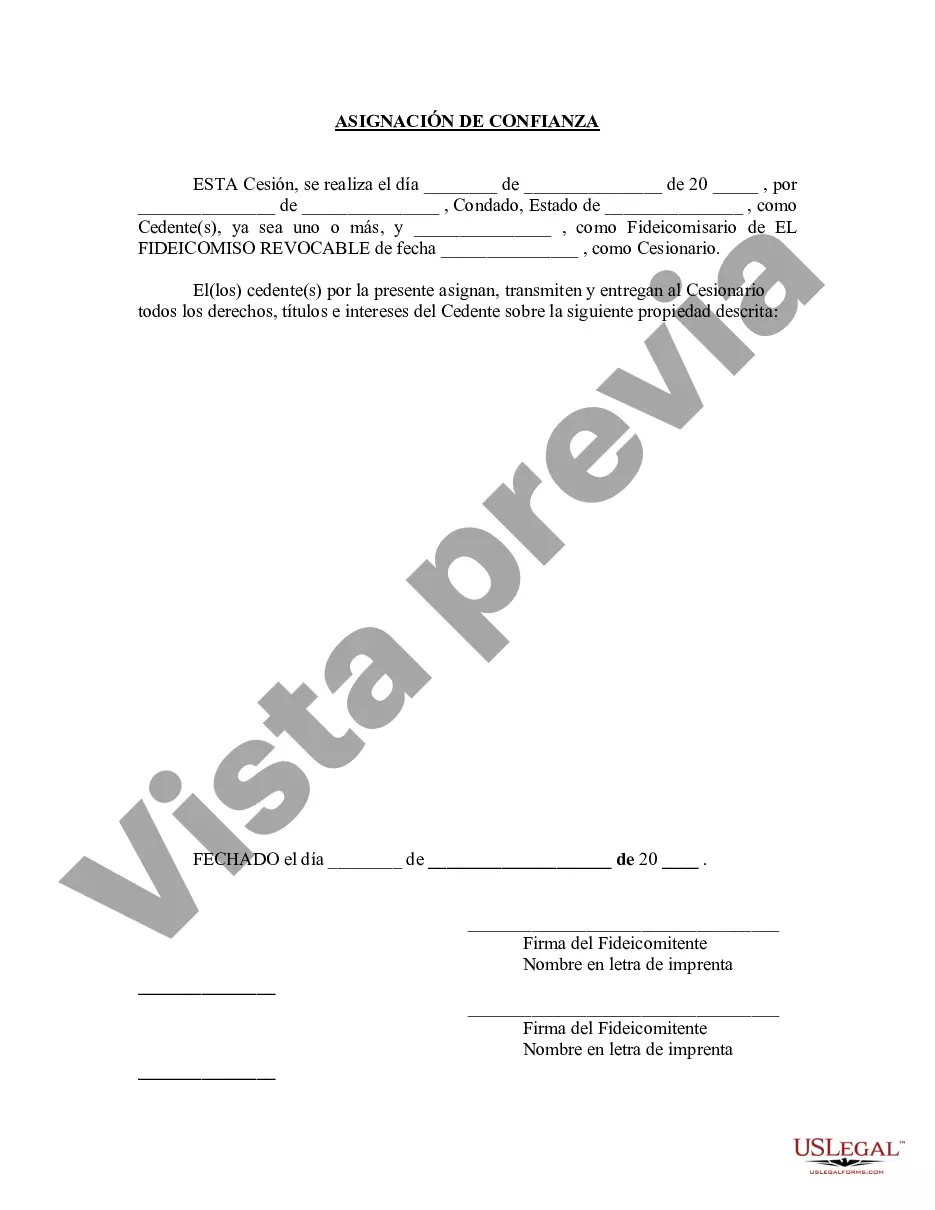

Orange California Asignación a un fideicomiso en vida - California Assignment to Living Trust

Description

How to fill out California Asignación A Un Fideicomiso En Vida?

We consistently endeavor to reduce or evade legal harm when navigating intricate law-related or financial matters.

To achieve this, we engage in legal options that are often prohibitively costly.

Nevertheless, not all legal issues are equally complicated.

Many of them can be resolved by us independently.

Take advantage of US Legal Forms whenever you need to quickly and securely locate and download the Orange California Assignment to Living Trust or any other document. Simply Log In to your account and click the Get button adjacent to it. If you misplace the form, you can always retrieve it again in the My documents tab.

- US Legal Forms is an online repository of current do-it-yourself legal documents, ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to manage your affairs autonomously, eliminating the necessity for legal counsel services.

- We grant access to legal document templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Para establecer un fideicomiso, cualquiera de los bancos en Mexico cobrara una cuota anual por mantener el fideicomiso, un promedio de $450 a $550 USD por ano.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Contrato mediante el cual una Persona Fisica o Moral transmite la titularidad de ciertos bienes y derechos a una institucion fiduciaria, expresamente autorizada para fungir como tal.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.