Miami-Dade Florida Último testamento legal y formulario de testamento con todos los bienes en fideicomiso llamado testamento invertido - Florida Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Florida Último Testamento Legal Y Formulario De Testamento Con Todos Los Bienes En Fideicomiso Llamado Testamento Invertido?

Utilize the US Legal Forms and gain immediate access to any form you require.

Our helpful site with countless documents streamlines the process of locating and acquiring nearly any document sample you might require.

You can save, complete, and authenticate the Miami-Dade Florida Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will in merely a few minutes rather than searching online for hours to discover the correct template.

Using our repository is an excellent tactic to enhance the security of your document submission.

If you do not have an account yet, follow the instructions provided below.

Access the page with the template you need. Ensure that it is the template you were looking for: confirm its title and description, and utilize the Preview feature if available. Otherwise, use the Search field to find the required one.

- Our knowledgeable attorneys consistently review all records to verify that the templates are suitable for a specific area and comply with current laws and regulations.

- How can you obtain the Miami-Dade Florida Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will.

- If you already possess a subscription, simply Log In to your account.

- The Download button will be activated for all documents you review.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

Aunque el otorgamiento de testamento notarial no tiene un precio fijo, ya que depende de su contenido y extension, su precio mas habitual puede estar entre los 50 y los 60 euros.

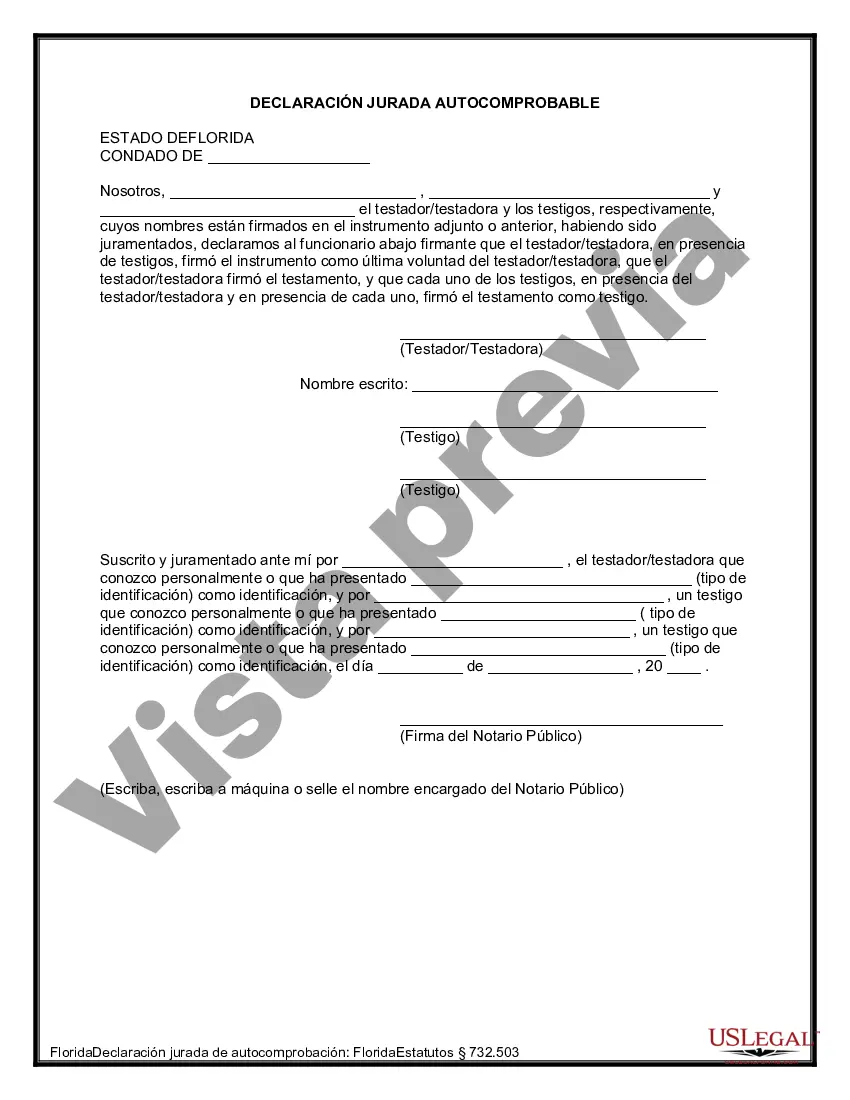

Para que un testamento de la Florida sea valido, debe haber testigos del mismo. Bajo la ley de la Florida, debe haber dos testigos. Estos testigos deben firmar el testamento en presencia del otro, asi como en presencia del testador.

En muchos casos esto no es necesario y usted solamente necesita los formularios correctos a llenar. Cuando contrata un abogado de testamentos, pagara lo que cuesta los honorarios del licenciado, generalmente alrededor de $350 por hora.

¿ Que requisitos debe cumplir? El testador debe tener como minimo 18 anos de edad. El testador debe tener buena salud mental. Al redactarlo, debe escribir su nombre y apellidos como aparecen en su acta de nacimiento. El testamento debe precisar quien sera el albacea.

¿COMO HACER SU PROPIO TESTAMENTO? Escriba cada palabra de su testamento con su puno y letra.Cancele cualquier testamento que haya escrito anteriormente.Haga un documento completo.Firme su nombre al pie de cada pagina.No necesita testigos que firmen su testamento holografo.

En la Ciudad de Mexico pueden comunicarse al Colegio de Notarios de la Ciudad de Mexico al telefono 55- 55-11-18-19. Para el resto del pais, se pueden comunicar al Colegio Nacional del Notariado Mexicano, A. C., a los telefonos: 55-55-14-60-58 y 55-55-25-64-15.

Los herederos acuden a la notaria o tambien podran hacerlo via judicial. Se realiza la busqueda del testamento y se apertura. Se nombra al albacea que decidiste en tu testamento y se hace un inventario y avaluo de tus bienes. Al final, se hace la reparticion de bienes para los herederos cumpliendose tu voluntad.

Los pasos son los siguientes: primero, es necesario tener claros los bienes y/o derechos de los que se dispondra y sus beneficiarios. Luego, hay que convocar a cinco personas mayores de edad al sitio de confinamiento en calidad de testigos del acto. En casos de suma urgencia, tres testigos serian suficientes.

El precio por hacer un testamento en linea esta entre $60 y $120.

¿COMO HACER SU PROPIO TESTAMENTO? Escriba cada palabra de su testamento con su puno y letra.Cancele cualquier testamento que haya escrito anteriormente.Haga un documento completo.Firme su nombre al pie de cada pagina.No necesita testigos que firmen su testamento holografo.