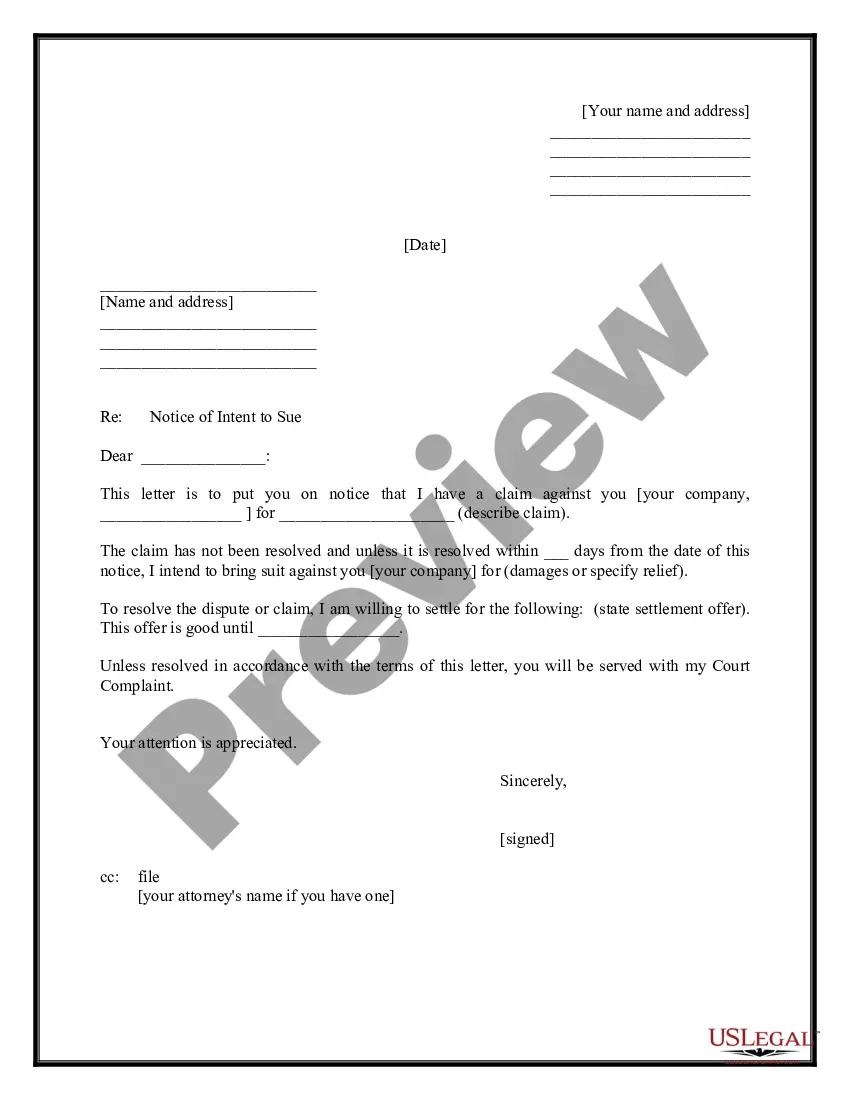

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

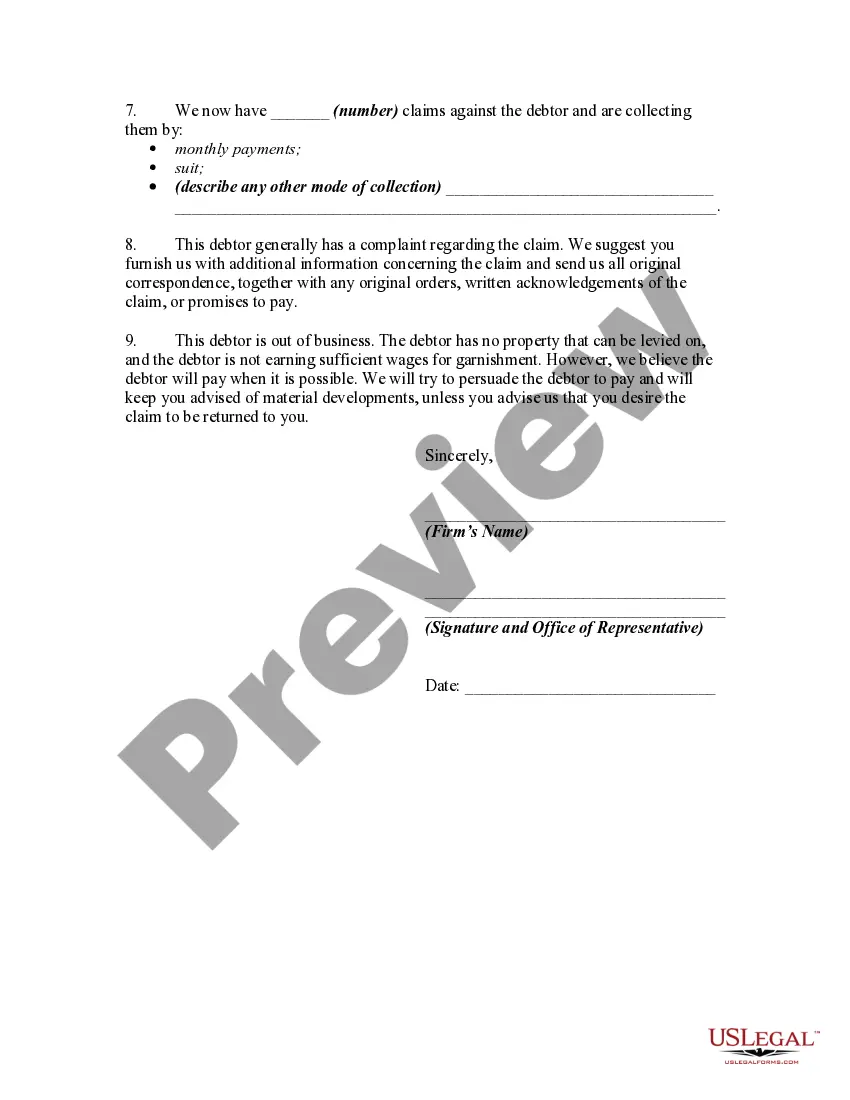

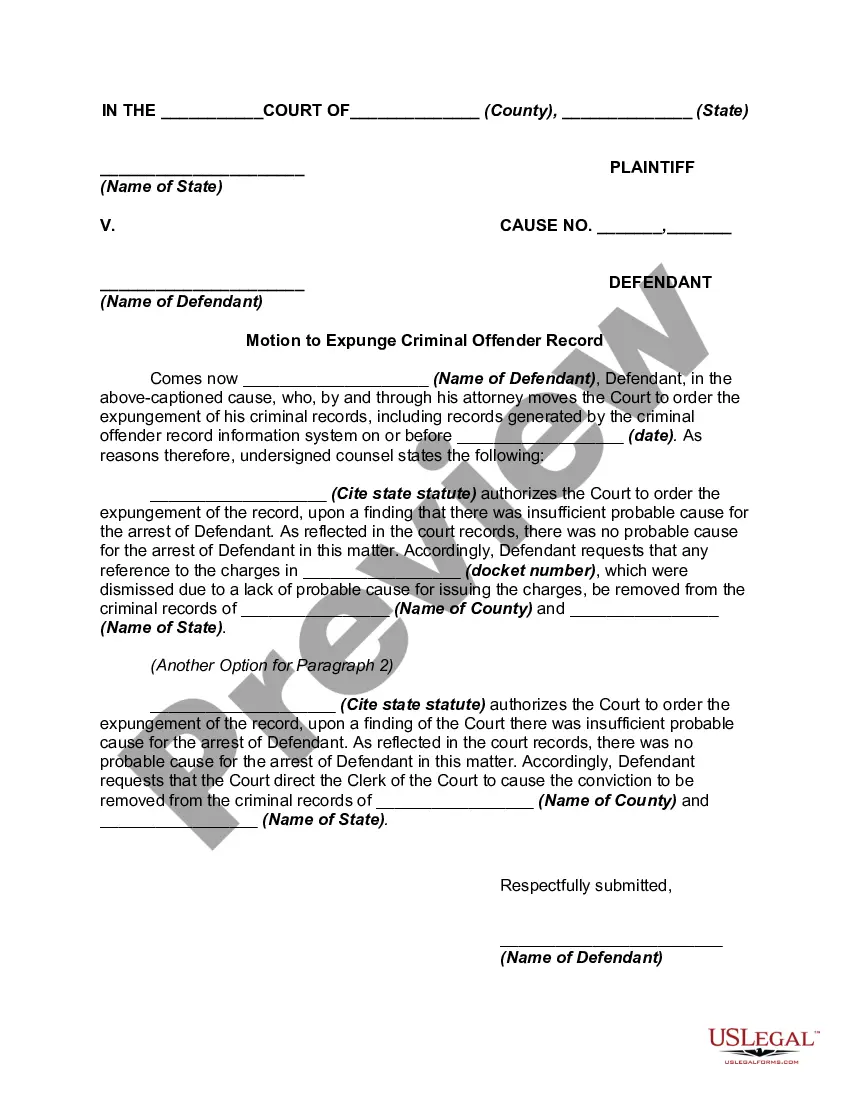

Pennsylvania Acceptance of Claim and Report of Experience with Debtor is a legal document used in the state of Pennsylvania to acknowledge and verify the acceptance of a claim against a debtor. This report provides a comprehensive and detailed account of the experience an individual or organization has had with the debtor, including any payment history, previous claims, and any outstanding balances. The Pennsylvania Acceptance of Claim and Report of Experience with Debtor serves as a vital tool in the legal proceedings associated with debt collection or bankruptcy cases. It helps both the creditor and the court to assess the credibility of the claim and to determine the appropriate resolution. There are various types of Pennsylvania Acceptance of Claim and Report of Experience with Debtor, each catering to specific situations and requirements. Some commonly used types include: 1. Individual Debtor Claim: This report is filled out by an individual creditor who has an experience with a debtor. It outlines the nature of the debt, payment history, and any relevant details about the debtor's previous dealings. 2. Business Debtor Claim: Designed for creditors who are business entities, this report elaborates on the commercial transactions with the debtor, company credit history, and any actions taken thus far to recover the debt. 3. Collection Agency Report: When a collection agency is involved in the debt recovery process, this report is used to present the collective experiences of multiple creditors who have engaged the debtor's services. It provides a consolidated view of the debtor's overall payment history, including any legal actions taken against them. Regardless of the type of Pennsylvania Acceptance of Claim and Report of Experience with Debtor, keywords related to this document include: — Pennsylvania debcollectionio— - Creditor report — Debt verificatExperiencecece documentation — Payment history repor— - Outstanding balances — Credibility assessmen— - Legal proceedings — Bankruptcy case— - Debt recovery - Debtor claim acceptance.