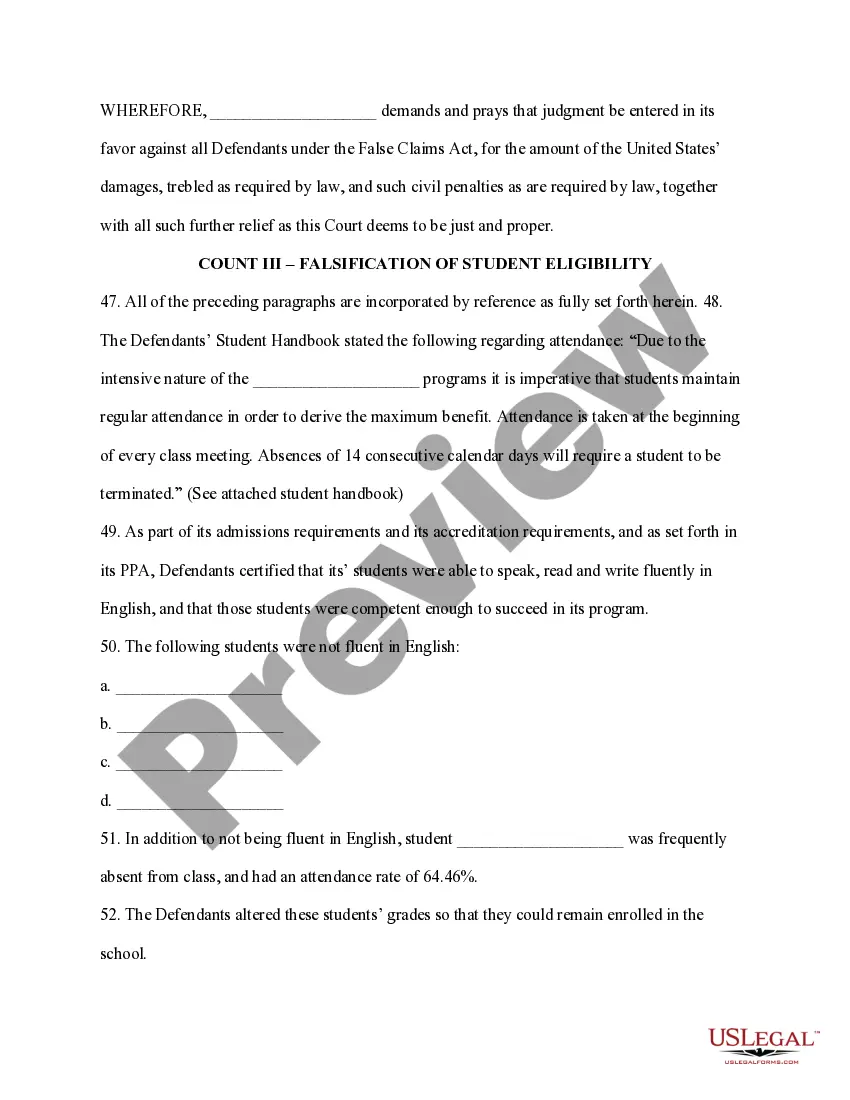

A Sample Complaint under the False Claims Act is a document filed with the court outlining the allegations of fraud against the defendant. The complaint must be specific and include detailed facts that support the legal theory of the case, such as the knowing submission of false claims, the use of false records or statements, and the making of false statements to get a claim paid. There are three primary types of Sample Complaint under the False Claims Act: 1. Quit Tam Complaint: This type of complaint is brought by a private individual or whistleblower as a civil action on behalf of the government for violations of the False Claims Act. 2. Intervene Complaint: This type of complaint is brought by the government as a civil action on its own behalf for violations of the False Claims Act. 3. Realtor Complaint: This type of complaint is brought by a private individual or whistleblower as a civil action on behalf of himself or herself, and is used to help the government collect damages and penalties from the defendant.

Sample Complaint under False Claims Act

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Sample Complaint Under False Claims Act?

How much time and resources do you usually spend on drafting formal paperwork? There’s a better opportunity to get such forms than hiring legal specialists or spending hours browsing the web for a suitable blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Sample Complaint under False Claims Act.

To acquire and complete a suitable Sample Complaint under False Claims Act blank, adhere to these simple steps:

- Examine the form content to ensure it meets your state laws. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Sample Complaint under False Claims Act. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally safe for that.

- Download your Sample Complaint under False Claims Act on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us today!

