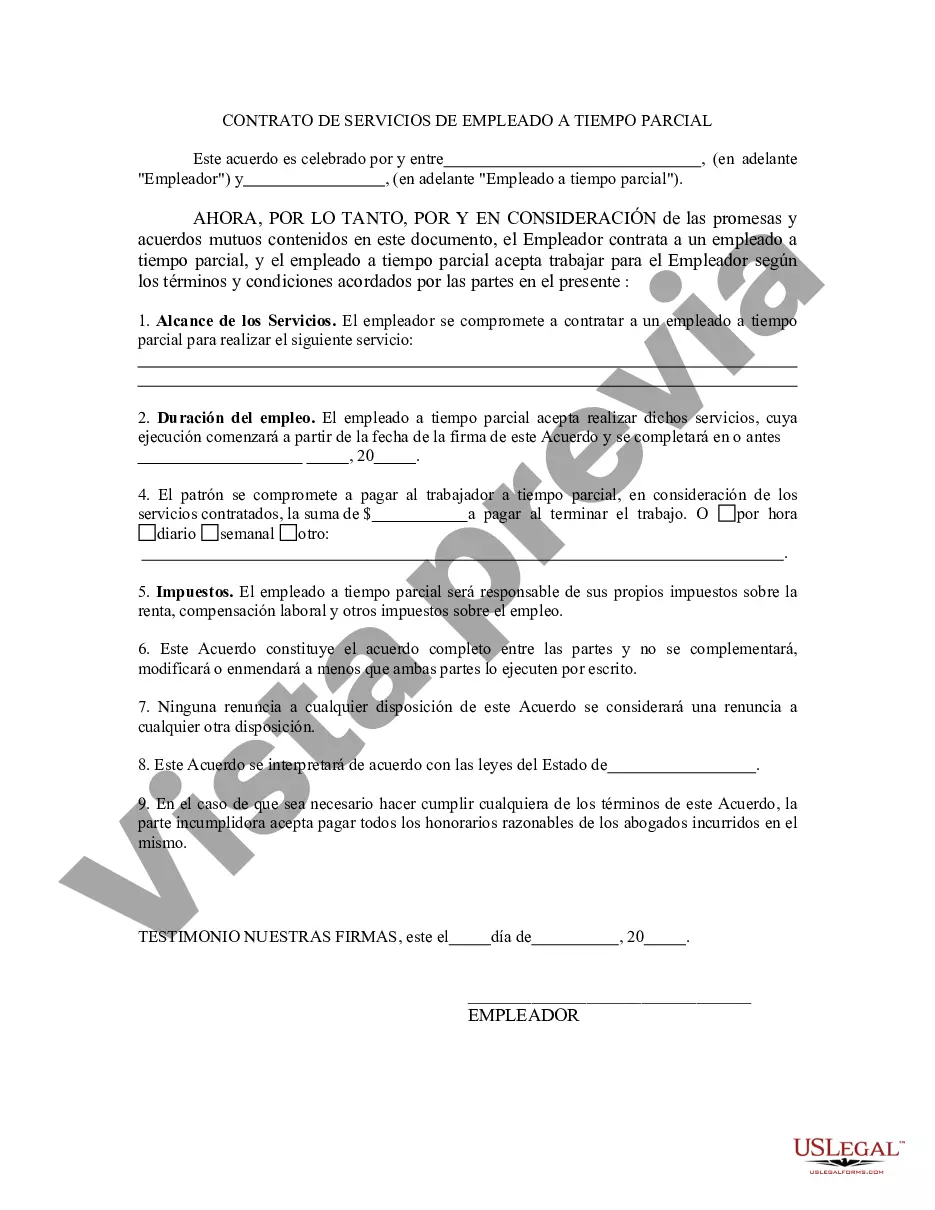

The Oregon Self-Employed Part-Time Employee Contract refers to a legally binding agreement between a self-employed individual and an employer for part-time work in the state of Oregon. This contract outlines the terms and conditions of the employment arrangement, ensuring clarity and protection for both parties involved. Key provisions addressed within the Oregon Self-Employed Part-Time Employee Contract include the scope of work, compensation details, working hours, and duration of the employment. The agreement also typically covers issues relating to intellectual property rights, non-disclosure agreements, and any confidentiality clauses that may be applicable to the specific job. Different types of Oregon Self-Employed Part-Time Employee Contracts may exist based on the nature of the work and the individual's status within the company. Some common types of contracts include: 1. Fixed-term Contract: This type of contract lays out a specific period during which the self-employed part-time employee will provide services to the employer. It includes a clear start and end date, defining the length of employment. 2. Project-Based Contract: In this contract, the self-employed individual is hired to work on a particular project or assignment, often with a predetermined deliverable or goal. The duration of employment depends on the completion of the specific project. 3. Annual Contract: This is a renewable contract that extends for one year. It is commonly used when the employer anticipates a long-term need for part-time services from the self-employed individual. 4. Retainer Contract: In a retainer contract, the self-employed part-time employee is engaged to be available for a certain number of hours or days per week or month to provide services as needed. This contract ensures a consistent commitment from the self-employed individual while allowing flexibility for the employer's fluctuating work requirements. Regardless of the type of contract, it is essential for both parties involved to carefully review and negotiate the terms and conditions to ensure a mutually beneficial arrangement. Seeking legal advice or using appropriate contract templates can help facilitate this process and protect the rights and interests of both the self-employed part-time employee and the employer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Contrato de Trabajador Autónomo a Tiempo Parcial - Self-Employed Part Time Employee Contract

Description

How to fill out Oregon Contrato De Trabajador Autónomo A Tiempo Parcial?

If you need to total, download, or produce lawful document templates, use US Legal Forms, the greatest collection of lawful kinds, which can be found on the Internet. Make use of the site`s simple and handy research to discover the paperwork you require. Different templates for company and specific uses are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Oregon Self-Employed Part Time Employee Contract in just a number of mouse clicks.

