18 U.S.C. Sec. 152(9) WITHHOLDING RECORDS — ELEMENTS is a federal law that sets out the minimum elements that must be included in an employer's record keeping system for federal income tax withholding from employees' wages. The law requires that the records must include the employee's name, address, and social security number; the dates, amount, and type of each payment; and the amount of federal income tax withheld from each payment. The records must also include the employer's name, address, and employer identification number; and the dates, amounts, and type of each payment made to employees. Additionally, the records must include information about any fringe benefits provided to employees, such as health care, sick leave, and vacation pay.

18 U.S.C. Sec. 152(9) WITHHOLDING RECORDS - ELEMENTS

Description

How to fill out 18 U.S.C. Sec. 152(9) WITHHOLDING RECORDS - ELEMENTS?

How much time and resources do you normally spend on composing official paperwork? There’s a better opportunity to get such forms than hiring legal experts or spending hours searching the web for a suitable blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, including the 18 U.S.C. Sec. 152(9) WITHHOLDING RECORDS - ELEMENTS.

To acquire and prepare an appropriate 18 U.S.C. Sec. 152(9) WITHHOLDING RECORDS - ELEMENTS blank, follow these simple instructions:

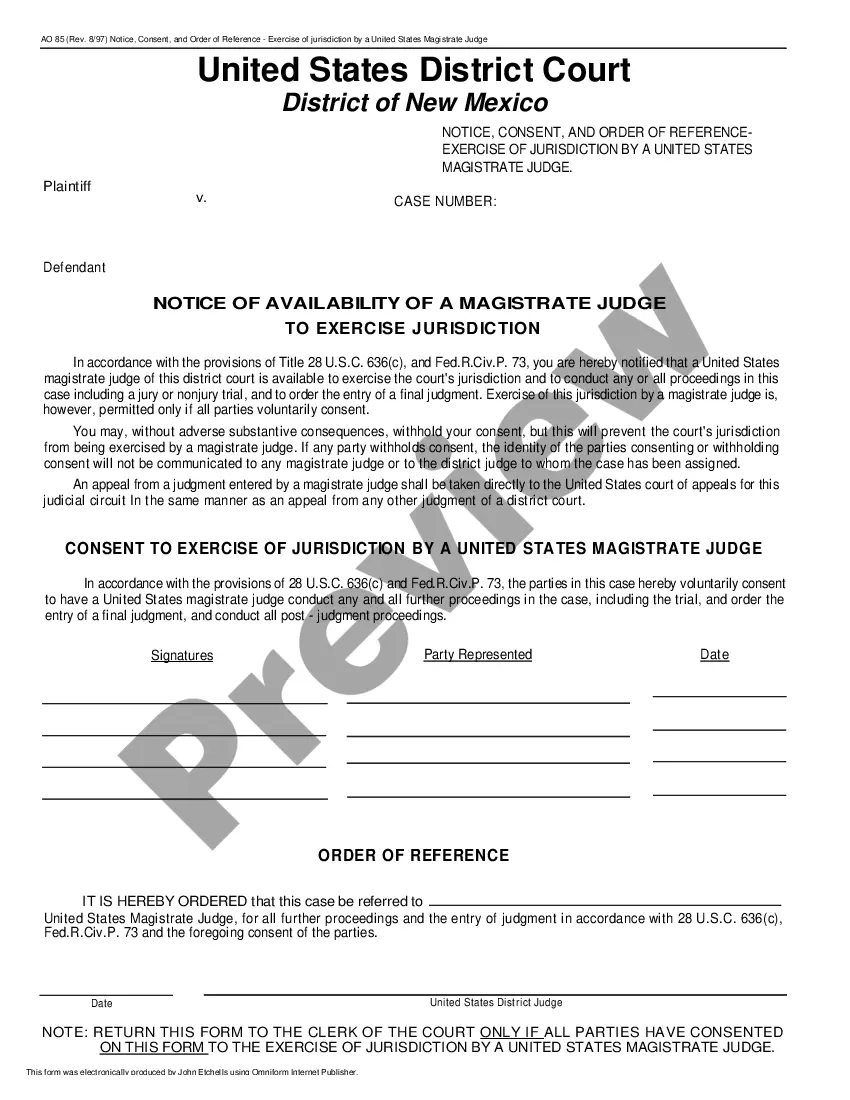

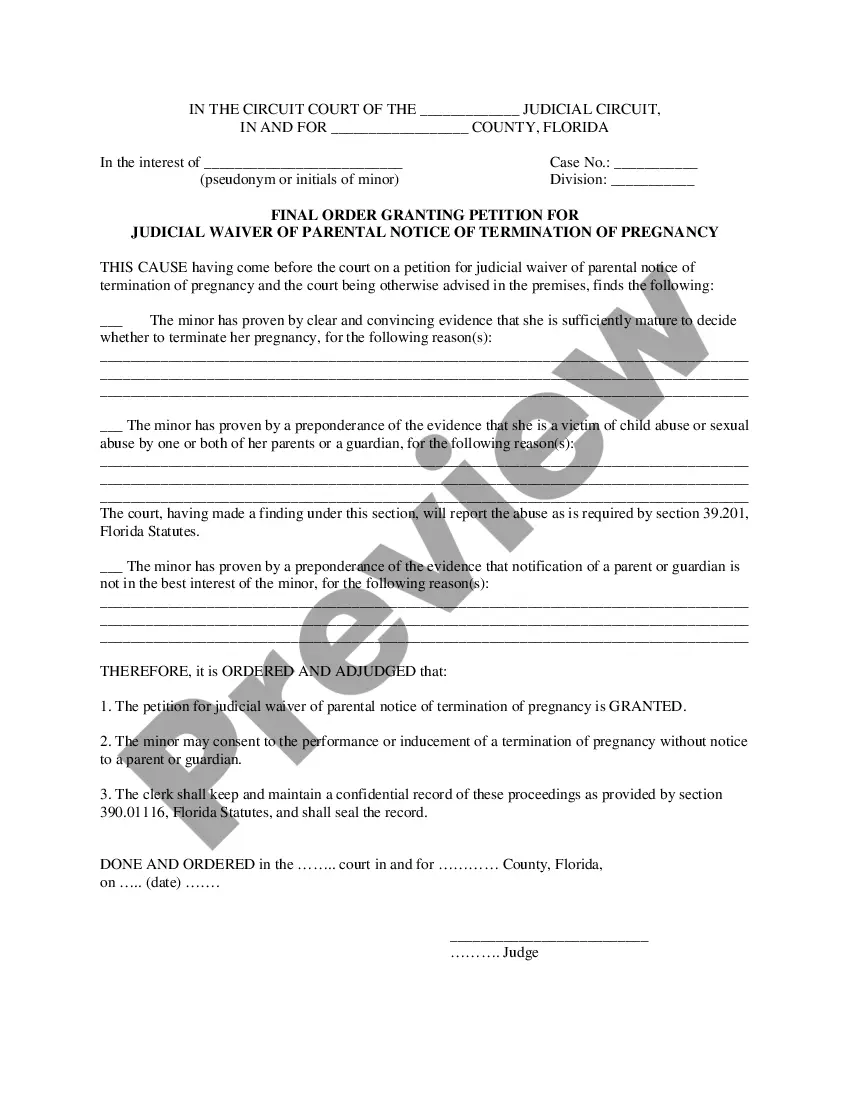

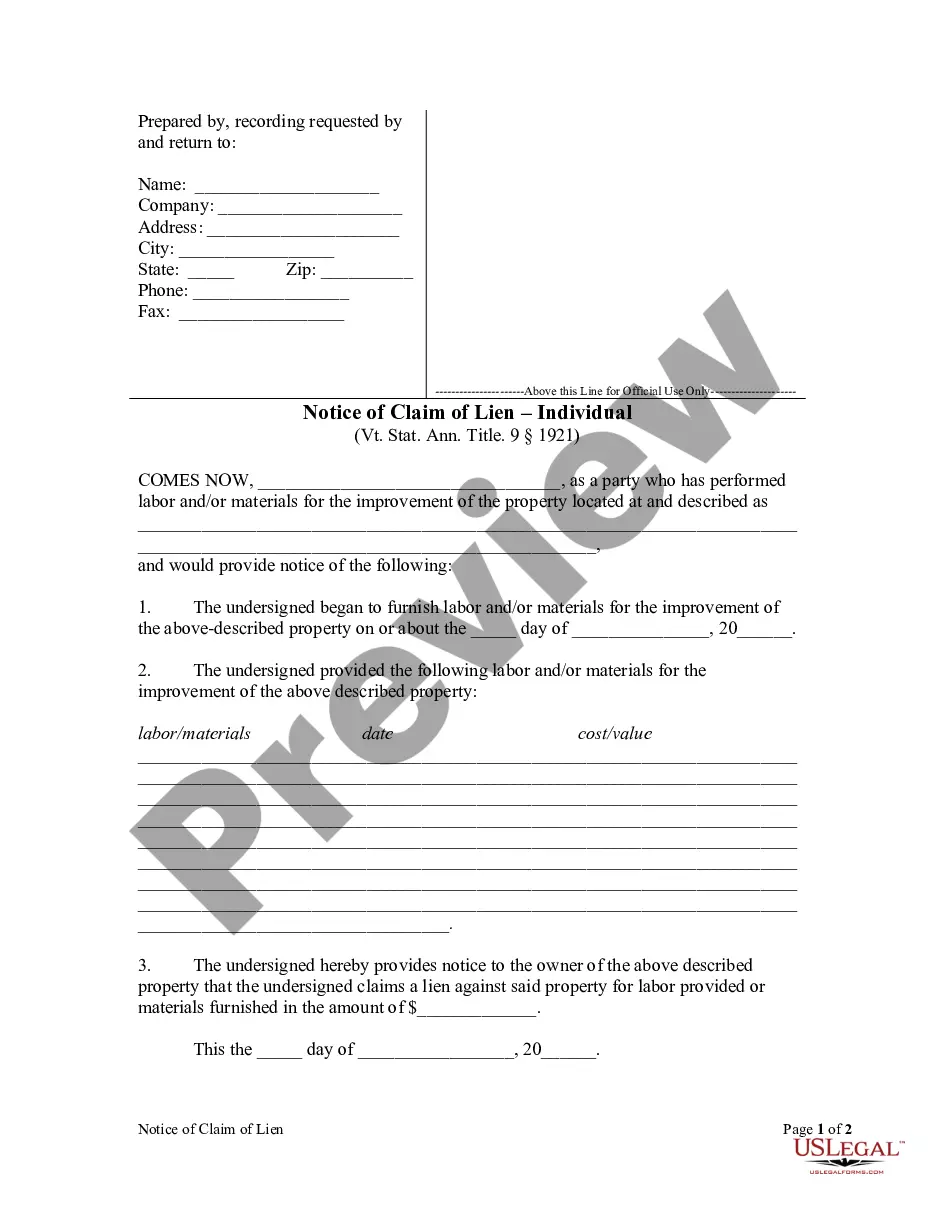

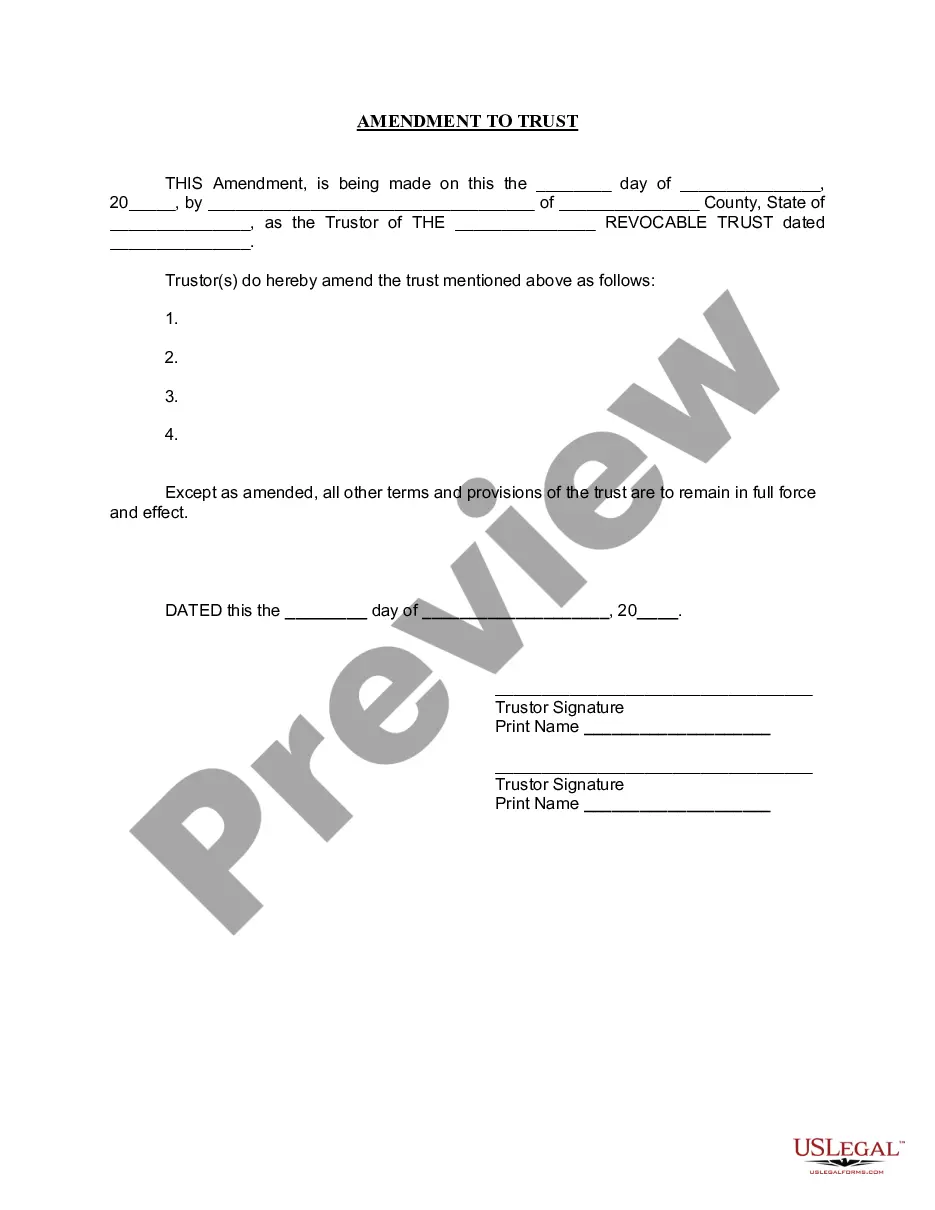

