Puerto Rico Superior Improvement Form

Description

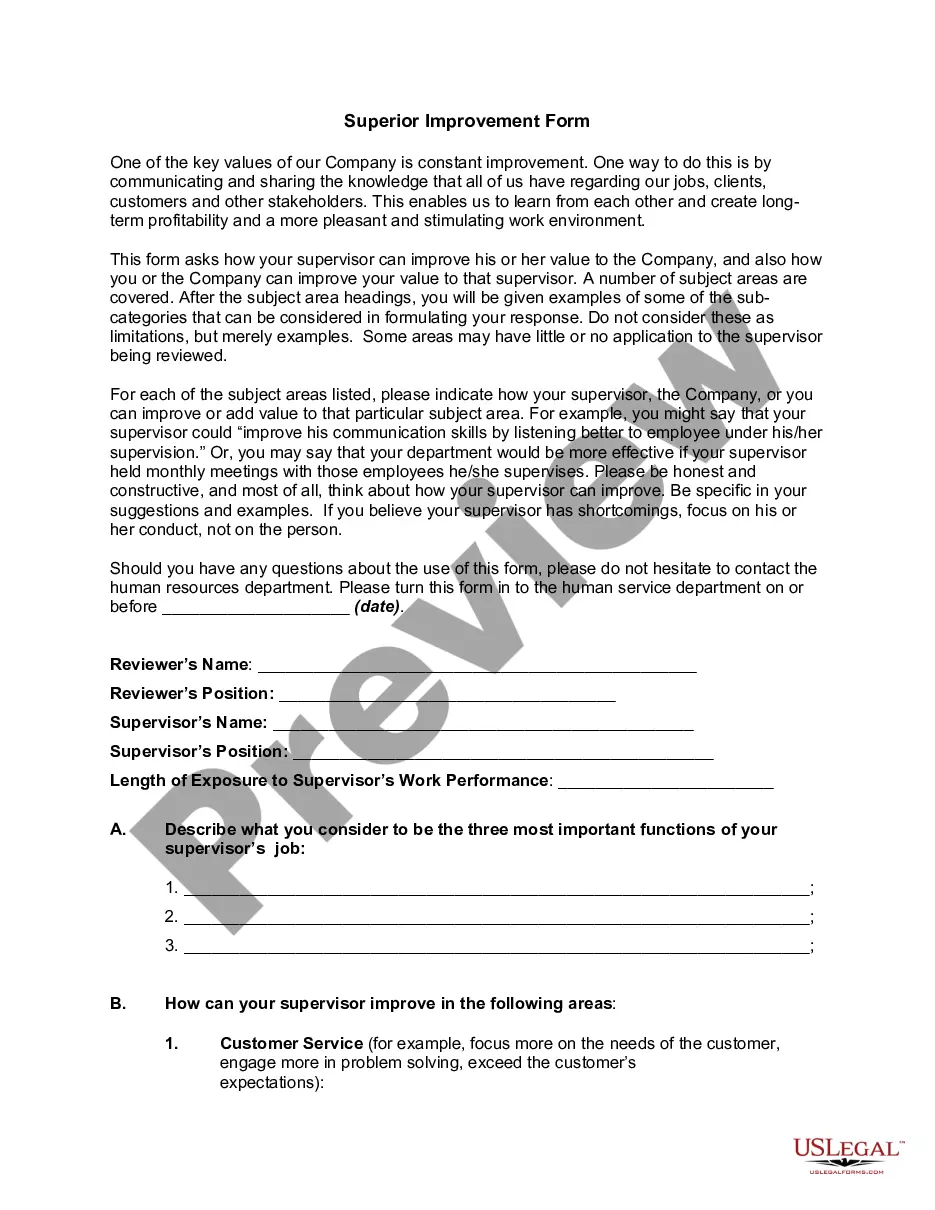

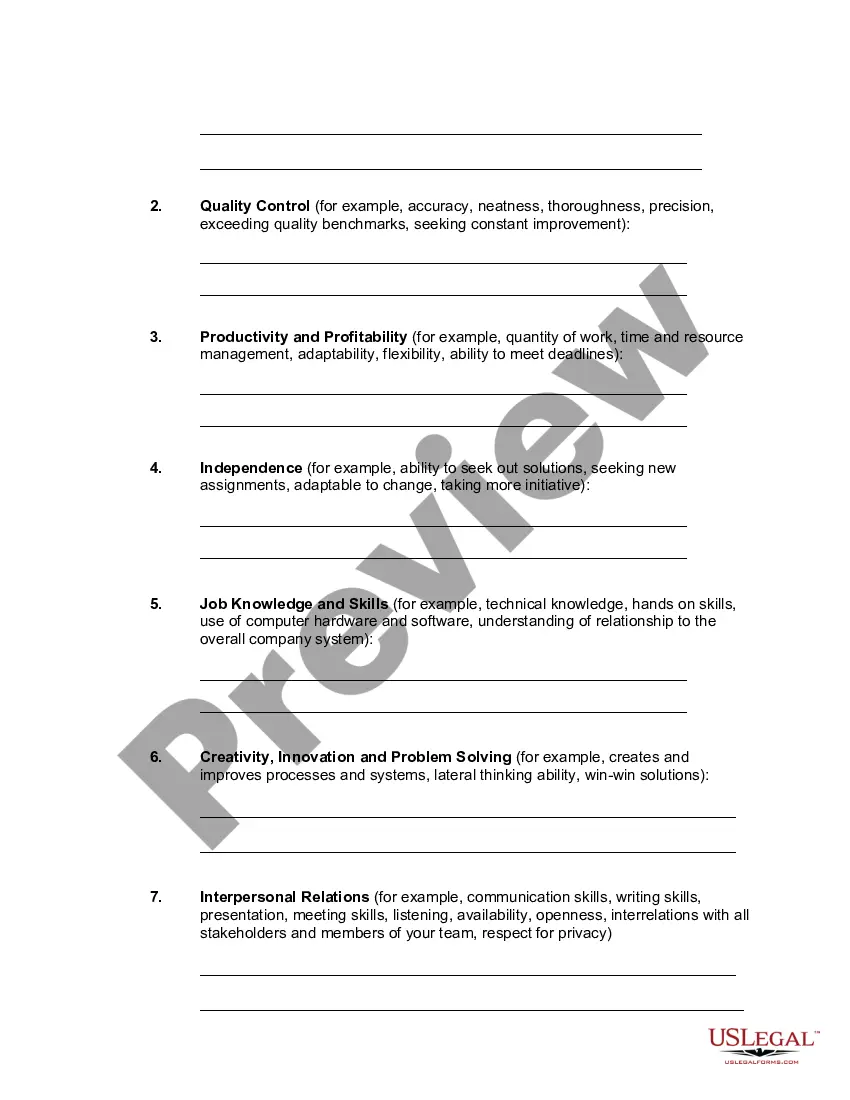

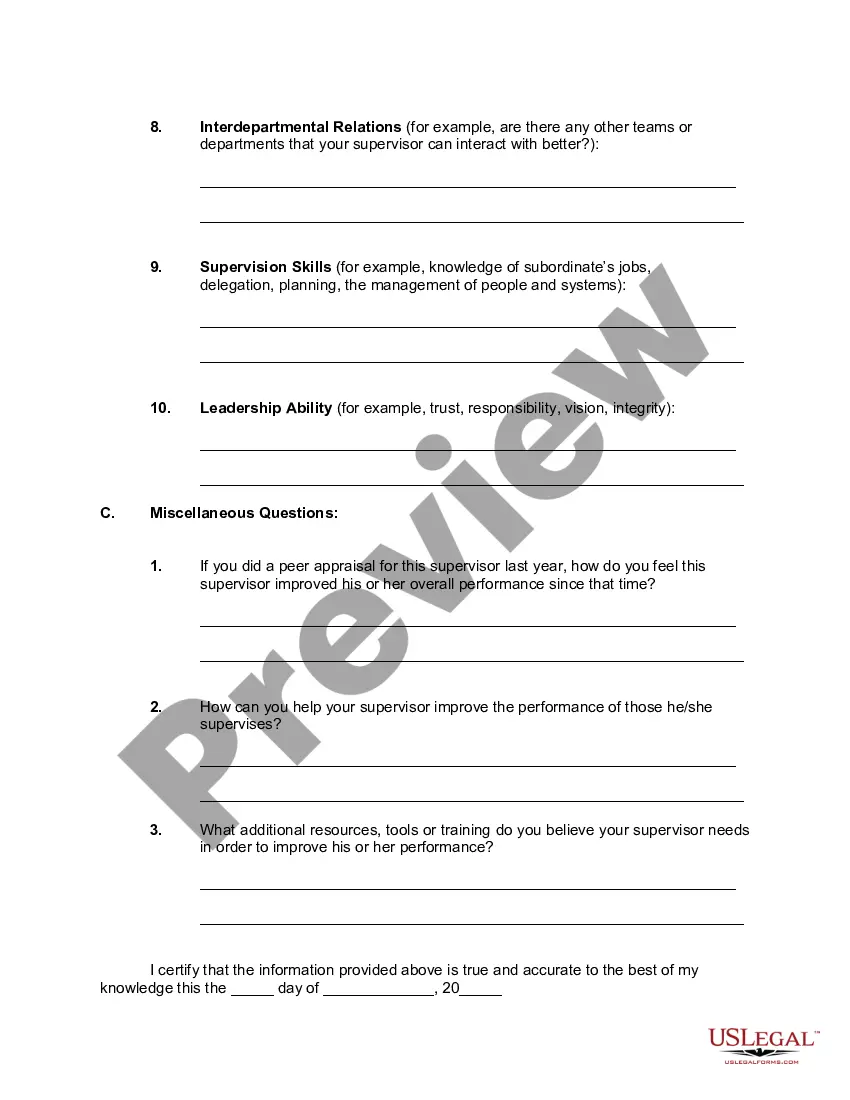

How to fill out Superior Improvement Form?

Have you ever found yourself in a situation where you require documents for business or personal activities almost daily.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of document templates, including the Puerto Rico Superior Improvement Form, designed to comply with state and federal regulations.

Once you locate the correct form, click on Get now.

Select the payment plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Superior Improvement Form template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/region.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have chosen the right form.

- If the form isn't what you're looking for, use the Lookup section to find the document that fits your requirements.

Form popularity

FAQ

Form 480.7 C is used in Puerto Rico to report income, particularly related to dividends and interest. This form ensures proper income reporting and tax compliance, crucial for minimizing any potential issues with the IRS. If you're navigating this process, consider using the Puerto Rico Superior Improvement Form to simplify your tax preparation.