Form popularity

FAQ

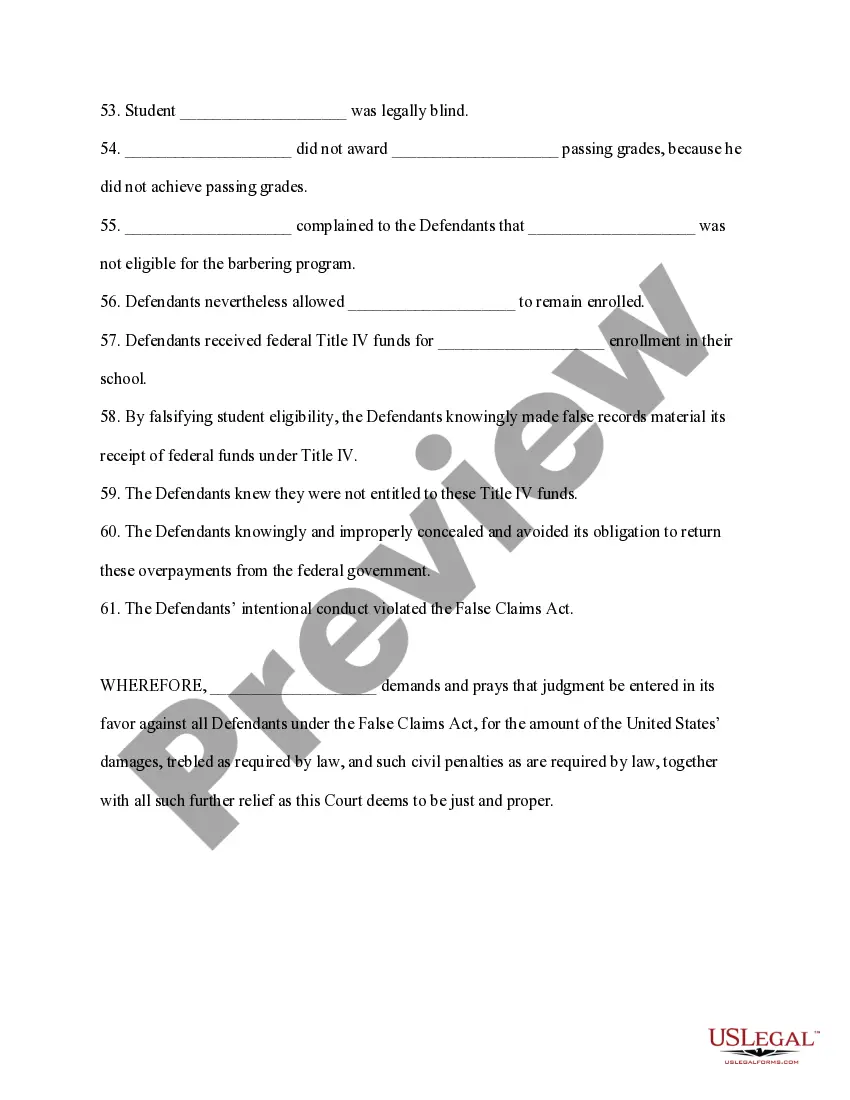

The FCA provides that any person who knowingly submits, or causes to submit, false claims to the government is liable for three times the government's damages plus a penalty that is linked to inflation .

Examples of practices that may violate the False Claims Act if done knowingly and intentionally, include the following: Billing for services not rendered. Knowingly submitting inaccurate claims for services.

A person does not violate the False Claims Act by submitting a false claim to the government; to violate the FCA a person must have submitted, or caused the submission of, the false claim (or made a false statement or record) with knowledge of the falsity.

Common Examples of False Claims Billing for goods/services never delivered. Double billing for the same good/service. Failing to report government overpayments. Misrepresenting costs or records related to performance or quality. Billing for non-FDA approved drugs or devices. Performing unnecessary medical procedures.

A person does not violate the False Claims Act by submitting a false claim to the government; to violate the FCA a person must have submitted, or caused the submission of, the false claim (or made a false statement or record) with knowledge of the falsity.

Identifying a false claim is seldom straightforward, so a False Claims Act case filing may take a variety of forms. Generally, however, there are three main elements seen in every false claim case: 1). a claim made by an individual or 2) for government money or funds and 3) which is somehow fraudulent or false.

The elements of a violation under the first prong of the reverse?FCA provisions are that (1) a record or statement was false, (2) the defendant had knowledge of the falsity, (3) the defendant made or used (or caused to be made or used) the false record or statement, (4) the defendant's purpose was to conceal, avoid, or