- Look through the form content to ensure it meets your state requirements. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t satisfy your needs, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the 18 U.S.C. Sec. 152(9) WITHHOLDING RECORDS - ELEMENTS. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your 18 U.S.C. Sec. 152(9) WITHHOLDING RECORDS - ELEMENTS on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most reliable web solutions. Sign up for us today!

Form popularity

FAQ

18 U.S.C. § 152 "attempts to cover all the possible methods by which a bankrupt or any other person may attempt to defeat the Bankruptcy Act through an effort to keep assets from being equitably distributed among creditors." Stegeman v.

18 U.S. Code § 152 - Concealment of assets; false oaths and claims; bribery.

§ 157 prohibits devising or intending to devise a scheme or artifice to defraud and, for purposes of executing or concealing the scheme either (1) filing a bankruptcy petition; (2) filing a document in a bankruptcy proceeding; or (3) making a false statement, claim, or promise (a) in relationship to a bankruptcy

A qualifying relative. If an individual is a dependent of a taxpayer for any taxable year of such taxpayer beginning in a calendar year, such individual shall be treated as having no dependents for any taxable year of such individual beginning in such calendar year.

§ 152(4) Subsection (4) of Section 152 sets out the offense of filing a false bankruptcy claim. A "claim" is a document filed in a bankruptcy proceeding by a creditor of the debtor.