Rhode Island E-commerce Product-Comparison Matrix

Description

How to fill out E-commerce Product-Comparison Matrix?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates you can download or print.

By utilizing the website, you can access thousands of forms for professional and personal purposes, organized by categories, states, or keywords.

You can retrieve the latest versions of forms such as the Rhode Island E-commerce Product-Comparison Matrix in just a few minutes.

Verify the form description to ensure you have selected the correct form.

If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- If you already have a subscription, Log In and download the Rhode Island E-commerce Product-Comparison Matrix from your US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to assist you in getting started.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

The Rhode Island e-file mandate requires certain taxpayers to file their tax returns electronically. This includes individuals and businesses meeting specific income thresholds outlined by the state. E-filing enhances accuracy and speeds up the refund process. To simplify your e-filing experience, check out the Rhode Island E-commerce Product-Comparison Matrix.

Calculating Sales Tax(Cost of the Item) (Sales Tax Rate) = Total Sales Tax.50 Cost of the Item .101 Sales Tax Rate = $5.05 Total Sales Tax(Cost of the Item) (1 + Sales Tax Rate) = Total Transaction Cost.50 Cost of the Item 1.101 1 + Sales Tax Rate = $55.05 Total Transaction CostMore items...?

How to Create a Comparison Chart in ExcelStep 1 Launch Excel. To create a comparison chart in Excel, launch the MS Excel desktop app, and select a blank workbook.Step 2 Enter Data. Now enter your data in the workbook.Step 3 Inset Comparison Chart.Step 4 Customize.Step 5 Save.

