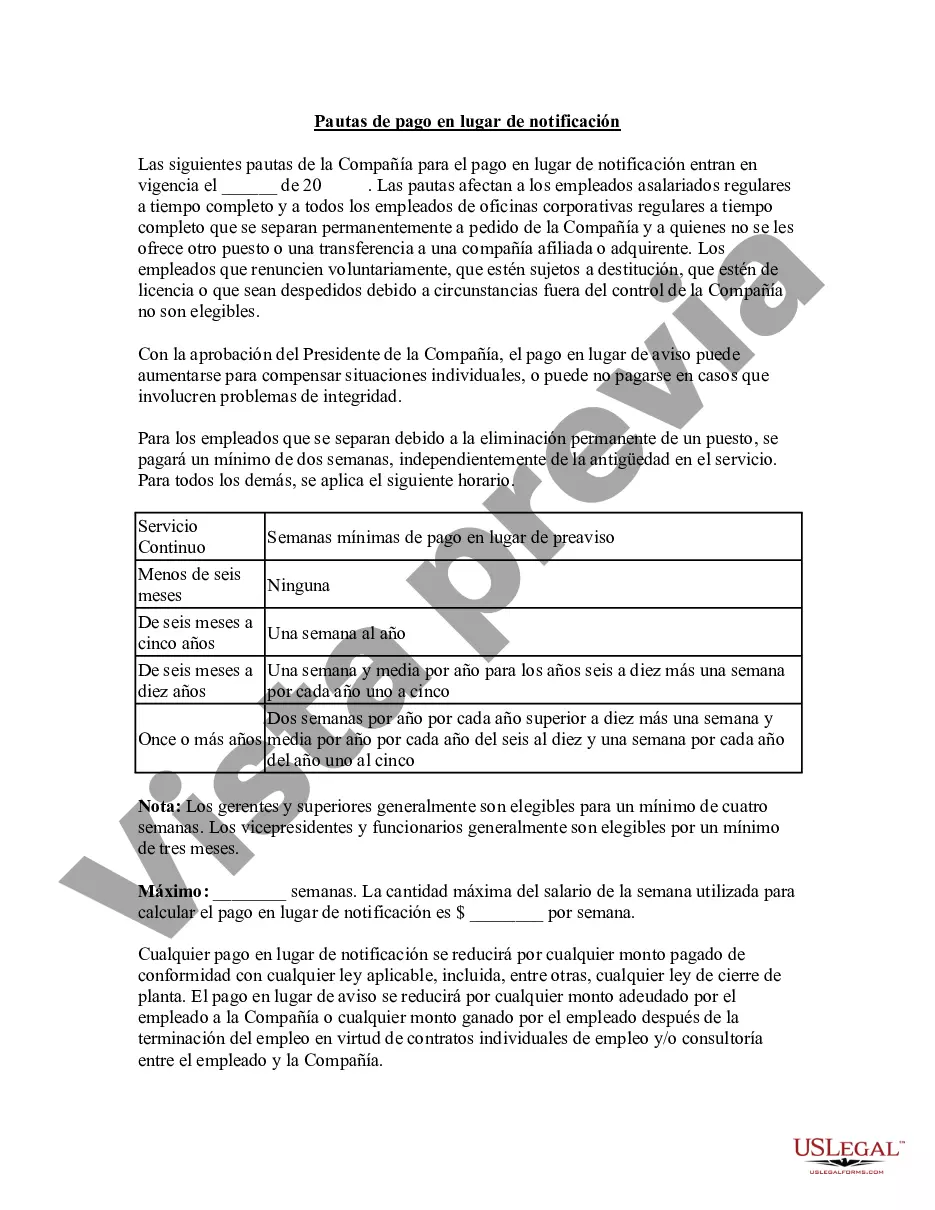

Keywords: South Carolina, Pay in Lieu of Notice, Guidelines, different types South Carolina Pay in Lieu of Notice Guidelines: Explained In South Carolina, Pay in Lieu of Notice (PILOT) refers to a legal concept that allows employers to compensate employees for the period they should have worked but were not given proper notice of termination or layoff. These guidelines aim to ensure fair and consistent compensation practices, taking into account various factors such as employment duration, type of employment, and the reason for termination. 1. Standard Pay in Lieu of Notice Guidelines: Under these guidelines, employers must provide employees with a specific notice period before terminating their employment. However, if an employer fails to provide the required notice, they are obliged to pay the employee a compensation amount equivalent to the wages the employee would have earned during the notice period. 2. Exceptions and Special Circumstances: Certain exceptions may apply in specific situations. For example, if an employee is terminated due to misconduct, the employer may be exempt from paying PILOT. However, it is crucial to consult legal counsel or refer to the South Carolina employment laws to verify the exceptions and circumstances where PILOT might not be applicable. 3. Employment Duration: South Carolina PILOT guidelines often consider the length of an employee's service with the company. Depending on the employment duration, there might be different guidelines for calculating the pay. For instance, employees who have served for a shorter tenure might be entitled to a lower PILOT amount compared to those with longer service. 4. Type of Employment: Another factor to consider when following the South Carolina PILOT guidelines is the type of employment. Different guidelines may apply to full-time employees, part-time employees, temporary workers, and independent contractors. It is essential to adhere to these distinctions to avoid legal complications. 5. Compliance with Federal Laws: While South Carolina has specific guidelines for PILOT, it is essential to note that certain federal laws, such as the Fair Labor Standards Act (FLEA), supersede state regulations. Employers need to ensure compliance with both state and federal guidelines when calculating PILOT. 6. Seek Legal Advice: Given the complexity of employment laws, it is advisable for both employers and employees to consult legal professionals experienced in South Carolina employment law. These experts can provide specific advice and guidance based on individual circumstances, ensuring adherence to all relevant PILOT guidelines. Understanding South Carolina Pay in Lieu of Notice Guidelines is crucial for both employees and employers. By following these guidelines accurately, employers can avoid legal disputes, while employees can ensure they receive fair compensation when termination or layoff occurs without proper notice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Carolina Pautas de pago en lugar de notificación - Pay in Lieu of Notice Guidelines

Description

How to fill out South Carolina Pautas De Pago En Lugar De Notificación?

If you wish to total, obtain, or produce legitimate papers layouts, use US Legal Forms, the biggest variety of legitimate varieties, which can be found online. Make use of the site`s easy and handy search to find the paperwork you need. Different layouts for organization and specific functions are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to find the South Carolina Pay in Lieu of Notice Guidelines in just a handful of mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your profile and then click the Acquire button to have the South Carolina Pay in Lieu of Notice Guidelines. You can also access varieties you formerly saved from the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for the right town/country.

