Nota Promisoria de Instalaciones de Pennsylvania a Tasa Fija Asegurada por Bienes Raíces Residenciales - Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Pennsylvania Pagaré De Tasa Fija A Plazos De Pensilvania Garantizado Por Bienes Raíces Residenciales?

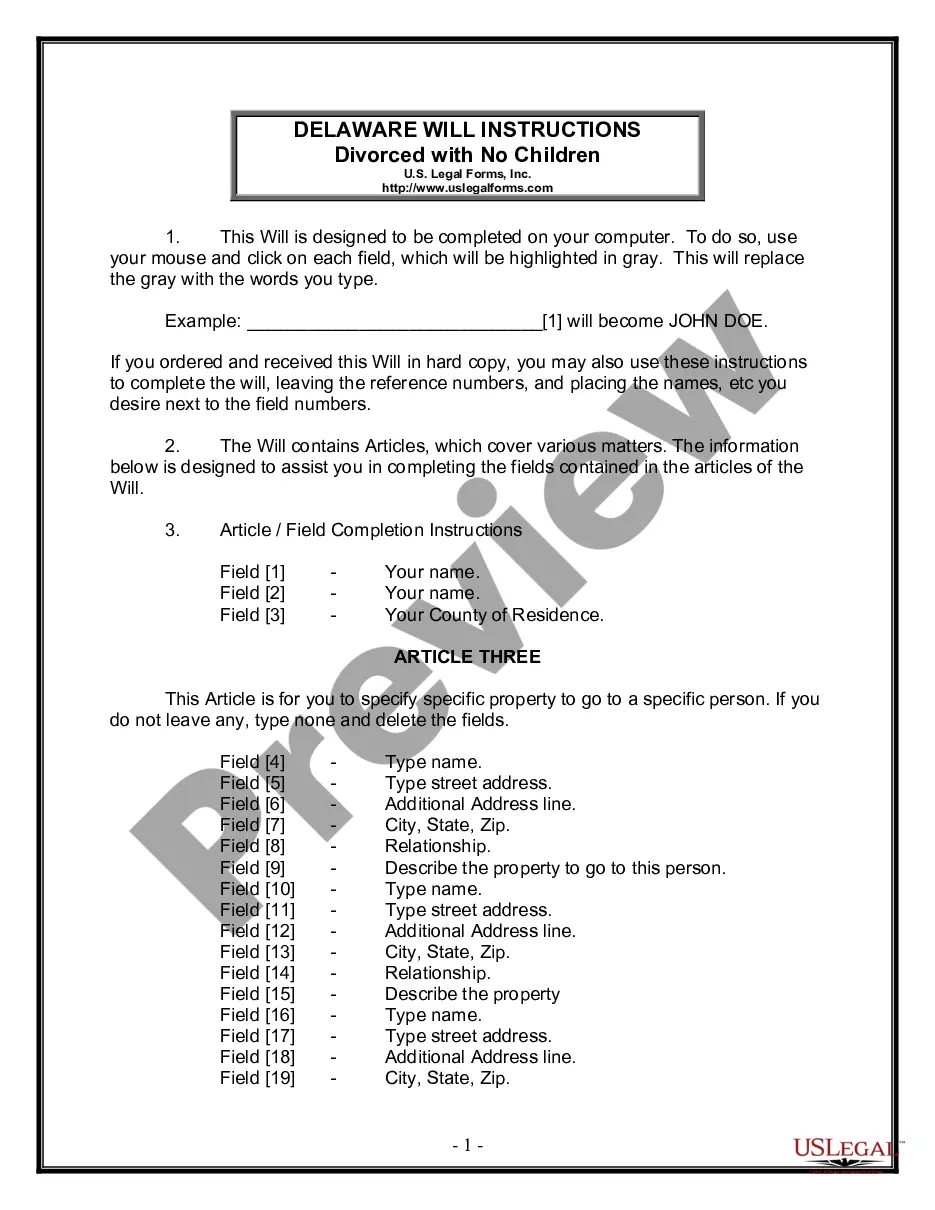

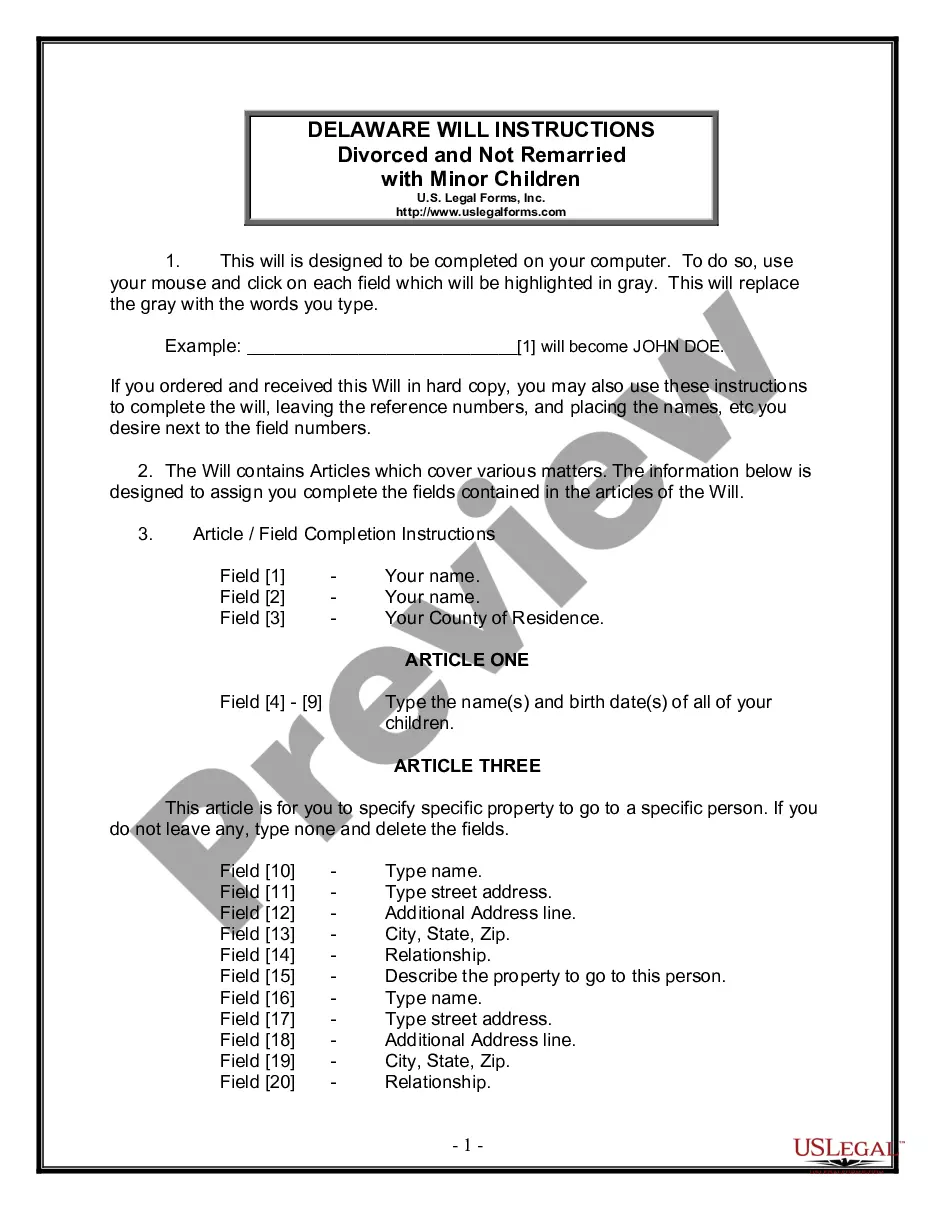

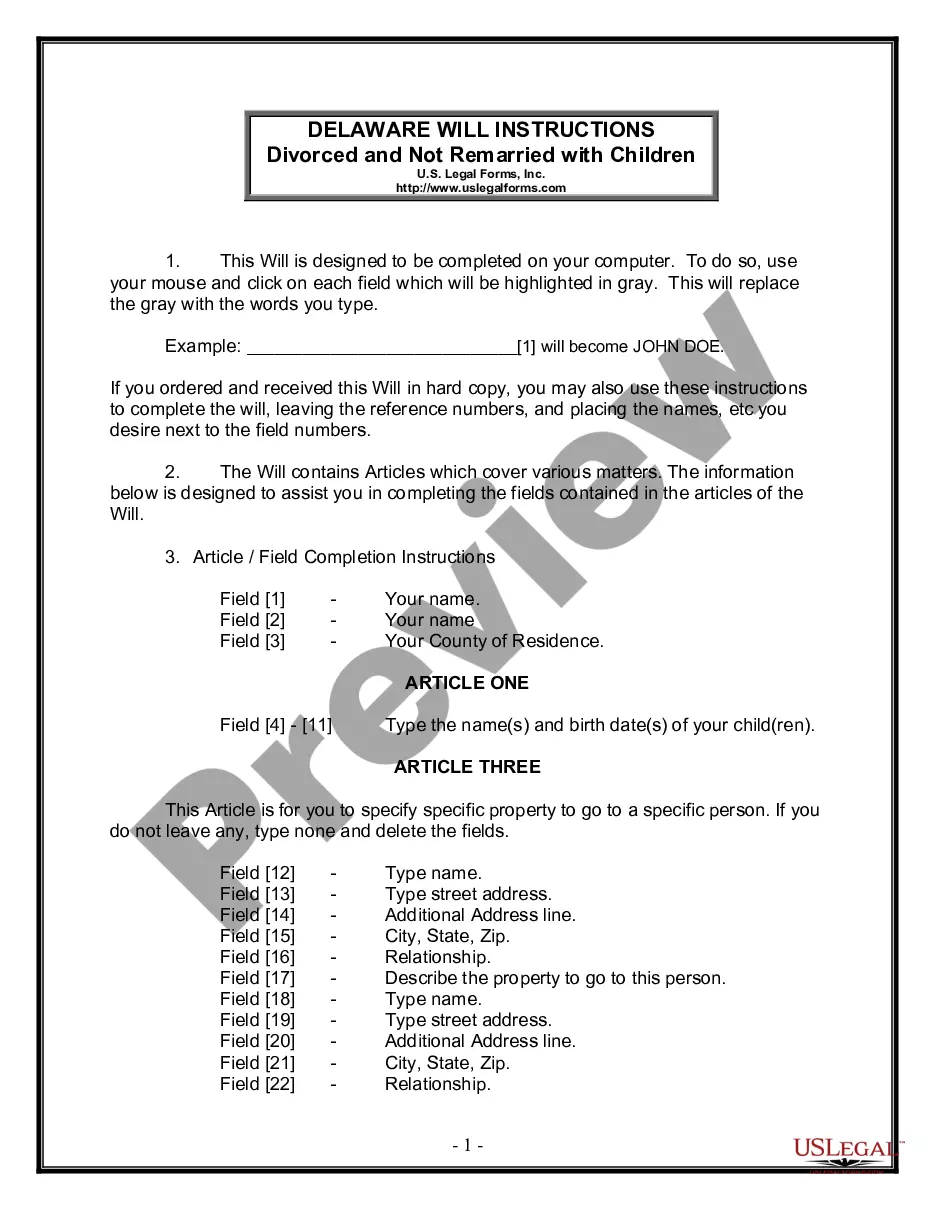

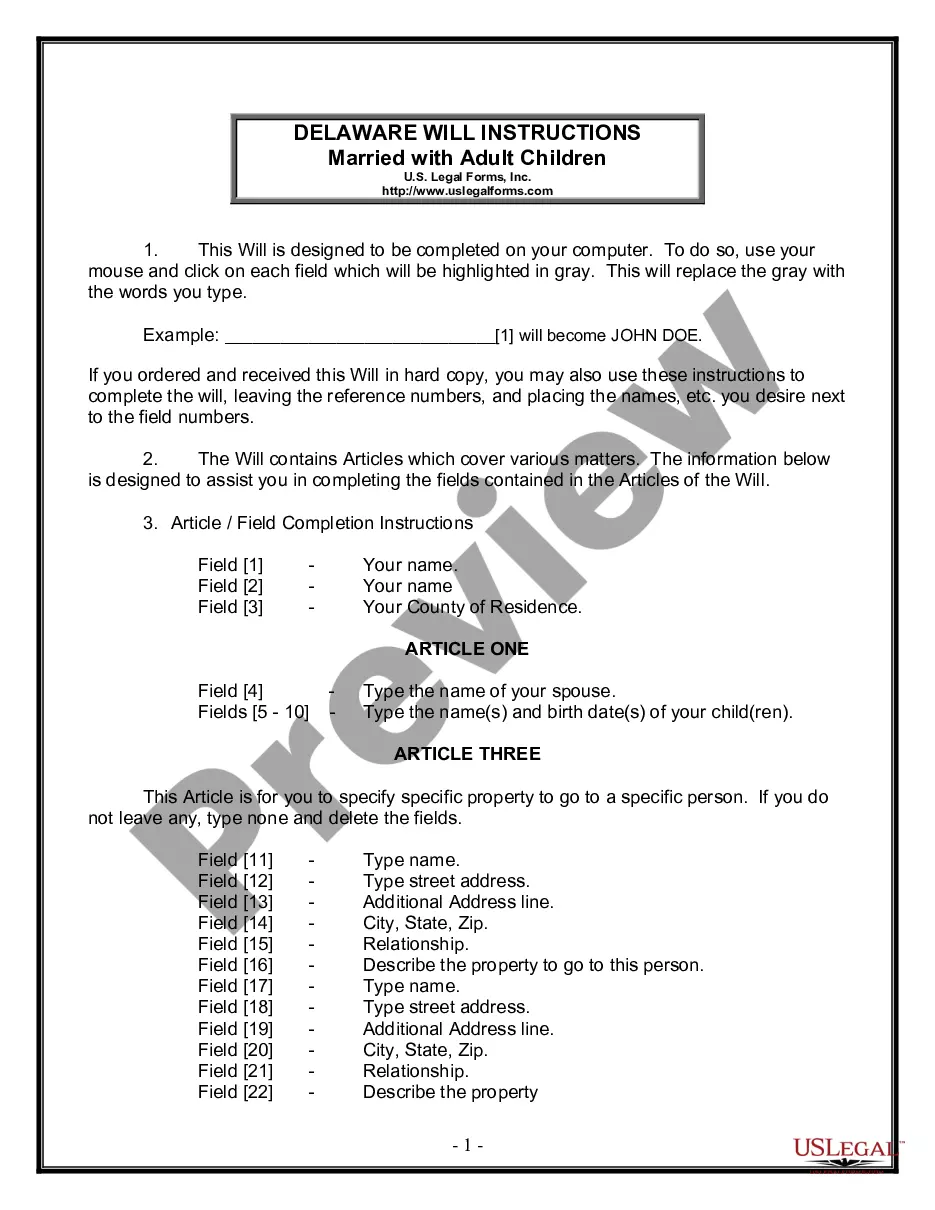

The work with documents isn't the most straightforward process, especially for those who rarely deal with legal papers. That's why we advise using correct Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate samples created by professional lawyers. It allows you to avoid troubles when in court or working with formal organizations. Find the files you require on our site for top-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the file page. Right after getting the sample, it’ll be stored in the My Forms menu.

Customers without an active subscription can easily create an account. Look at this brief step-by-step help guide to get the Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate:

- Ensure that file you found is eligible for use in the state it’s required in.

- Confirm the document. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this template is the thing you need or use the Search field to get a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after finishing these straightforward actions, you can fill out the form in an appropriate editor. Double-check filled in details and consider requesting a legal representative to review your Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate for correctness. With US Legal Forms, everything becomes much easier. Test it now!