Sample Stock Purchase Agreement between Reassure America Life Insurance Co. and Penncorp Financial Group, Inc. regarding issued and outstanding shares common stock

Description

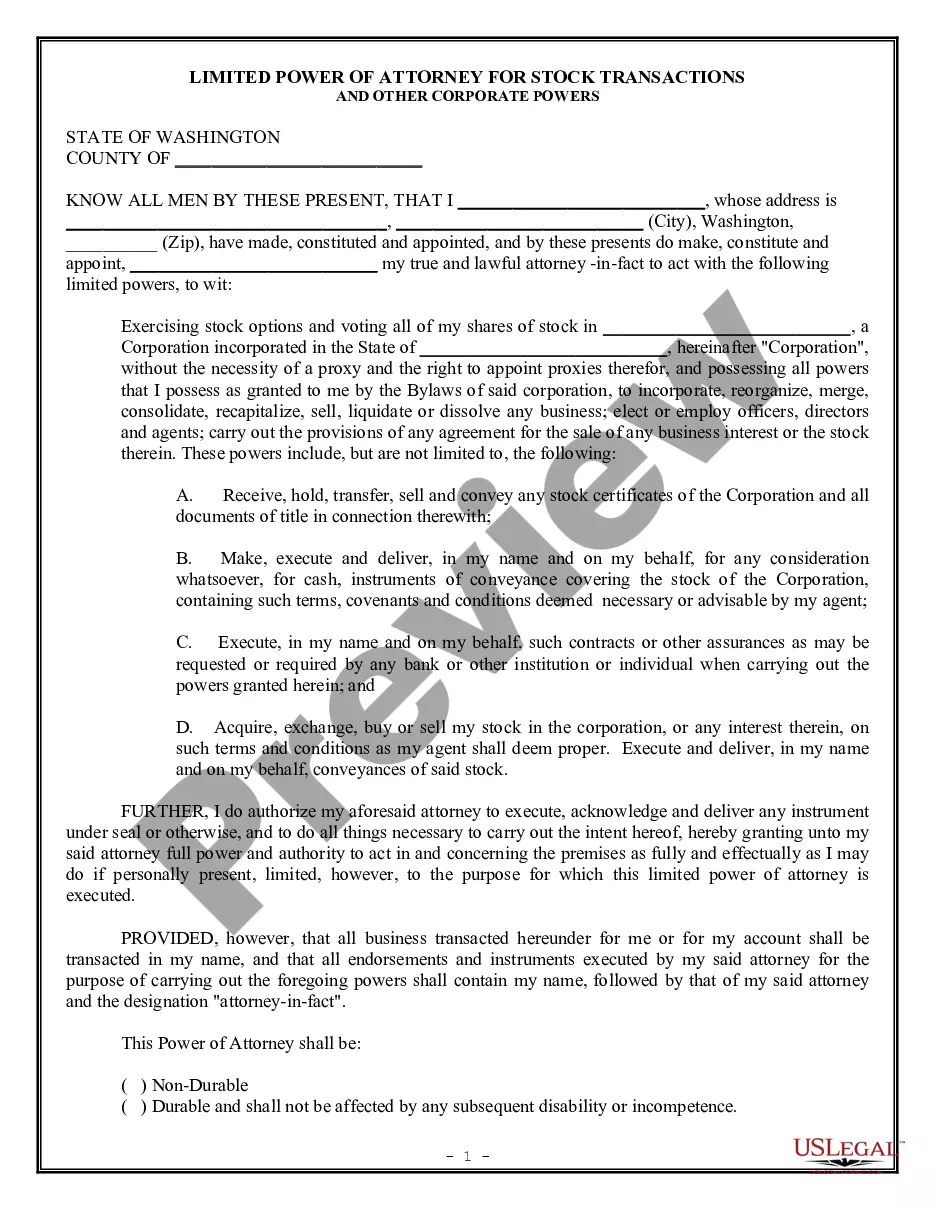

How to fill out Sample Stock Purchase Agreement Between Reassure America Life Insurance Co. And Penncorp Financial Group, Inc. Regarding Issued And Outstanding Shares Common Stock?

When it comes to drafting a legal form, it’s better to delegate it to the specialists. Nevertheless, that doesn't mean you yourself can’t find a sample to utilize. That doesn't mean you yourself can not find a template to utilize, however. Download Sample Stock Purchase Agreement between Reassure America Life Insurance Co. and Penncorp Financial Group, Inc. regarding issued and outstanding shares common stock right from the US Legal Forms site. It offers a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. As soon as you are registered with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things much easier, we have provided an 8-step how-to guide for finding and downloading Sample Stock Purchase Agreement between Reassure America Life Insurance Co. and Penncorp Financial Group, Inc. regarding issued and outstanding shares common stock quickly:

- Be sure the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Click Buy Now.

- Choose the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

Once the Sample Stock Purchase Agreement between Reassure America Life Insurance Co. and Penncorp Financial Group, Inc. regarding issued and outstanding shares common stock is downloaded it is possible to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

While purchasing a single share isn't advisable, if an investor would like to purchase one share, they should try to place a limit order for a greater chance of capital gains that offset the brokerage fees.Buying a small number of shares may limit what stocks you can invest in, leaving you open to more risk.

While there is no minimum order limit on the purchase of a publicly-traded company's stock, it's advisable to buy blocks of stock with a minimum value of $500 to $1,000. This is because no matter what online or offline service an investor uses to purchase stock, there are brokerage fees and commissions on the trade.

But there is nothing wrong with owning one share of stock, financial advisers say. In fact, buying one share of stock has recently become easier than ever.Some brokerages even offer free trading for fractional sharesjust a piece of one shareof companies and exchange-traded funds.

A share is the single smallest denomination of a company's stock. So if you're divvying up stock and referring to specific characteristics, the proper word to use is shares. Technically speaking, shares represent units of stock.

It means you own part of the company. For most companies, one share is a really small portion public companies usually have millions of shares outstanding. However, some private companies may only have a few shares outstanding. If you have a local restaurant, it may have only 10 shares or 100 shares.

A share, sometimes called a stock or security, is a unit of ownership in a company. If you buy shares in a company, you own part or a 'share' of that company. This part ownership is sometimes referred to as having equity in that company.

Buying Through a Broker. Open a trading account. You can choose a broker in a brick-and-mortar office if you want advice, but many full-service brokers charge as much as $150 per stock purchase. Online brokers let you buy a stock for anywhere from $4 to $10 per trade, though you won't get any guidance for that price.

At the time of writing, a single share of Amazon costs north of $3,000. Thankfully, we can use what are called fractional shares to invest in Amazon with much less than that. Fractional shares allow you to use M1's account minimum deposit ($100) to buy roughly 1/33 of a share of Amazon stock.

Getting a PAN card: Obtaining a Permanent Account Number (PAN) is the first step towards any trade in the stock markets. Open a Demat Account: Open a Trading Account: Register with a Broker/ Brokerage Platform: You'll also need a Bank Account: Get your Unique Identification Number (UIN):