- Step 2. Make use of the Preview method to look through the form`s content material. Do not overlook to read through the outline.

- Step 3. Should you be not satisfied using the type, use the Search discipline near the top of the display to locate other models of your legitimate type template.

- Step 4. Once you have found the shape you need, click on the Buy now button. Choose the costs plan you prefer and add your qualifications to register for the profile.

- Step 5. Approach the purchase. You may use your credit card or PayPal profile to finish the purchase.

- Step 6. Find the structure of your legitimate type and obtain it in your system.

- Step 7. Full, change and produce or indicator the South Carolina Pay in Lieu of Notice Guidelines.

Each and every legitimate papers template you get is the one you have forever. You may have acces to each and every type you saved inside your acccount. Click on the My Forms portion and pick a type to produce or obtain once more.

Contend and obtain, and produce the South Carolina Pay in Lieu of Notice Guidelines with US Legal Forms. There are thousands of professional and status-distinct varieties you may use for your personal organization or specific requires.

Form popularity

FAQ

Employees are sometimes under the impression that two weeks' notice is required by law. Neither federal nor South Carolina law requires that two weeks' notice be given, but both the employer and the employee may be contractually bound by a written policy implemented by the employer.

Employees are sometimes under the impression that two weeks' notice is required by law. Neither federal nor South Carolina law requires that two weeks' notice be given, but both the employer and the employee may be contractually bound by a written policy implemented by the employer.

Job abandonment occurs when an employee does not report to work as scheduled and has no intention of returning to the job but does not notify the employer of his or her intention to quit. Employers should develop a policy defining how many days of no-call/no-show will be considered job abandonment.

Which means if the employee does not give one month notice or as many months as prescribed, in the letter of appointment, he/she has to pay one month salary or as many months salary as prescribed in the letter of appointment.

South Carolina is an at-will state, which means that employers can terminate employees at any time, with or without cause and with or without notice. The employee handbook should reinforce that employees are at will.

In South Carolina, workers have the right to organize and the right to designate representatives of their own choosing to negotiate the terms and conditions of employment. No employer may discharge or discriminate in the payment of wages against any person because of his or her membership in a labor organization.

If a notice period such as one month is required for an employer to terminate a contract, a 'payment in lieu of notice' is immediate compensation at an amount equal to that an employee would have earned as salary or wages by working through the whole notice period: for example, one month's salary.

South Carolina requires that final paychecks be paid on the within 48 hours or next scheduled payday, whichever comes first. The final paycheck should contain the employee's regular wages from the most recent pay period, plus other types of compensation such as commissions, bonuses, and accrued sick and vacation pay.

If you get a payment in lieu of notice it means that your employer pays your salary, and perhaps also benefits, for your notice period, but you do not have to work during that time. It's also known as PILON for short and sometimes called wages in lieu of notice.

A. South Carolina is an at-will state, which means that employees may be terminated for any reason, a good reason, a bad reason, or no reason. The employee may also quit for similar reasons without providing notice to employer.