Whether you must file an FBAR (Foreign Bank Account Report) from Puerto Rico depends on your financial situation. Generally, if you have foreign financial accounts exceeding $10,000, you'll need to file. It’s wise to consult resources and tools, like the Puerto Rico Superior Improvement Form, to ensure you meet all reporting obligations.

The 1099C form is used to report cancellation of debt, which can affect your taxable income. If you had a debt forgiven, you might receive this form, indicating that you need to adjust your tax filings appropriately. Be sure to consider how any debt cancellation may interact with your Puerto Rico Superior Improvement Form to maintain compliance.

Filing Form 8689, which relates to the allocation of income tax, requires careful attention to detail. To complete this form, gather your income details and deductions, as well as any relevant information from the Puerto Rico Superior Improvement Form. Accurate reporting helps ensure you comply with IRS requirements and maximizes your tax benefits.

Yes, there are significant tax incentives for individuals and businesses relocating to Puerto Rico, particularly under laws designed to attract investment. These incentives can greatly reduce your tax responsibilities. To take full advantage of these benefits, understanding the Puerto Rico Superior Improvement Form is essential.

There is no formal tax treaty between the U.S. and Puerto Rico since Puerto Rico is a territory of the U.S. Instead, Puerto Rico operates under its own tax system and regulations. Being informed about the Puerto Rico Superior Improvement Form can help you navigate your tax responsibilities effectively.

Proposition 60 primarily relates to property tax exemptions for elderly residents in Puerto Rico who meet specific criteria. This provision aims to reduce the tax burden for seniors while promoting home ownership. Understanding how it interacts with the Puerto Rico Superior Improvement Form can maximize benefits for eligible taxpayers.

Public Law 86-272 primarily addresses state taxation issues and does not provide the same protections in Puerto Rico. Therefore, businesses in Puerto Rico must comply with local tax laws, which may differ from those in the mainland U.S. The Puerto Rico Superior Improvement Form can help clarify your tax situation.

Form 482 is primarily used for reporting income from interest and dividends in Puerto Rico. This form is crucial for individuals and entities earning interest that need to adhere to tax reporting requirements. Knowing how to utilize the Puerto Rico Superior Improvement Form can enhance your understanding of local tax obligations.

Yes, Puerto Rico qualifies for foreign tax credits under certain conditions. Residents may be able to claim credits to avoid double taxation on income earned outside the United States. Seeking guidance on the Puerto Rico Superior Improvement Form can assist you in navigating these credits effectively.