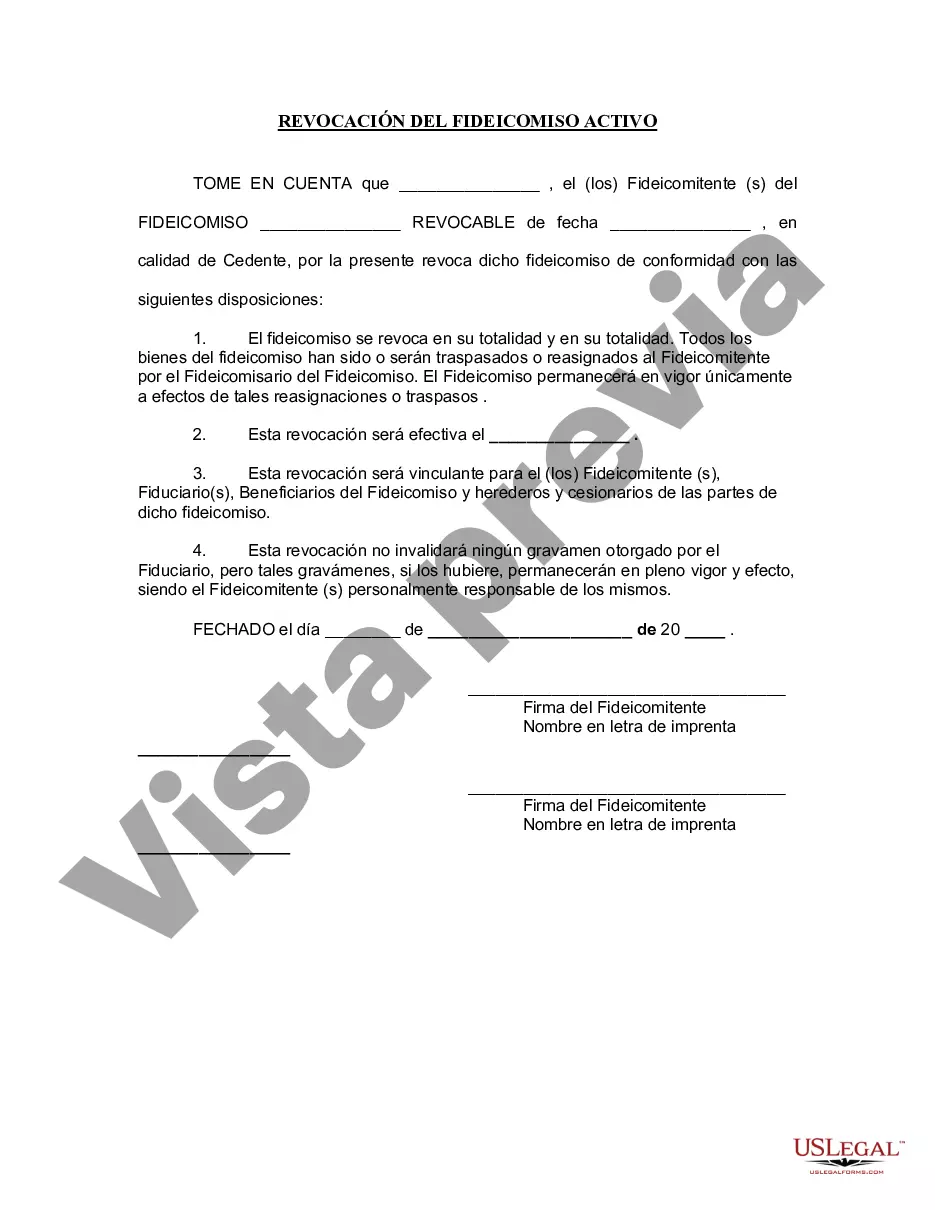

Clark Nevada Revocación de fideicomiso en vida - Nevada Revocation of Living Trust

Description

How to fill out Nevada Revocación De Fideicomiso En Vida?

Regardless of social or career standing, completing legal forms is a regrettable requirement in the modern workplace.

Frequently, it’s nearly impossible for individuals without a legal background to generate these types of documents from scratch, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms can be beneficial.

Confirm that the form you’ve discovered is appropriate for your jurisdiction, as the laws of one state or region do not apply to another.

Review the document and read a brief description (if provided) of the scenarios for which the document can be utilized.

- Our platform provides a vast library with over 85,000 ready-to-use state-specific documents applicable for nearly every legal circumstance.

- US Legal Forms also functions as an excellent tool for associates or legal advisors aiming to conserve time through our DIY forms.

- Whether you require the Clark Nevada Revocation of Living Trust or any other document that is valid in your jurisdiction, with US Legal Forms, everything is easily accessible.

- Here’s how to swiftly acquire the Clark Nevada Revocation of Living Trust using our dependable platform.

- If you are already a customer, feel free to Log In to your account to access the necessary form.

- However, if you are new to our platform, ensure you follow these steps before securing the Clark Nevada Revocation of Living Trust.

Form popularity

FAQ

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

Los fideicomisos le permiten al otorgante controlar las propiedades, aun despues de su muerte. Los fideicomisos proporcionan privacidadson contratos discretos entre dos partes que raramente son partes del registro publico. Los fideicomisos pueden funcionar para eliminar la necesidad de tutores.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Contrato mediante el cual una Persona Fisica o Moral transmite la titularidad de ciertos bienes y derechos a una institucion fiduciaria, expresamente autorizada para fungir como tal.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.