A South Carolina Promissory Note in connection with a sale and purchase of a mobile home is a legally binding document that outlines the terms and conditions agreed upon between the buyer and seller for the financing of a mobile home purchase. This promissory note is specific to the state of South Carolina and serves as evidence of the debt owed by the buyer to the seller. The content of a South Carolina Promissory Note for the sale and purchase of a mobile home generally includes: 1. Parties involved: The full legal names and addresses of both the buyer (referred to as the "maker" or "borrower") and the seller (known as the "payee" or "lender"). 2. Description of the mobile home: The details of the mobile home being purchased, including the make, model, year, and any identification numbers or VIN's. 3. Purchase price and terms: The total purchase price of the mobile home, the agreed-upon down payment amount, and the payment schedule for the remaining balance, including the frequency (monthly, bi-weekly) and due dates. 4. Interest rate and calculation: The interest rate charged on the remaining balance, which may be a fixed rate or variable rate, and the formula for calculating the interest amount due on each payment. 5. Late fees and penalties: Any penalties or fees that will be imposed if the borrower fails to make timely payments, including a late payment fee or a percentage charge on overdue amounts. 6. Security agreement: If applicable, a provision outlining the collateral or security interest that the lender holds over the mobile home until the debt is fully repaid, such as a lien or mortgage. 7. Default and remedies: A clause detailing the actions that may be taken by the lender in the event of a default, such as acceleration of the debt, repossession of the mobile home, or legal action. Different types of South Carolina Promissory Notes in connection with a sale and purchase of a mobile home may include variations in interest rates, payment terms, and security agreements. Some common variations include fixed-rate promissory notes, adjustable-rate promissory notes, and balloon payment promissory notes. It is important to consult with a qualified attorney or legal professional to ensure that the South Carolina Promissory Note complies with all state laws and accurately reflects the intentions and expectations of both parties involved in the sale and purchase of a mobile home.

South Carolina Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out South Carolina Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

If you aim to finish, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, accessible online.

Take advantage of the site's user-friendly search functionality to find the documents you require.

Various templates for business and individual purposes are categorized by type and jurisdiction, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the South Carolina Promissory Note in Relation to a Sale and Purchase of a Mobile Home in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and press the Download button to obtain the South Carolina Promissory Note in Relation to a Sale and Purchase of a Mobile Home.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

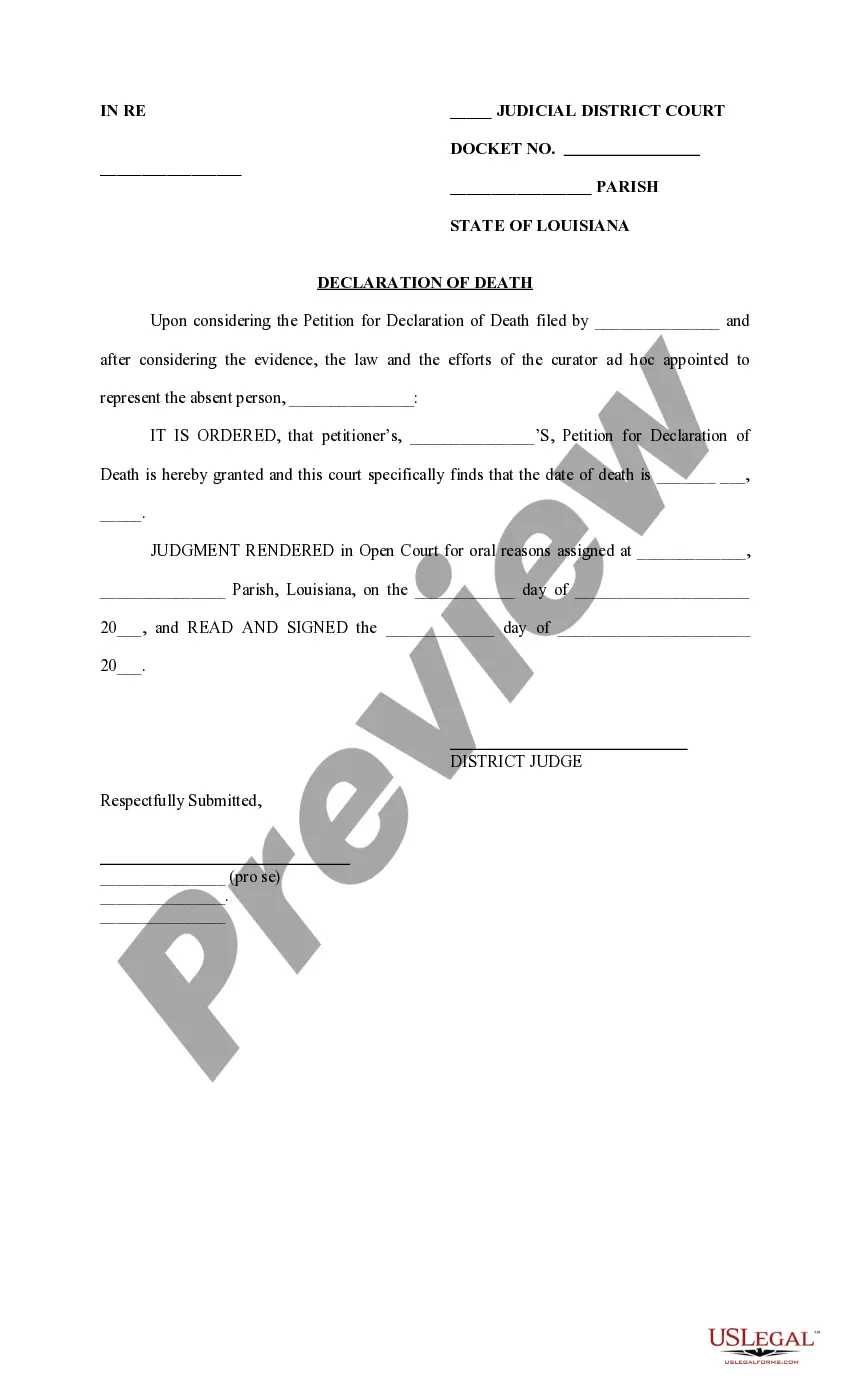

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Characteristics of promissory note:It is a written legal document. There must be a clear, point to point and unconditional promise of paying a certain amount to a specified person. It should be drawn and signed by the maker. It should be stamped properly. It specifically identifies the name of the maker and payee.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A Promissory note is a contract, which means that it is legally binding. However, it must include certain conditions to ensure it is enforceable.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note is not the same as a contract. A contract details all the terms of a legal agreement. A promissory note covers only the following: The date by when someone needs to be paid.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Acceptance is not an essential requirement of a valid promissory note.