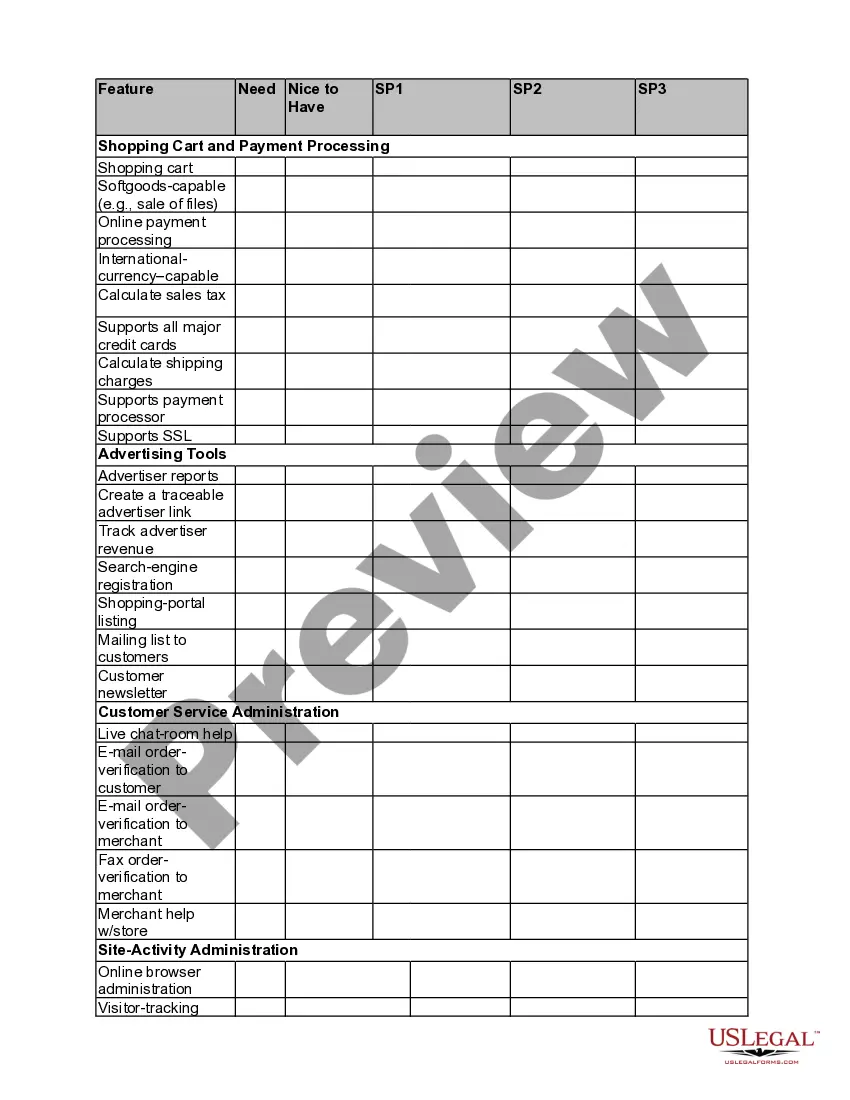

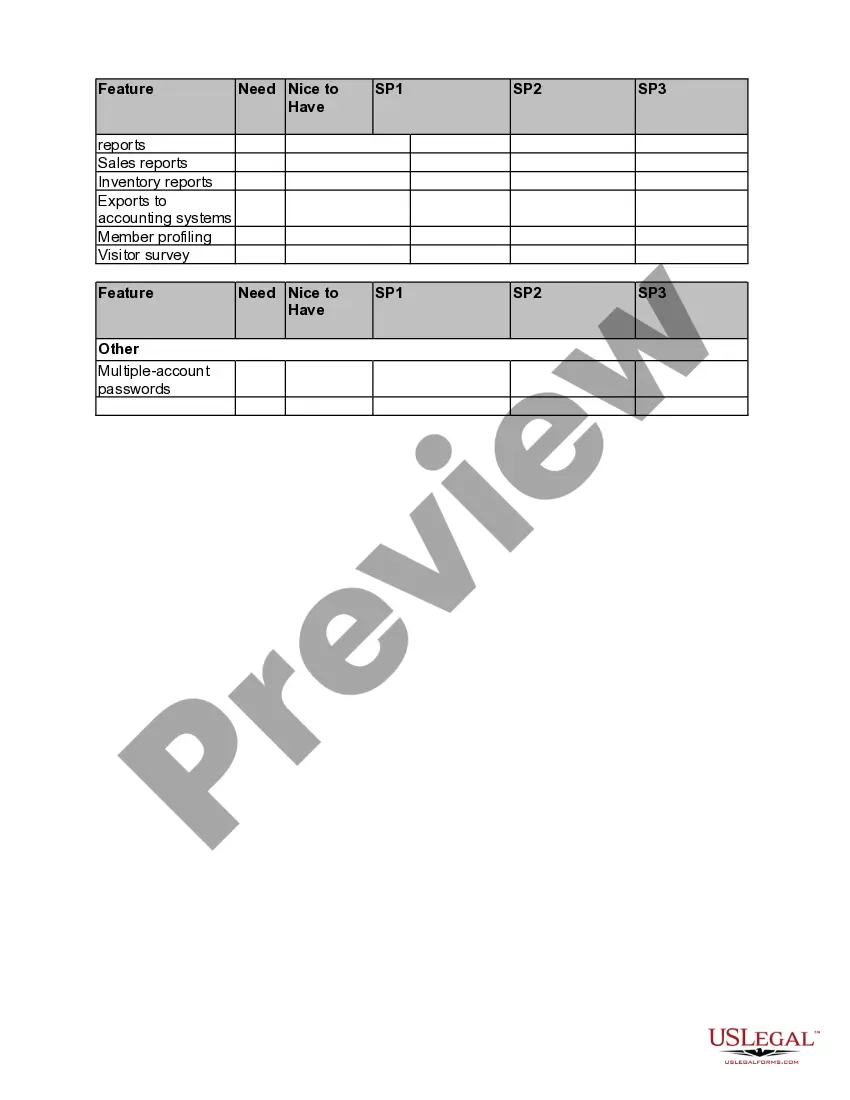

How To2026 Undertake a Product ComparisonStep 1: Create a list of competiting products. Determine which products compete directly in the same marketplace as your product.Step 2: Undertake research.Step 3: Create a Product Comparison table.Step 4: Conclusion.

How To2026 Undertake a Product ComparisonStep 1: Create a list of competiting products. Determine which products compete directly in the same marketplace as your product.Step 2: Undertake research.Step 3: Create a Product Comparison table.Step 4: Conclusion.

The basic rule for collecting sales tax from online sales is:If your business has a physical presence, or nexus, in a state, you must collect applicable sales taxes from online customers in that state.If you do not have a physical presence, you generally do not have to collect sales tax for online sales.

Competitive Product AnalysisStep 1: Assess your current product pricing. The first step in any product analysis is to assess current pricing.Step 2: Compare key features. Next is a comparison of key features.Step 3: Pinpoint differentiators.Step 4: Identify market gaps.

Place the similar features on top, followed by the unique and exclusive details about the products. Compare products with distinct features, so the buyers will know that they benefit from choosing one item. Know the customers' deciding factor. Research what they need, why purchasing the items can be beneficial to them.

How To2026 Undertake a Product ComparisonStep 1: Create a list of competiting products. Determine which products compete directly in the same marketplace as your product.Step 2: Undertake research.Step 3: Create a Product Comparison table.Step 4: Conclusion.