Acuerdo de Fideicomiso Nacional Calificado - Qualified Domestic Trust Agreement

Description

Key Concepts & Definitions

Qualified Domestic Trust Agreement (QDOT) is a specialized trust in the United States designed for non-citizen surviving spouses to qualify for the unlimited marital deduction in estate taxes. This tool postpones the payment of estate taxes until the death of the non-citizen spouse or if the assets leave the trust.

Step-by-Step Guide on Setting Up a Qualified Domestic Trust

- Assess Eligibility: Ensure that the surviving spouse is a non-U.S. citizen and that setting up a QDOT makes financial sense based on the size of the estate.

- Select a Trustee: Appoint a U.S. citizen or a domestic corporation to act as the trustee.

- Draft the Trust Agreement: Work with an experienced estate planning attorney to draft the trust document, meeting all the IRS requirements for QDOTs.

- Fund the Trust: Transfer the assets into the trust as outlined in the trust document.

- File Necessary Tax Forms: Submit any required forms with the IRS, possibly including Form 706-QDT.

Risk Analysis

- Tax Liability: Failure to properly set up or maintain a QDOT can result in significant estate taxes becoming due immediately upon the death of the citizen spouse.

- Trustee Management Risk: Poor management by the trustee can lead to asset mismanagement or legal challenges.

- Regulatory Changes: Changes in tax law or estate law could alter the benefits of a QDOT, potentially impacting the financial strategy.

Common Mistakes & How to Avoid Them

- Not Assigning a Qualified Trustee: Ensure the trustee is either a U.S. citizen or a corporation qualified under U.S. laws to handle trust operations.

- Delay in Trust Funding: Timely transfer of assets into the trust is crucial to avoid immediate taxation.

- Inadequate Record Keeping: Maintain thorough records to ensure all transactions and decisions are well documented, aiding in compliance and future audits.

FAQ

What happens if the non-citizen spouse becomes a U.S. citizen? If the non-citizen spouse becomes a U.S. citizen and meets specific IRS residency requirements, the assets in the QDOT can be transferred out without immediate estate taxes being incurred.

Can a QDOT be revoked? Generally, QDOTs are irrevocable, meaning they cannot be altered or terminated without specific provisions in the trust or by court order.

Key Takeaways

- A QDOT allows non-citizen spouses to benefit from the marital deduction for estate taxes.

- Proper setup and management of a QDOT are crucial to avoid significant tax liabilities.

- Consulting with specialized legal and tax professionals is advised when considering a QDOT.

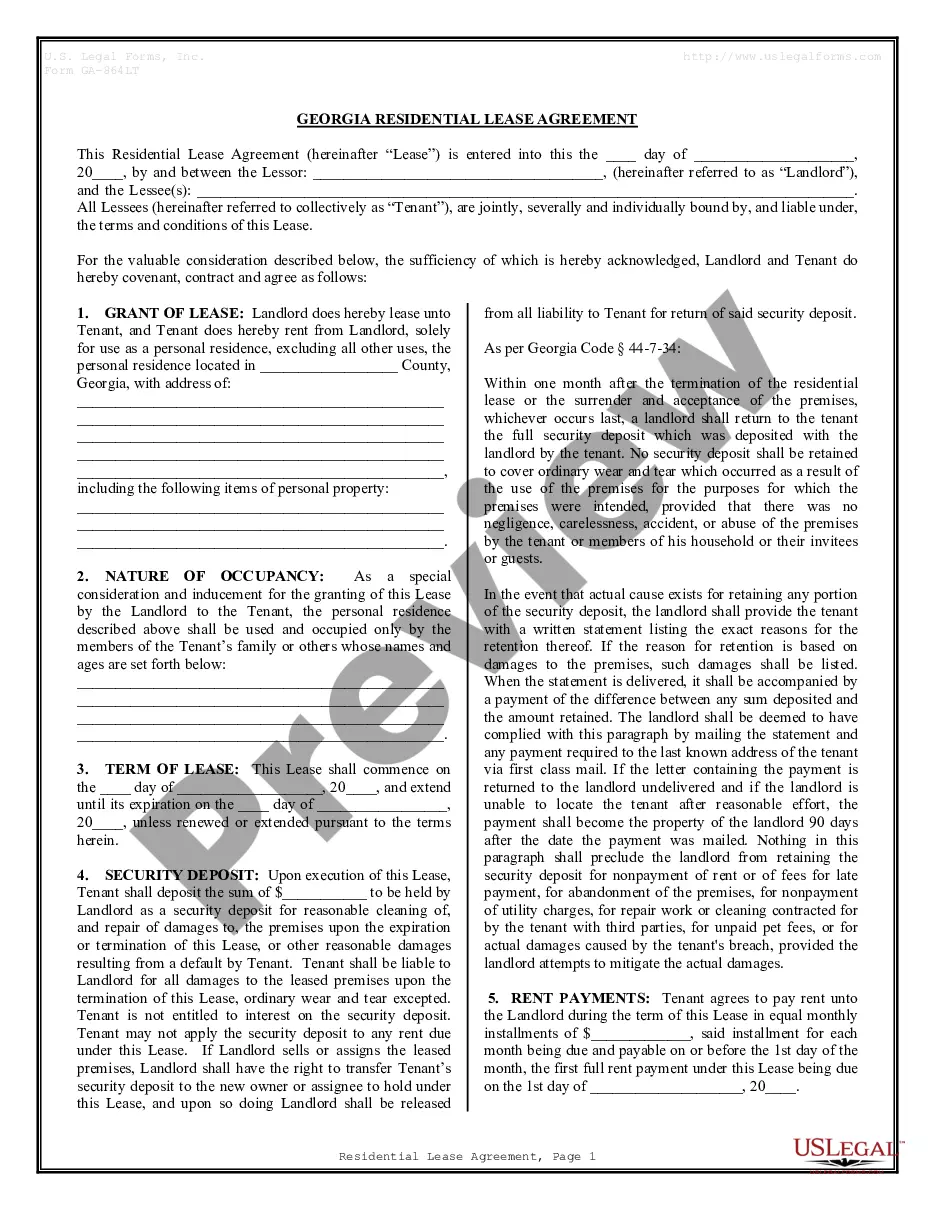

How to fill out Acuerdo De Fideicomiso Nacional Calificado?

Employ the most comprehensive legal library of forms. US Legal Forms is the best platform for getting updated Qualified Domestic Trust Agreement templates. Our service provides thousands of legal forms drafted by licensed lawyers and sorted by state.

To obtain a template from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and choose the template you need and buy it. After buying forms, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines listed below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- If the form has a Preview option, utilize it to review the sample.

- In case the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the template meets your needs.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with the debit/credit card.

- Select a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill out the Form name. Join a large number of pleased customers who’re already using US Legal Forms!