In case you are already a US Legal Forms client, log in to the accounts and click on the Down load option to find the Oregon Self-Employed Part Time Employee Contract. You can even access kinds you formerly saved within the My Forms tab of your accounts.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the correct city/land.

- Step 2. Use the Preview choice to examine the form`s content. Don`t forget to learn the description.

- Step 3. In case you are not satisfied together with the form, take advantage of the Look for area at the top of the display to get other types from the lawful form design.

- Step 4. When you have located the shape you require, select the Acquire now option. Select the pricing prepare you favor and add your qualifications to register for an accounts.

- Step 5. Procedure the purchase. You should use your Мisa or Ьastercard or PayPal accounts to perform the purchase.

- Step 6. Choose the structure from the lawful form and download it on your gadget.

- Step 7. Full, modify and produce or indication the Oregon Self-Employed Part Time Employee Contract.

Every single lawful document design you buy is your own forever. You might have acces to each form you saved inside your acccount. Click on the My Forms portion and select a form to produce or download once again.

Contend and download, and produce the Oregon Self-Employed Part Time Employee Contract with US Legal Forms. There are millions of expert and status-specific kinds you may use to your company or specific requires.

Form popularity

FAQ

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Like other small business owners, sole proprietors do have the ability to hire employees. As per the IRS, any time a sole proprietor hires an employee other than an independent contractor, the sole proprietorship will need to obtain an Employer Identification Number (EIN).

It is also important to note that a self-employed worker can be both employed and self-employed at the same time. For example, a worker can be an employee at a company during the day and run a business by night. Employment status may also change from contract to contract.

A sole proprietor can hire employees. There is no limit to the number of workers you can employ. As an employer, you are responsible for all employment administration, recordkeeping, and taxes. You have the same responsibilities as any other employer.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time. They set their own hours of work and are paid a fee for completing each set assignment.

What is an independent contractor? Under Oregon law, an independent contractor must be: free from direction and control over the means and manner of providing the services, subject only to the right to specify the desired results; is customarily engaged in an independently established business; and.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.